BorgWarner Bags New Order To Supply E-Motor To Chinese Automaker

- By MT Bureau

- August 11, 2025

American tier 1 supplier BorgWarner has announced that it has bagged a new order from a major Chinese original equipment manufacturer (OEM) for its electric motors.

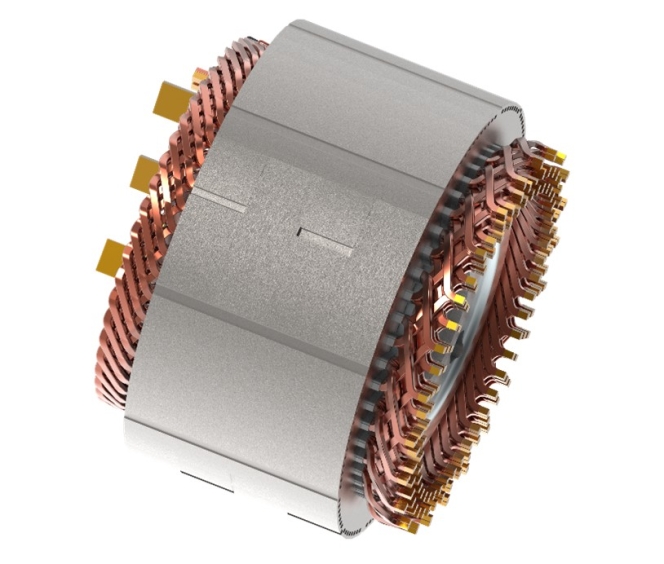

As per the understanding, BorgWarner will supply a platform-based design, compatible across a full range of NEV applications, including battery electric and hybrid models. It also incorporates BorgWarner’s innovative ultra-short hairpin welding process, which reduces end-turn height for a more compact structure and significantly improves space utilisation.

Dr Stefan Demmerle, Vice-President, BorgWarner Inc and president & General Manager, PowerDrive Systems, said, “We are pleased with the continued progress of our electric motor business in China. Our partnership with this customer spans nearly a decade. BorgWarner remains committed to delivering smarter, more efficient motor solutions as we work together toward an electrified future.”

Furthermore, to meet rising demand from the Chinese automotive industry, BorgWarner is expanding its motor operations and early this year it signed a MoU with the Wuhu municipal government to establish a new manufacturing base for electric drive systems.

Once on stream, the facility will feature intelligent manufacturing lines capable of producing multiple motor platforms on shared lines, increasing motor capacity and laying a solid foundation for scaled delivery.

Garrett Motion Secures First Serial Award For Centrifugal Compressor From China's Cling

- By MT Bureau

- February 22, 2026

Garrett Motion has announced its first serial award for a centrifugal compressor from Chinese automotive company Cling, which involves the integration of Garrett’s oil-free, foil bearing-based technology into next-generation HVAC systems for electric buses and trucks.

Production is scheduled to commence in 2027. The technology was validated through joint testing between the two companies throughout 2025.

The Garrett centrifugal compressor utilises a high-speed motor exceeding 160,000 RPM. Compared to traditional scroll compressors, the system is 50 percent smaller, 30 percent lighter and reduces noise levels by a claimed 10 dB.

Key technical features include:

- Voltage Support: Compatible with 400V–800V heat pump systems.

- Maintenance: Oil-free design offering up to 45,000 hours of maintenance-free operation.

- Refrigerants: Supports low-pressure and low-GWP (Global Warming Potential) refrigerants.

- Thermal Performance: Designed to enhance cooling capacity and energy performance to extend vehicle range.

The partnership aims to establish new standards for thermal management in the commercial vehicle segment. The compressor architecture is designed for automotive-grade production and is scalable for both EV deployment and industrial applications.

Olivier Rabiller, President and CEO, Garrett Motion, said, “This collaboration brings Garrett’s cutting-edge centrifugal cooling compressor technology to electric commercial vehicle applications for the first time. By combining our high-speed, oil-free compressor architecture with Cling’s leadership in commercial vehicle HVAC systems, we are setting new benchmarks for efficiency and thermal performance – driving innovation for electric buses and trucks in China and beyond.”

Junfeng Guo, General Manager, Cling, added, “Our collaboration with Garrett reflects Cling’s vision to become a leading provider of integrated HVAC and thermal management solutions for commercial vehicles. This partnership will help us push the boundaries of comfort, efficiency, and environmental responsibility across China and global markets.”

- Tata AutoComp Systems

- Artifex Interior Systems

- Artifex Systems Slovakia

- Jaguar Land Rover

- Volkswagen

- Audi

- Skoda

- Sweden Engineering Centre

- Arvind Goel

- Alan Fennelly

- Manoj Kolhatkar

Tata AutoComp Completes Acquisition Of IAC Slovakia, Renames It As Artifex Systems Slovakia

- By MT Bureau

- February 18, 2026

Tata AutoComp Systems, through its British subsidiary Artifex Interior Systems, has completed the acquisition of 100 percent of the share capital of IAC Group (Slovakia). The entity has been renamed Artifex Systems Slovakia s.r.o.

The acquisition establishes a presence for Tata AutoComp in the European Union, specifically as a supplier to Jaguar Land Rover, Volkswagen, Audi and Skoda. The move is part of a strategy to unify Artifex operations in the UK, Sweden and Slovakia under a single identity.

Coinciding with the acquisition, Artifex has opened the Sweden Engineering Centre in Gothenburg. The facility is intended to support innovation and collaboration with regional partners and customers.

Artifex now operates with an annual revenue of USD 1.3 billion and a workforce of 4,100 employees across Europe. Its portfolio includes instrument panels, consoles, door trims and headliners.

Arvind Goel, Vice-Chairman of Tata AutoComp Systems, said, "The integration of Artifex Systems Slovakia s.r.o (formerly IAC Slovakia) has been successfully completed, marking a significant step in building the Artifex brand and advancing our global growth strategy. With this integration, we are now better positioned to deliver long-term value, operational excellence, and world-class quality to global OEMs."

Manoj Kolhatkar, MD & CEO, Tata AutoComp Systems, added, “In the light of this development, I would like to inform you that our European businesses demonstrate strong operational and cultural alignment. This integration will enable quicker decision-making, improved execution, and enhanced value delivery for our OEM clients in the region.”

Alan Fennelly, CEO, Artifex Interior Systems, stated, "We are proud to formally welcome Artifex Systems Slovakia (formerly IAC Slovakia) into the Artifex and Tata AutoComp family. Their skilled workforce, strong customer focus combined with great technical expertise will be key in accelerating our growth as we support the next generation of vehicle platforms."

- BWI Group

- Dayton Engineering Laboratory Company

- Delco

- Beijing West Smart Mobility Zhangjiakou Automotive Electronics Co

- Zhang Jia Kou Financial Holding Group

- ZJKFH

- Semi-Active Roll Control

- SARC

- GWM Tank

- Bruno Perree

BWI Group Launches Automated Roll Control System For SUVs And EVs

- By MT Bureau

- February 18, 2026

BWI Group has introduced an automated mode for its Semi-Active Roll Control (SARC) system, designed to address the weight challenges of modern SUVs and battery electric vehicles (BEVs). The update allows a vehicle's anti-roll bar to disconnect and reconnect on demand while driving.

For the unversed, BWI Group was incepted in 1909 as Dayton Engineering Laboratory Company (Delco). It is said to have created the first reliable electric self-starter for the global automotive market, and is now currently owned by China’s Beijing West Smart Mobility Zhangjiakou Automotive Electronics Co, led by Zhang Jia Kou Financial Holding Group (ZJKFH) and an assembled syndicate of key investors.

The SARC system aims to resolve the engineering conflict between ride comfort and handling. As SUVs now account for over half of European car registrations and BEVs weigh significantly more than internal combustion counterparts, chassis engineers have historically used stiff stabiliser bars that can compromise comfort.

Operational Data and Speed

The new mode uses vehicle data – including steering angle, speed, lateral acceleration, and yaw rate – to manage the anti-roll bar. During high-speed cornering, the system reconnects the bar in less than 200 milliseconds. When the bar is disconnected during normal driving, the vehicle maintains a more compliant ride.

At the centre of the technology is a rotary actuator and a self-contained hydraulic mechanism. Unlike mechanical alternatives, this hydraulic setup allows for connection and disconnection even when wheels are positioned at different heights. The system also features self-centring technology to ensure engagement across all suspension travel.

SARC is currently in production for several platforms, including the GWM Tank series. BWI Group expects the automated functionality to increase adoption in the SUV and BEV sectors, where managing vehicle mass is a priority for manufacturers.

Bruno Perree, Engineering Manager, BWI Group, said, “Chassis engineers are continually trying to improve road handling and comfort, but the two goals are often incompatible. The latest update to SARC removes that compromise, allowing engineers to optimise the roll bar purely for handling as it will be disconnected the majority of the time. This not only improves comfort but also adds significant off-road capability, which can be a key competitive differentiator in a crowded SUV market.”

ZF India Secures Contract To Supply Electric Low-Floor Axle For E-Buses

- By MT Bureau

- February 16, 2026

German automotive component supplier ZF India has secured a contract from an Indian original equipment manufacturer (OEM) to supply the AxTrax 2 LF electric portal axle. The technology will be utilised in 11-metre city buses and 18-metre articulated buses for domestic and export markets.

The nomination, confirmed in October 2025, involves a multi-year programme for several thousand units, with deliveries scheduled to begin in 2026.

The AxTrax 2 LF integrates propulsion, braking and suspension within a single unit. This architecture replaces the engine, transmission, and conventional axle, increasing space for passengers and batteries. The system uses the same mounting points as previous generations, allowing for backward compatibility.

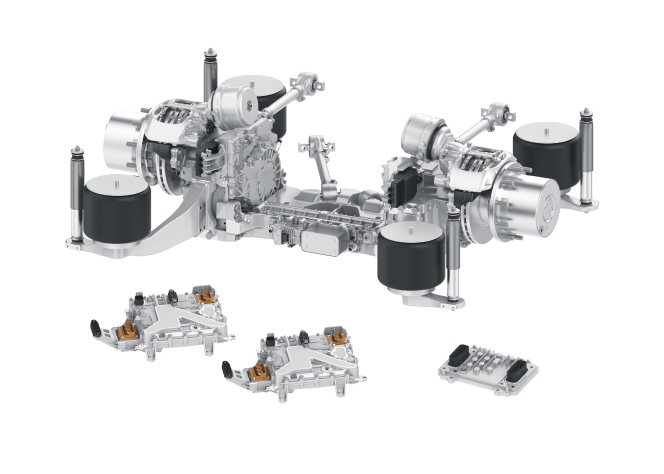

The unit is built on a modular platform featuring:

- Dual PMS Motors: Two permanent magnet synchronous hairpin motors.

- Inverters: Two 800V Silicon Carbide (SiC) inverters.

- Power Output: Continuous power variants of 260 kW and 360 kW.

- Torque: Peak torque of 36,800 Nm.

An oil cooling system with an integrated e-pump manages temperature and lubrication to maintain performance. The system is compatible with battery-electric, hydrogen fuel cell and trolley bus configurations.

The axle includes software for torque vectoring, regenerative braking, hill hold, and axle condition monitoring. It is designed to meet ISO 26262 functional safety requirements and cybersecurity standards. The electronics are capable of receiving over-the-air (OTA) updates.

Akash Passey, President - ZF Region India, said, “AxTrax 2 LF enables OEMs to design buses that maximise passenger and battery space while delivering superior efficiency and reliability. Its compatibility with battery-electric; fuel cell and trolley bus platforms enable ZF to address the zero-emission mobility aspirations and reinforces the country’s emerging role in next-generation commercial vehicle technology.”

Paramjit Singh Chadha, Senior Vice-President - CVS, ZF Group (Region India), said, “By combining propulsion, braking, suspension, low noise, comfort, safety and intelligent electronics within a compact architecture, ZF helps OEMs simplify vehicle design and accelerate development timelines. Our focus remains on partnering with customers to enable reliable, efficient and future-ready solutions for zero-emission transportation in India.”

Comments (0)

ADD COMMENT