Outlining the journey of M&HCVs for the last 12 years and how they have reflected IIP growth in India, Jayesh Shelar, Head – Product Management Group, Mahindra Truck & Bus Division, Mahindra & Mahindra Ltd, mentioned, “The last decade was one of discovery and presented key challenges like the 3 emission cycles. The BS IV to BS VI emission norm transition was the fastest in the world.” In his presentation as part of the webinar organized by S&P Global Mobility- formerly IHS Markit Automotive- (as part of their 2022 Automotive Solutions Webinar Series) under the theme ‘Indian MHCV Outlook – Is the Future Truly Electrifying’, Shelar expressed that the industry recovered quickly at a GACR of almost 14.8 percent – from the slowdown of FY2014 to the high of FY2019 – by displaying resilience and strong fundamentals. He spoke about the challenge posed by railways starting from 2010. “The rising fuel prices, a shift towards eco-friendly logistics, and an increase in technology have pushed the vehicle cost up,” he added.

Describing the journey of M&HCV segments as a decade of discovery to a decade of disruption, Shelar said, “There were limited brands in India in 2010. By 2030 there will be multiple brand options available.” Drawing attention to a change in the customer profile, he mentioned, “The entry and exit barriers have come down and will ease further. From being acquisition and resale value sensitive in 2010, customers are now looking at Total Cost of Ownership (TCO). They are ready to experiment with new technologies and brands.” Pointing at a shift to higher capacity engines, Shelar said, “A movement towards battery-operated vehicles is also taking place. Fuel cell technologies are catching up and power requirements are ignificantly going up.” Of the opinion that average speeds have gone up and regulations and infrastructure have improved, he informed, “Trucks are traveling up to 450 km a day as compared to 275 km in 2010. By 2030, they will travel up to 700 km per day.”

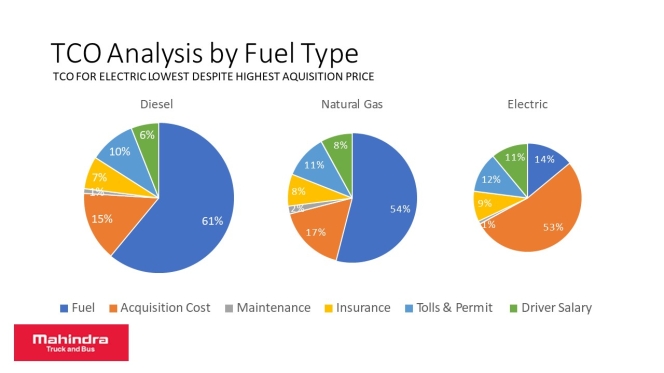

Highlighting rising affinity for technologies like telematics, Shelar mentioned, “A shift from transport to logistics model is taking place.” He drew attention to the TCO of an electric vehicle (despite high acquisition cost) being lower in comparison to the running cost of a diesel and natural gas vehicle over five years. “Fuel cost in diesel and natural gas vehicles is about 55 to 60 percent whereas, in case of the electrical vehicle, it is 14 percent,” quipped Shelar. Underlining the government’s pledge to be net zero by 2030 through measures like 500 gigawatts of non-fossil fuel electricity generation and an increase in natural gas production among others, he said, “Electric vehicle technology is relevant event though issues like high initial acquisition price and charging time will take some time to resolve.”

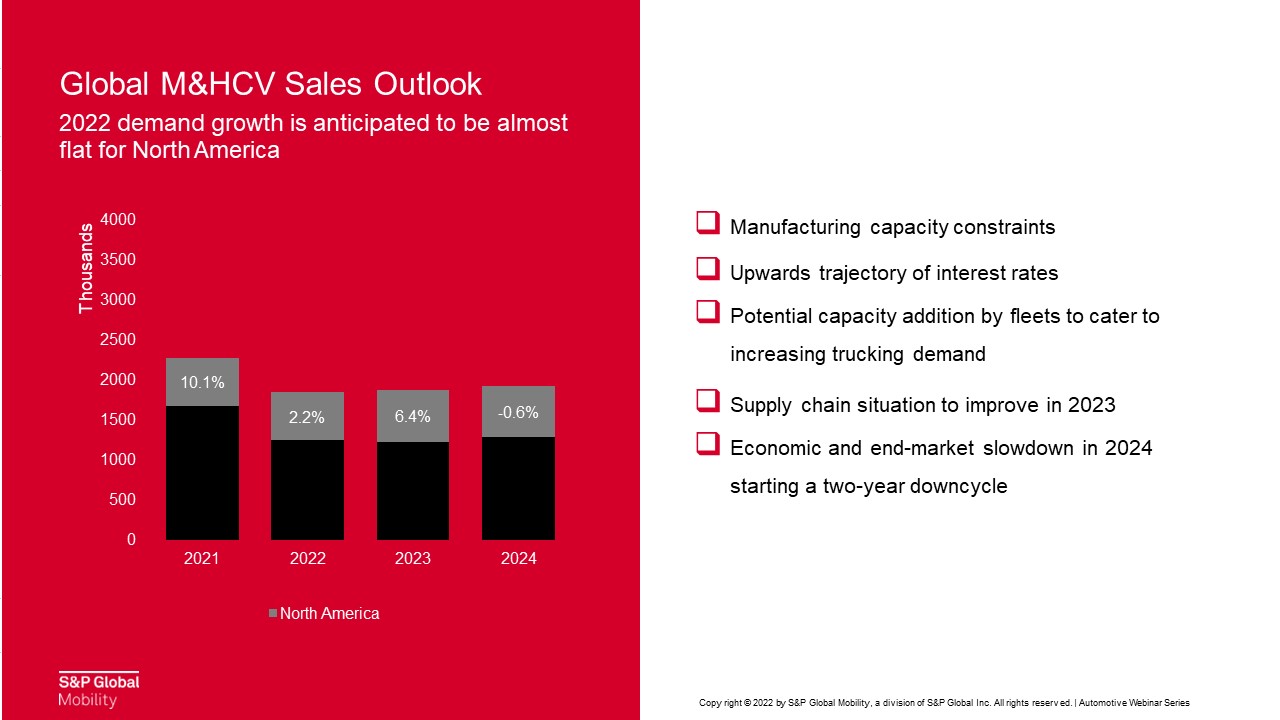

Drawing attention to key drivers like the FAME policy, stringent emission norms, higher compliance cost, and new business models against challenges like the high initial acquisition cost of EVs, range anxiety, developing charging infrastructure, and battery performance, Shelar said that fuel cell is the long-term technology for M&HCVs. In his presentation, Paritosh Gupta, Analyst – M&HCV Forecasting, S&P Global Mobility, averred that the global M&HCV industry headwinds include the Russia-Ukraine conflict and supply chain constraints. “The forecast for 2022 alone is a drop of about 150,000 units, which is 4.4 percent of the entire market size,” he added. Informing that major degradation has come from Europe and North America, Gupta mentioned, “In 2022, the European and North American markets have dropped by 86,000 units and 38,000 units respectively. A lot of volume from central and eastern Europe has been lost and the possibility of sales moving up smartly in the next three years is less.”

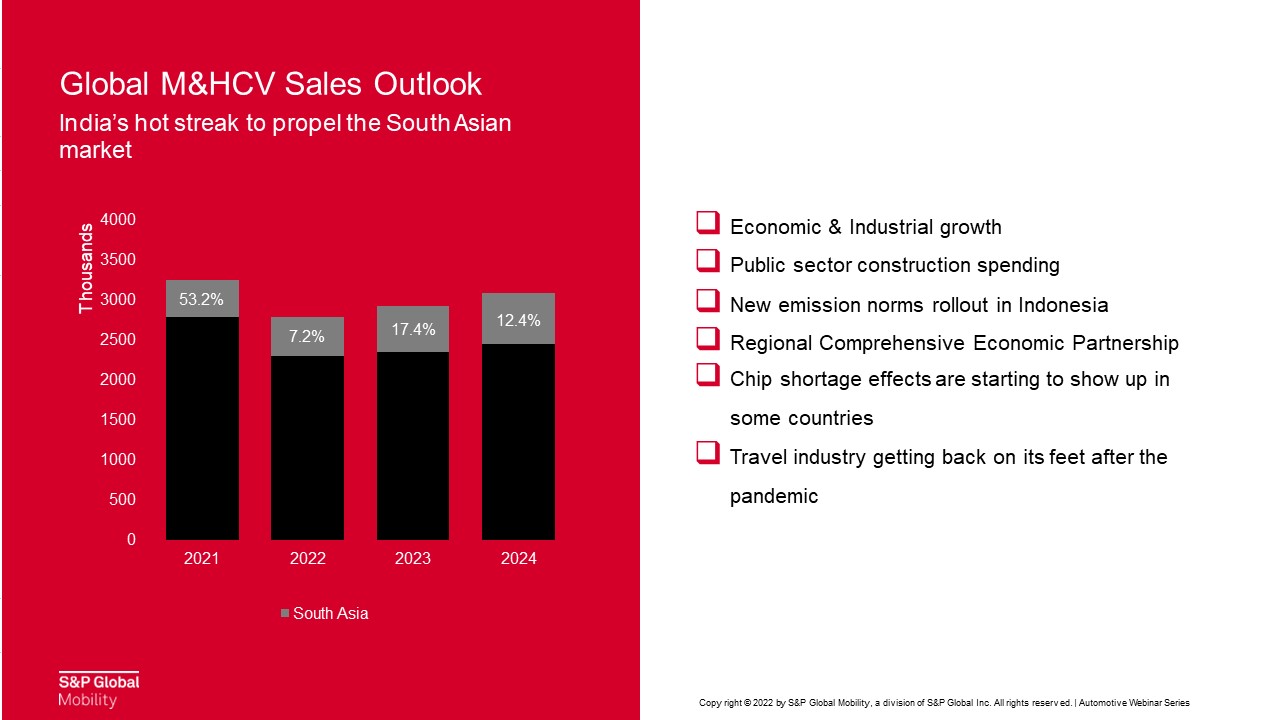

Stating that South Asia, Middle East, and African regions are showing optimism, he explained, “The South Asian market is primarily driven by the performance of the Indian market over the last two quarters. The Chinese market was the only one in 2020 among the key regional M&HCV markets to report positive growth numbers.” Underlining China’s slowing economic growth due to factors like a highly stringent pandemic policy, ithdrawal of pandemic state support, and a shift from road to rail for bulk materials, Gupta expressed, “A 26 percent drop in 2022 and another 1.6 percent drop in 2023 is expected before recovery starts in 2024,” Announcing that the North American forecast is largely positive even though the potential for growth remains limited, he stressed on rising inflation, increasing interest rates, and manufacturing constraints. “We expect fleets to add capacity with the supply chain situation improving in 2023,” quipped Gupta.

Describing that the Western European market is estimated to remain flattish while the Central and Eastern European market is estimated to drop by 28 percent, Gupta pointed at the Russia-Ukraine conflict and supply constraints as the reasons. Western European markets are facing challenges like raw material and truck price increase whereas the Eastern-Central European markets are facing sanctions, stoppage of production by foreign OEMs, and the possibility of Chinese OEMs setting up shops in Russia, he said. Stressing that South Asia was the fastest growing market in 2021, led by India outgrew expectations, Gupta revealed that India accounts for around 60 percent of the M&HCV sales in the region. “In 2022, the South Asian M&HCV market should grow by 7.2 percent and the figures for 2023 and 2024 will be healthy double-digit ones,” he explained. Of the opinion that the factors driving the South Asian M&HCV market include economic and industrial growth, public sector construction spending, the roll-out of new emission norms in Indonesia, comprehensive economic partnership across the region, and an increase in travel, Gupta quipped, “Struggling with chip and other raw material shortage, the Japanese and South Korean markets are expected to be largely flat.”

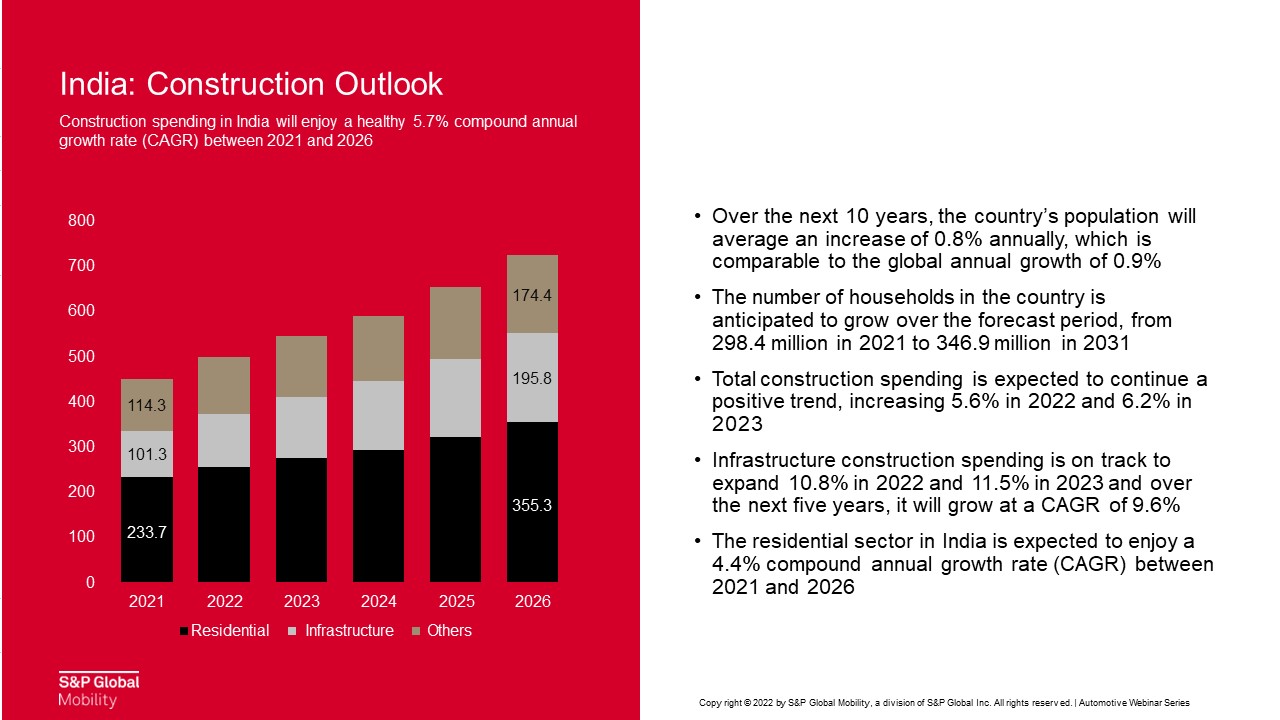

Highlighting rising inflation, high import bills, and weaker global demand as Indian M&HCV headwinds, Gupta mentioned, “The outlook is largely positive though not to the extent it was two years back.” “The construction industry spending will command a CAGR of 10.1 percent between 2021 and 2026 and provide a solid impetus for M&HCV growth,” he added. Stating that while the infrastructure segment’s growth will fuel the growth of heavy-duty trucks, Gupta quipped, “The upward growth trajectory of the e-commerce industry towards becoming the second largest by 2034 is indicative of the growth in demand for medium-duty trucks.” Explaining that the rise of e-commerce and medium-duty trucks over the last five years is a parallel journey, he averred, “Expected to grow at a CAGR of 21 percent over the next 8 years as per IBEF, the e-commerce industry will give a huge boost to medium-duty trucks in India in the future.” “The government has also introduced several policies which are aimed at providing growth to the automotive industry,” he added.

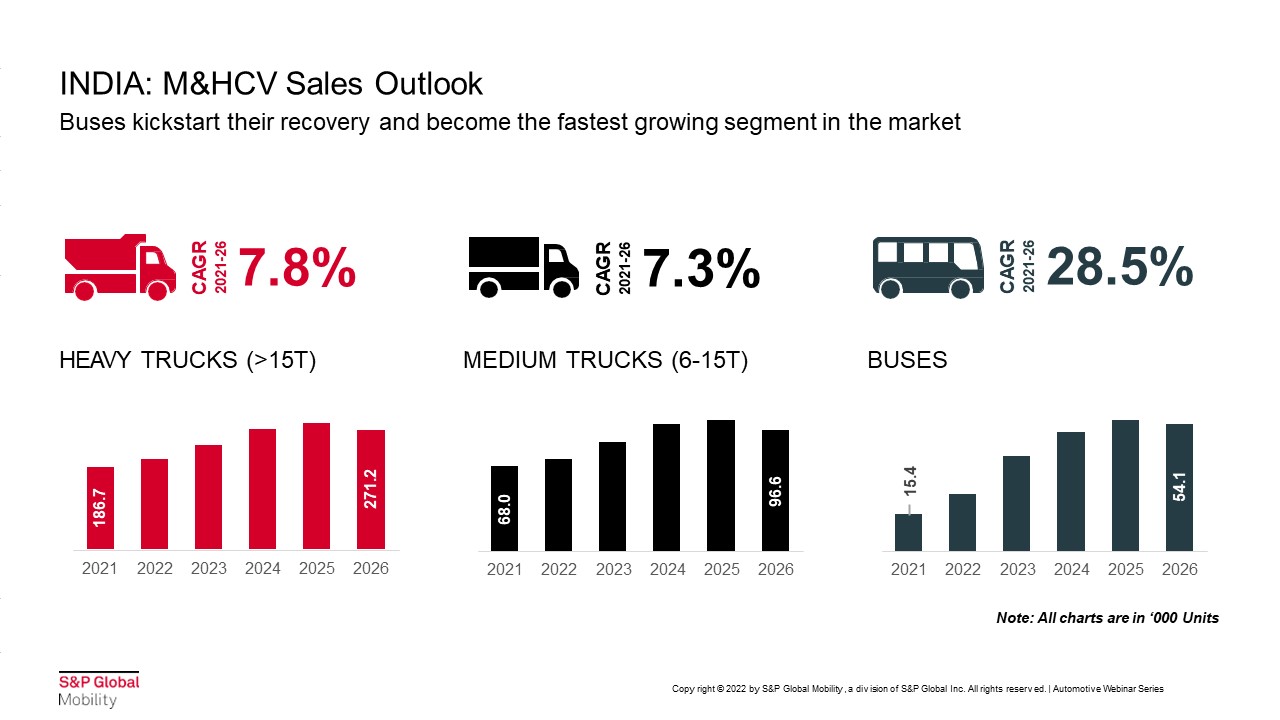

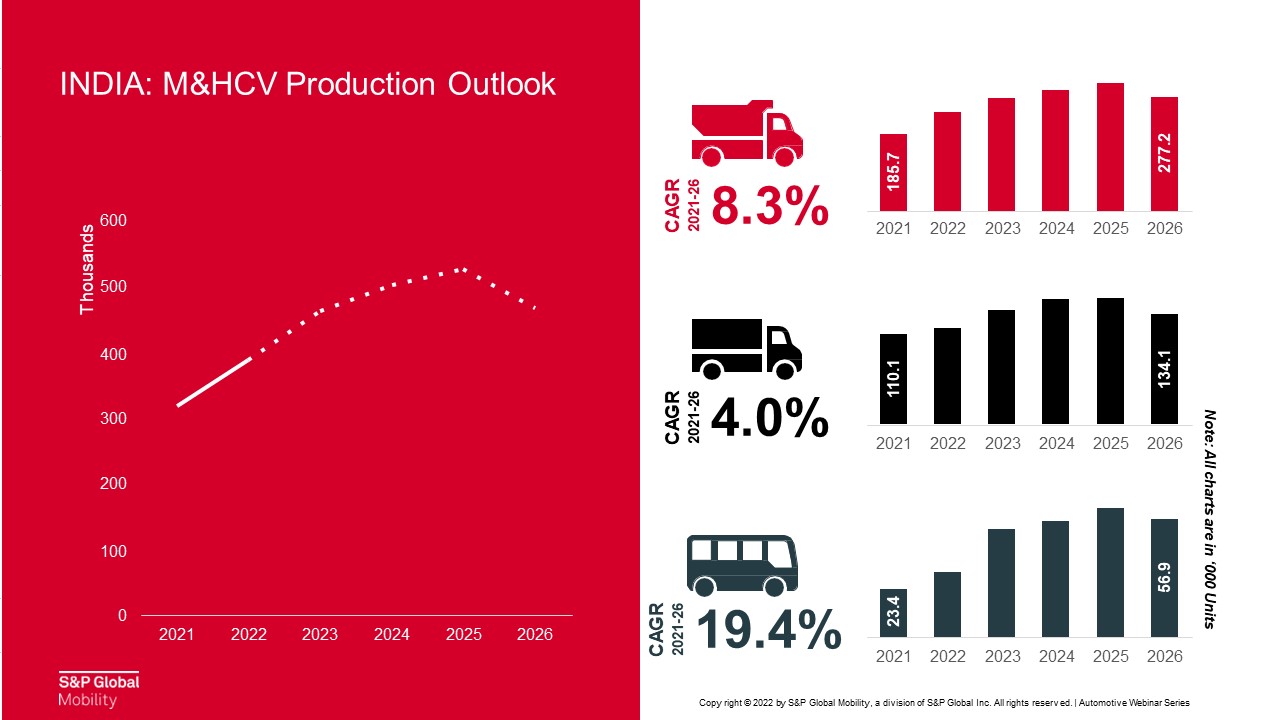

Pointing at the scrappage policy, production-linked incentive scheme, and electrification initiatives, Gupta said, “We see a big tranche of about 50,000 e-buses to come over the next five years” Of the opinion that the monopoly of Tata Motors and Ashok Leyland will continue over the next decade, he averred, “Expect the industry volumes to peak in 2025. Tata Motors will almost touch 200,000 units in 2026.” “In terms of segmental sales, heavy trucks are the largest shareholder in the (M&HCV) market and are expected to clock 275,000 units in 2026 growing at a rate of 7.8 percent,” quipped Gupta. Explaining that MCVs rise will be linked to the rise of e-commerce industry growth and will clock almost 97,000 units by 2026 at a rate of 7.3 percent, Gupta said, “Worst hit by the pandemic, the M&HCV bus segment is expected to pick up in 2022 and reach 54,000 units by 2026.” “The production trend of M&HCVs will be similar to the demand trend in the market. Some buffer will be provided by exports as part of the PLI scheme,” he added.

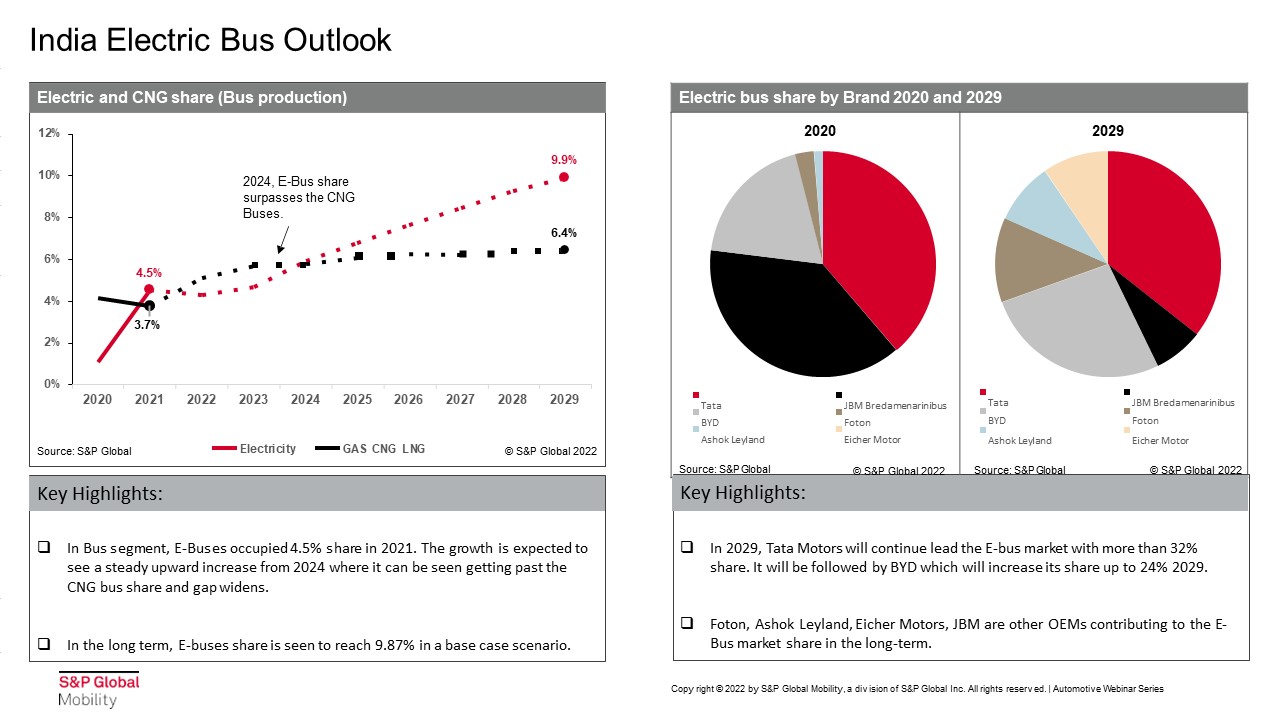

On the topic of M&HCV propulsion trends, Manat Bali, Research Analyst, S&P Global Mobility, mentioned, “Electrification is happening at a much higher pace in buses than trucks. About 99 percent of the M&HCV truck market is currently belonging to IC engines comprising gas and diesel fuels. About 75 percent of the bus market is driven by IC engines running on gas and diesel. With electrification initiatives, the market share of e-buses is expected to reach 30 percent in the long run. It will reach about 9.8 percent by 2029. Natural gas market share will increase up to 12 percent by 2029, triggered mainly by increased availability. It will achieve better traction in medium-duty trucks rather than in heavy-duty ones.”

Of the opinion that diesel fuel will see a de-growth of about 9 percent by 2029 in the Indian CV market at the cost of gas and electrification, Bali averred, “The only electrification taking place in the M&HCV segments is in the bus space as of now. In the long-run, the CNG market share will continue to trail that of the e-bus market share.” “Tata Motors will continue to lead the e-bus market followed by BYD and others in the long run,” he added. About the global e-bus market in the M&HCV category, Bali mentioned, “China is a highly ature and dominant player in e-buses. Other regions are moving up with South Asia having a CAGR growth of 46 percent from 2020 to 2029. India will dominate the e-bus market in South Asia by contributing to over 90 percent of the share.” “The factors driving electrification in India include FAME, state schemes, COP26 target, PLI schemes, and taxation,” he added. “The hindrances in electrification include regulatory drawbacks, infrastructure issues, cost concerns, and end-user dilemmas,” Bali concluded.

Recorded webinar session Available on Demand, please click the link below to watch the session:

https://event.on24.com/wcc/r/3673674/7F886C4E4B36403DD80C623612674EFF?partnerref=motoringtrends

- Daimler India Commercial Vehicles

- DICV

- Indian Institute of Technology Madras

- IIT Madras

- Prof. Ashwin Mahalingam

- Alexander Schoen

IIT Madras, Daimler India Commercial Vehicles To Develop Driver Rating System

- By MT Bureau

- February 02, 2026

The Indian Institute of Technology Madras (IIT Madras) and Daimler India Commercial Vehicles (DICV) have signed a Memorandum of Understanding (MoU) to develop a rating system for commercial driving. The partnership aims to establish a framework for driving standards, insurance assessments and background checks.

The project focuses on creating a technology stack to support a digital public infrastructure for a nationwide rollout. This initiative addresses the current difficulties in monitoring commercial driver performance, safety and well-being, which are often affected by inconsistent standards and limited accountability.

The system will use data-driven approaches, leveraging smartphone inputs and vehicle sensor data to evaluate driving behaviour. The goal is to provide fleet operators, insurers and government bodies with a tool to track performance and compliance in real time.

Prof Gitakrishnan Ramadurai, Project Coordinator at IIT Madras, said, “Trucks and truck drivers are the backbone of our country. This project provides them an aadhaar for their good work. The driver rating system rewards good driving and helps correct risky driving thereby saving lives, money and time for all stakeholders.”

The collaboration combines academic research with industrial application to translate data into scalable products. By incentivising responsible driving, the system is intended to improve employability for drivers and provide data for policymaking.

Prof. Ashwin Mahalingam, Dean of Alumni and Corporate Relations at IIT Madras, said, “IIT Madras has been at the forefront of research in road safety and mobility, with the goal of building systems, processes, and infrastructure that ensure safer outcomes for our roads, drivers and commuters. Our partnership with Daimler is a testament to our shared commitment to this vision and also emphasises how industry-academia collaborations play a crucial role in translating research into impactful, scalable and ready-to-implement products and processes that deliver meaningful societal impact.”

For Daimler India Commercial Vehicles, the partnership aligns with corporate sustainability goals focused on driver professionalism and safety within the transport ecosystem.

Alexander Schoen, Chief Financial Officer, Daimler India Commercial Vehicles, stated, “At DICV, road safety and responsible mobility are central to how we approach sustainability. This collaboration with IIT Madras reflects our commitment to using technology and data-driven innovation to create meaningful, scalable solutions that improve driver safety, professionalism, and well-being across the commercial transport ecosystem. By contributing to the development of a universal driver rating framework, we aim to support safer roads, stronger livelihoods, and a more accountable mobility system for India.”

Jake Morris Succeeds Bal Panaser To Lead ZF’s UK R&D Hub

- By MT Bureau

- January 26, 2026

German technology company ZF Group has appointed Jake Morris as the Site Leader for ZF Hub UK, located in Solihull, effective from 1 January 2026.

Morris assumes responsibility for the leadership of the technical centre, which opened in 2021 to support the company’s research, development and manufacturing footprint in the UK.

He has spent over 25 years with ZF, holding positions in portfolio management, finance, purchasing and engineering. In addition to his new role, he will continue to oversee the global steer-by-wire strategy, a technology that replaces mechanical steering connections with electronic signals. His previous experience as Portfolio Director involved managing steering product strategies for mobility technologies.

At present, the Solihull facility serves as a centre for advanced engineering and testing across the automotive, industrial and aerospace sectors. The site has contributed to the development of autonomous driving systems and steer-by-wire technologies. It houses a testing facility used by both ZF and external customers to validate new technologies within the UK’s automotive sector.

Morris succeeds Bal Panaser, who is retiring following a career of more than 40 years in the automotive industry. Panaser was involved in the establishment and management of ZF’s operations in the UK. Morris will now focus on the site’s integration into ZF’s global technology roadmap and the delivery of engineering solutions.

“I am proud to take on this role and to lead the talented teams at the ZF Hub UK. The site has a strong legacy within both ZF and the automotive industry, with significant history of automotive technology development and testing. For instance, technologies including ZF’s autonomous driving and Steer-by-Wire technologies began life at the site. I look forward to working closely with colleagues and partners to continue delivering innovative technology solutions for our customers and supporting ZF’s long-term success,” said Morris.

- Mitsubishi Fuso Truck and Bus Corporation

- MFTBC

- Hon Hai Technology Group

- Foxconn

- Katsuto Kora

- Mtisubishi Fuso Bus Manufacturing

- MFBM

- Foxtron Vehicle Technologies

- MODEL T

- MODEL U

- FUSO

- Karl Deppen

- Jun Seki

Mitsubishi Fuso, Foxconn To Form A New Standalone Bus Company In Japan

- By MT Bureau

- January 26, 2026

Mitsubishi Fuso Truck and Bus Corporation (MFTBC) and Hon Hai Technology Group (Foxconn) have announced plans to establish a new standalone bus company, which will be headquartered in Kawasaki, Japan.

The new entity will be led by Katsuto Kora as the designated Chief Executive Officer. The transaction is expected to close in the second half of 2026, subject to regulatory and shareholder approvals.

The partnership involves Mitsubishi Fuso Bus Manufacturing (MFBM) and Foxtron Vehicle Technologies, which will cooperate on the development, production, supply chain management and sales of zero-emission buses, starting with the MODEL T and MODEL U models. Operations will be based at a plant in Toyama, where vehicles will be manufactured under the FUSO brand.

The new OEM brand will focus on the launch of electric buses for domestic and international markets while maintaining the existing internal combustion engine portfolio. By using local development and production, the company aims to comply with Japanese regulations and quality standards. The project integrates Foxconn’s software and electronics expertise with MFTBC’s experience in commercial vehicle manufacturing.

The new entity will function as a dedicated original equipment manufacturer (OEM). The collaboration follows a previous memorandum of understanding regarding zero-emission mobility. MFTBC is 89.29 percent owned by Daimler Truck AG, with the remainder held by Mitsubishi group companies.

Karl Deppen, CEO, MFTBC, said, “We are excited to join forces with Foxconn. This collaboration will combine the strengths of both parties to accelerate our transformation in the bus sector. By combining FUSO and Foxconn’s extensive experience and technological know-how, we will offer customers state-of-the art solutions for public transport, thereby contributing to society both in Japan and abroad.”

Jun Seki, Foxconn Chief Strategy Officer for EVs, added, “Mobility is a strategic priority for Foxconn. This collaboration with MFTBC will provide a comprehensive electrification solution for Japan’s transportation ecosystem. This approach will significantly shorten development cycles and enhance cost-efficiency.”

Katsuto Kora, designated CEO of the new company, stated, “The new joint venture will integrate the corporate cultures of both companies, blending Japan’s spirit of manufacturing excellence with Foxconn’s agility and technological prowess. Given the extensive existing partnerships of both shareholders, we expect even broader collaboration opportunities in the field of future technologies in the years to come. Our focus will be on meeting customer expectations not only for current conventional ICE improvement but also for zero-emission transportation and leading FUSO bus into a new era of digitalisation and electrification.”

Ashok Leyland Reintroduces Taurus And Hippo Heavy-Duty Truck Range

- By MT Bureau

- January 22, 2026

Ashok Leyland, one of the leading commercial vehicle manufacturers, has reintroduced the Taurus and Hippo nameplates to its heavy-duty truck portfolio.

In its new avatar, the Taurus will serve as the brand’s high-horsepower tipper range, while the Hippo anchors the tractor segment. Both vehicles are built on the AVTR modular platform, allowing for various configurations to meet specific haulage requirements.

The new range is powered by an 8.0-litre A-Series 6-cylinder engine, producing 360 HP and 1,600 Nm of torque. These vehicles feature reinforced chassis and heavy-duty drivetrains designed for mining, infrastructure and construction applications. The modular architecture is intended to improve component life and fuel efficiency while reducing driver fatigue through updated cabin ergonomics.

The Hippo was a prominent heavy hauler from the 1980s until the early 2000s, while the Taurus was known as the first multi-axle truck in India. The reintroduction of these names targets the medium and heavy commercial vehicle (MHCV) industry, specifically segments involving bulk commodities, industrial raw materials and over-dimensional cargo (ODC) transportation.

Bookings and deliveries for both ranges have commenced through dealerships nationwide. The company aims to use these models to consolidate its position in the high-horsepower segment of the Indian market.

Shenu Agarwal, Managing Director & CEO, Ashok Leyland, said, “Taurus and Hippo are purpose-built for heavy-duty requirements of mining, infrastructure, and construction applications. The new truck range is powered by Ashok Leyland’s A-Series 6-cylinder engines, now with industry-leading peak torque and power, delivering unmatched durability and reliability, higher productivity and faster turnaround times.”

Sanjeev Kumar, President – MHCV, Ashok Leyland, added, “Hippo and Taurus aren't just product names; they are legends that earned the trust of generations of Indian transporters. These names became synonymous with heavy-duty performance across Indian highways and mining sites, and that's the legacy we're building upon. Tippers and tractors are among the fastest-growing segments in the MHCV industry, playing a critical role in India’s infrastructure growth. Operating in harsh terrains and extreme conditions, these vehicles demand superior reliability, robustness, and driver comfort.”

Comments (0)

ADD COMMENT