Chinese-owned car brands outsell Tesla in Europe in February

- By MT Bureau

- March 26, 2025

With Chinese brands like BYD, MG and Polestar gaining traction in Europe, the US electric vehicle brand Tesla has lost much of its stream since the last two months. Tesla registrations have plunged, according to a recent report of Jato Dynamics. The Elon Musk led brand saw its market share fell to 9.6 percent in February 2025 – the lowest it has been during the month of February over the last five years. Its year-to-date market share fell from 18.4 percent in 2024 to 7.7 percent this year.

A total of 966,300 new passenger cars were registered in Europe in February 2025, marking a decline of three percent, compared to the corresponding month last year. As per the Jato Dynamics report encompassing 28 markets, sale of automobiles witnessed a decline in Germany, Italy, Belgium, the Netherlands, Switzerland and Ireland mainly. The year-to-date registrations fell by two percent to a total of 1,962,850 units.

Felipe Munoz, Global Analyst, Jato Dynamics, averred, “There are still no clear signs of recovery in the European automotive industry. Uncertainty in the domestic market is being further complicated by challenges in both China and the US.”

In February 2025, the registrations of battery electric vehicles (BEVs) increased by 26 percent to 164,000 units – the highest volume on record for both the month of February and the period of January to February. A total of 329,700 units were registered, up by 31 percent.

Of the opinion that Tesla is experiencing a period of immense change while pointing at an increase in electric vehicle registrations in Europe, Munoz said, “In addition to Elon Musk’s increasingly active role in politics and the increased competition it is facing within the EV market, the brand is phasing out the existing version the Model Y – its best-selling vehicle – in anticipation of the introduction of a new refreshed version.”

“During this process, brands often experience a drop in sales before they return to normal levels, once the updated model becomes widely available. Brands like Tesla, which have a relatively limited model lineup, are particularly vulnerable to registration declines when undertaking a model changeover,” he added.

The registrations of the Model Y fell by 56 percent to 8,800 units in February 2025. The registrations of the Model 3 fell by 14 percent to 6,800 units.

“The difference in volume drops between these two vehicles suggests that the decline in the brand’s overall sales is more firmly rooted in the Model Y changeover than Musk’s political activity,” Munoz articulated. “However, it will be interesting to see to what extent demand rebounds once the new Model Y hits markets across the region,” he expressed.

Chinese brands outpace Tesla for BEV sales

The difficulties that Tesla is currently facing have created opportunities for some of its competitors. In February, Chinese-owned car brands registered 19,800 new electric vehicles in Europe, outpacing Tesla which registered just over 15,700 units. In the same month last year, the former registered 23,182 units compared to the 28,131 registered by Tesla.

The best-selling Chinese-owned car brands in February 2025 turned out to be Volvo, BYD and Polestar. While Volvo recorded a 30 percent drop in BEV registrations, BYD and Polestar made substantial gains, with increases of 94 percent and 84 percent respectively. Xpeng also performed well with more than 1,000 units, closely followed by Leapmotor with almost 900 units.

Renault Group shines

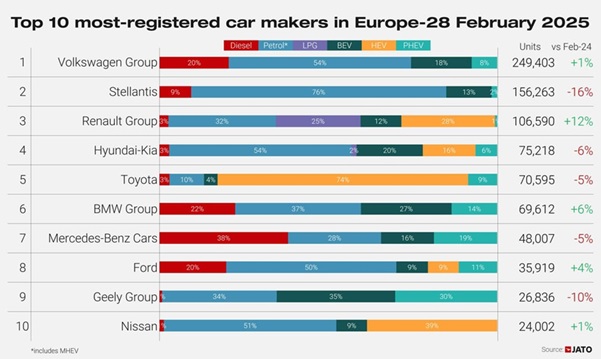

Volkswagen group continued to lead the market with share of 25.8%. Stellantis followed in second position but lost 2.6 points of share when compared to February 2024 due to double-digit drops at Citroen, Opel/Vauxhall and Fiat. Renault Group was the month’s top performer, with a 12 percent increase in volumes and a market share gain of 1.5 points. The group’s strong performance in February can be attributed to positive results posted by the Renault Clio, Dacia Duster and the new Renault Symbioz and Renault 5.

Much of Renault’s success was found in the BEV segment, with 9,400 BEVs registered in February, up by 96 percent. The French manufacturer was only outperformed by Volkswagen, which recorded a 108 percent increase in BEV sales. Other strong increases within the BEV segment included Audi (up by 67 percent), Kia (up by 56 percent), Skoda (up by 63 percent), Citroen (up by 190 percent), Cupra (up by 179 percent), Mini (up by 804 precent) and Ford (up by 146 percent). In contrast, Tesla, Volvo, MG, Fiat, Jeep and Smart recorded a sales decline in the respective month.

The Dacia Sandero leads again

The Dacia Sandero once again led in the ranking by model as Europe’s most registered new vehicle during the month. Meanwhile, second position was occupied by the Citroen C3, with the new generation already being widely available. The Renault Clio followed closely in third thanks to a 22 percent increase in volumes – the second best within the top 10, only outperformed by the Volkswagen Tiguan, in ninth position, which recorded a 43 percent increase in registrations.

The Tesla Model Y and Skoda Octavia have dropped out of the top ten model rankings, making way for the Dacia Duster and Volkswagen Tiguan. The best-performing models in the top 100 included the Peugeot 3008 (with sales up by 40 percent), MG ZS (up by 47 percent), Skoda Kodiaq (up by 32 percent), Jeep Avenger (up by 40 percent), Volkswagen ID.4 (up by 150 percent), Volkswagen ID.3 (up by 114 percent), Skoda Enyaq (up by 41 percent), Mini Countryman (up by 109 percent), BMW 5 Series (up by 54 percen), Fiat 600 (up by 369 percent), Audi A5 (up by 181 percent), Audi A6 (up by 74 percent), Mercedes E-Class (up by 49 percent) and Cupra Born (up by 64 percent)

Image for representative purpose only.

- January 2026

- sales

- Hero MotoCorp

- TVS Motor Company

- Royal Enfield

- B Govindarajan

- Eicher Motors

- Mahindra & Mahindra

- Tata Motors Passenger Vehicles

- Hyundai Motor India

- Toyota Kirloskar Motor

- JSW MG Motor India

- Kia India

- Tarun Garg

- Nalinikanth Gollagunta

- Atul Sood

- Tata Motors Commercial Vehicles

Indian Automotive Sector Starts 2026 With Robust January Wholesales Growth

- By MT Bureau

- February 01, 2026

The Indian automotive industry has commenced the 2026 calendar year on a high note, with automakers across two-wheeler, passenger vehicle and commercial vehicle segments reporting significant YoY wholesale growth for January. The performance reflects a resilient domestic market and a burgeoning recovery in international exports.

The two-wheeler sector saw massive volume gains, spearheaded by Hero MotoCorp, which recorded dispatches of 557,871 units, marking a robust 26 percent growth compared to 442,873 units in January 2025. This performance marks the company’s 25th consecutive year of market leadership. TVS Motor Company followed with a 30 percent increase in domestic two-wheeler sales, reaching 383,262 units, while its electric vehicle (EV) wing grew by 50 percent to 37,756 units.

Royal Enfield achieved a significant milestone, surpassing 1 million year-to-date sales in just 10 months, posting January sales of 104,322 motorcycles – a 14 percent YoY increase, which includes 93,781 units in the domestic market and 10,541 units exported.

B. Govindarajan, Managing Director, Eicher Motors and CEO, Royal Enfield, said, "The new year has begun on a positive note for Royal Enfield – extending the strong momentum from the previous quarter and marking four consecutive months of healthy double-digit growth. We have crossed 1 million motorcycle sales in this financial year across the globe and also crossed 100,000 motorcycle sales in exports."

In the passenger vehicle (PV) segment, Mahindra & Mahindra reported a 25 percent growth in utility vehicles, selling 63,510 units domestically. Tata Motors Passenger Vehicles saw a dramatic 47.1 percent rise in total sales (including EVs) to 71,066 units.

Hyundai Motor India achieved its highest-ever monthly domestic sales of 59,107 units, up 9.5 percent, while Toyota Kirloskar Motor registered 30,630 units, representing a 17 percent YoY growth. Kia India also started the year strong with 27,603 units, a 10.3 percent increase and JSW MG Motor India grew 9 percent with 4,843 wholesale units.

Honda Cars India reported domestic wholesales of 6,193 units and 748 units in exports. These figures follow a January 2025 performance where the company registered 7,325 domestic units and 4,979 units in exports.

The current sales volume is supported by demand for the Honda Amaze, alongside steady contributions from the City and Elevate models.

Tarun Garg, MD & CEO, Hyundai Motor India, said, "January 2026 marks a defining chapter in Hyundai Motor India’s journey. Achieving our highest-ever monthly domestic sales of 59,107 units... reflects not only Hyundai’s brand leadership but also the collective strength of our people, partners and customers."

Nalinikanth Gollagunta, CEO, Automotive Division, Mahindra & Mahindra, said, "Building on the strong momentum of last year's performance, we began the year on a strong note in January... On 14th January, we opened bookings for XUV7XO and XEV 9S clocking 93,689 bookings for a booking value of INR 205 billion - a record-breaking milestone in just 4 hours."

Atul Sood, Senior Vice-President, Sales & Marketing, Kia India, said, "The encouraging start to 2026 reflects the continued trust customers place in the Kia brand. The positive response to the new-generation Seltos, steady demand for the Sonet, and growing popularity of the Carens Clavis and Clavis EV, underline the strength and balance of our portfolio."

Kunal Behl, Vice President, Marketing & Sales, Honda Cars India Ltd, said: “The year has begun on a strong note, supported by a healthy sales momentum. The Honda Amaze continues to bring in strong demand for its value for money offering along with the City and Elevate that contribute steadily to the overall business. We remain confident of sustaining this positive momentum in the coming months.”

The commercial vehicle (CV) sector also demonstrated strength, particularly in heavy and light cargo segments. Tata Motors reported total CV sales of 38,844 units, up 29.1 percent from 30,083 units in the previous year. Within this, Heavy Commercial Vehicle (HCV) trucks saw the sharpest rise at 41.2 percent. Mahindra’s domestic CV sales grew by 22 percent to 27,656 units, driven largely by the LCV 2T–3.5T category.

Union Budget 2026-27: Supply Chain Resilience, Infra Push To Drive Auto Industry Growth

- By MT Bureau

- February 01, 2026

In a strategic pivot from direct consumer subsidies to foundational supply-chain resilience, the 2026-27 Union Budget, presented by Finance Minister Nirmala Sitharaman, focuses on bolstering the structural integrity of the Indian automobile industry.

A cornerstone of this year’s fiscal policy is the massive infrastructure and logistics push, highlighted by the development of the Dankuni-Surat Dedicated Freight Corridor and the operationalisation of 20 new national waterways. These initiatives, alongside a coastal cargo promotion scheme aiming to double the share of waterway freight to 12 percent by 2047, are designed to drastically lower logistics costs and ease the movement of components across the country.

Simultaneously, the government is reinforcing the industry's backbone by establishing a INR 100 billion SME Growth Fund to provide long-term capital for auto-component MSMEs, while enhancing liquidity through the Trade Receivables Discounting System (TReDS) and easing regulatory hurdles via ‘Corporate Mitras’ in Tier-II and Tier-III cities.

To secure the future of high-tech mobility, the Budget further expands the India Semiconductor Mission (ISM 2.0) to include domestic equipment manufacturing and chip IP, while nearly doubling the allocation for the Electronics Components Manufacturing Scheme to INR 400 billion. This technological drive is matched by a robust commitment to the electric vehicle (EV) ecosystem, specifically through the creation of ‘rare earth corridors’ in Odisha, Kerala, Andhra Pradesh and Tamil Nadu. These hubs will provide plug-and-play ecosystems to insulate the industry from global mineral volatility and supply curbs. Complementing this is a series of customs duty exemptions on capital goods used for lithium-ion cell manufacturing and critical mineral processing, which is expected to drive down battery costs and encourage local gigafactory expansion. Finally, for the clean energy segment, the full excise duty exemption on the biogas portion of blended CNG offers immediate relief to fuel prices, marking a comprehensive effort to foster a self-reliant, sustainable, and cost-competitive automotive landscape in the wake of previous GST reforms.

Motul Charts Future Of Mobility With Advanced Fluids At SIAT Expo 2026

- By MT Bureau

- January 31, 2026

Motul India presented a comprehensive vision for the future of automotive fluids at SIAT Expo 2026, centred on innovation, sustainability and supporting the industry’s technological transition. The company’s exhibition was built around the event’s core theme of pioneering safe and sustainable mobility, demonstrating a strategic commitment to evolving alongside new vehicle architectures.

A cornerstone of this vision is the development of fluids for new propulsion systems. A keynote address by Dr Julien Plet, Global Head of R&D, elaborated on the critical role of innovative fluids for next-generation mobility. The company showcased its E-Gen series, engineered for the thermal management of electric vehicle components like motors, batteries and power electronics, positioning it as a critical solution for evolving electrified mobility. Simultaneously, for alternative fuels, Motul presented specialised lubricant formulations for hydrogen internal combustion engines, reflecting early and active research into diverse energy sources. This dual focus underscores a readiness to support the industry’s broad technological transition.

Further solidifying its technical credibility, Motul emphasised its race-to-road development philosophy. The exhibit featured OEM-validated products, including a lubricant with formal Mercedes-Benz approval and another born from collaboration with Toyota Racing Development. These examples illustrate how the company leverages the extreme demands of motorsport as a dynamic proving ground for future commercial technologies, rather than for immediate market launch.

Integral to its presentation was a strong sustainability narrative, exemplified by the NGEN lubricant range. This product line utilises base oils derived from re-refined materials, embodying circular economy principles and a long-term commitment to reducing environmental impact through responsible resource use.

Ultimately, by participating in the expo, Motul India reinforced its role as an innovation-led partner to the automotive ecosystem. With a robust global research backbone and deep industry relationships, the company showcased its structured approach to developing high-performance, sustainable fluids tailored to meet the specific demands of the Indian market as it advances.

Dr Plet said, “Motul’s research and development teams across geographies continue to focus on advancing lubricant performance for existing powertrains while developing technologies aligned with future mobility needs and local market conditions.”

Nagendra Pai, CEO, Motul India & South Asia, said, ‘’SIAT Expo is a key platform for future mobility, and Motul is proud to showcase its global innovation strength in India. By combining advanced technologies with local adaptability, Motul is ready to lead solutions across electrification, sustainability and alternative fuels.”

India-EU Ink Historic Trade Deal To Reshape Global Automotive Landscape

- By Nilesh Wadhwa

- January 27, 2026

In a move that signals a seismic shift in global trade dynamics, the European Union and India today concluded negotiations for a historic and ‘commercially significant’ Free Trade Agreement (FTA). As the largest deal ever brokered by either side, the pact creates a massive free trade zone encompassing 2 billion people and the world's second and fourth largest economies.

While the agreement spans sectors from agriculture to pharmaceuticals, it is the automotive industry that stands as the centrepiece of this industrial realignment.

Cracking the 110% tariff wall

For decades, European automakers have struggled against India’s formidable trade barriers. Under the new agreement, these hurdles are set to crumble. India has committed to a radical reduction in car tariffs, which currently sit at a staggering 110 percent. According to the official release, these duties will be gradually slashed to as low as 10 percent.

Furthermore, the deal provides a massive boost to the automotive supply chain. Tariffs on car parts – a critical sector for European manufacturers – will be fully abolished within a 5-to-10-year window. This move is expected to integrate Indian and European manufacturing hubs more closely than ever before.

European Commission President Ursula von der Leyen hailed the deal as a milestone for rules-based cooperation. "The EU and India make history today. We have sent a signal to the world that rules-based cooperation still delivers great outcomes," she said.

With a population of 1.45 billion and a GDP of EUR 3.4 trillion, India is currently the world’s fastest-growing large economy. This FTA grants European carmakers and industrial firms a ‘privileged access’ that no other Indian trading partner currently enjoys.

Beyond the finished vehicles, the deal addresses the broader industrial ecosystem:

- Machinery & Chemicals: Tariffs of up to 44 percent on machinery and 22 percent on chemicals will be mostly eliminated.

- SME Support: Dedicated contact points will be established to help smaller European component manufacturers navigate the Indian market.

- Intellectual Property: The agreement guarantees high-level protection for designs and trade secrets, providing the legal certainty required for high-tech automotive transfers and R&D investment.

The deal is not merely about volume; it is about the future of mobility. A dedicated chapter on trade and sustainable development focuses on climate change and environmental protection.

To support India’s transition toward sustainable industrialisation – a move critical for the electric vehicle (EV) sector – the EU intends to provide EUR 500 million in support over the next two years. Additionally, a new EU-India platform for climate action cooperation is slated to launch in early 2026, likely serving as a catalyst for joint ventures in green hydrogen and battery technology.

The EU expects the deal to double its goods exports to India by 2032, saving European businesses approximately EUR 4 billion per year in duties.

The path to implementation now moves to the legal and political stage. The negotiated texts will undergo legal revision and translation before being presented to the European Council and the European Parliament for consent. On the Indian side, the agreement will move toward formal ratification.

After nearly two decades of stop-and-start negotiations – beginning in 2007 and relaunching in 2022 – the road is finally clear for a new era of Euro-Indian industrial synergy.

Comments (0)

ADD COMMENT