ContiTech Launches Reduced Dimension Spiral Hydraulic Hose Series For APAC Region

- By MT Bureau

- December 18, 2025

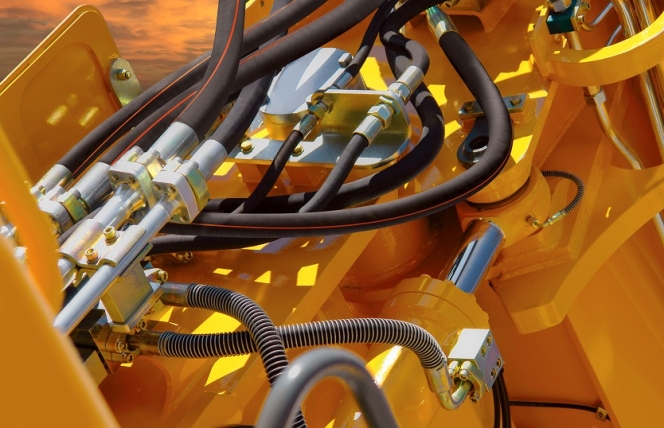

ContiTech, a Continental group sector, has officially introduced its new Reduced Dimension Spiral hydraulic hose series to the Asia-Pacific market. Designed specifically for construction, agricultural and mining machinery, this series aims to improve equipment efficiency through high-pressure capability, flexibility, a lightweight build and extended service life.

The hose incorporates a four- to six-layer spiral of high-tensile steel wire and an optimised synthetic rubber inner tube. This construction yields a more compact and lighter hose with a tighter bending radius, allowing for easier installation in space-constrained machinery like excavators and loaders. The reduction in weight and size contributes to lower system load and energy consumption while also simplifying logistics, installation and maintenance for improved efficiency across the value chain.

Engineered for extreme conditions, the series operates reliably in temperatures ranging from –40°C to +120°C. It maintains flexibility in deep cold and provides strong resistance to oil and swelling at high temperatures. A durable inner tube and weather-resistant cover ensure consistent performance in demanding settings, from arctic mines to high-temperature industrial plants, minimising environmental stress and the need for frequent maintenance.

The product line spans working pressures from 4,100 to 6,100 psi, complies with ISO 18752 CC class standards and carries MSHA flame-resistance certification, adhering to a 4:1 safety factor. This multi-pressure design allows equipment manufacturers to consolidate hose variants, simplifying inventory management, reducing storage costs and maintaining safety across diverse high-pressure uses. Standardisation further streamlines customer processes in assembly, procurement and upkeep.

Tailored for the Asia-Pacific region, the SRDS version features a reinforced synthetic rubber cover that excels in repeat bending applications. Its compound resists surface cracking in tough conditions, including low temperatures, offering a reliable and cost-effective solution. For more severe environments, the XRDS series includes an abrasion-resistant cover for enhanced protection against impacts, friction, and wear in mining, construction, and forestry, thereby extending service life and reducing downtime.

Aligning with its customer-focused approach, ContiTech applies its expertise in high-performance materials and manufacturing to provide safe, efficient and sustainable solutions. The company collaborates with industry partners to advance reliability, efficiency and sustainability across the construction sector.

Xin Song, Head of Mobile Industrial Solutions, Industrial Solutions APAC, ContiTech, said, “The construction, agriculture and mining industries are rapidly transforming towards greater reliability, lower emissions and smarter equipment systems. Leveraging over 150 years of materials expertise, ContiTech develops customer-centric solutions. The Reduced Dimension Spiral series was engineered with deep insights into industry challenges, delivering breakthroughs in lightweight design, space efficiency and extreme-environment adaptability while maintaining constant high-pressure performance. It helps customers reduce equipment load, improve energy efficiency and maximise value across the full equipment lifecycle.”

Volvo Marks 70 Years Of Seatbelt Innovation With Intelligent New Multi-Adaptive System

- By MT Bureau

- March 06, 2026

Volvo Car UK is marking a major milestone in automotive safety this year, celebrating seven decades of pioneering seatbelt innovation with a groundbreaking new system in the EX60 model. This latest development represents the world’s first multi-adaptive safety belt.

The brand’s legacy began in 1956, when the Volvo Amazon prototype was fitted with a two-point diagonal chest belt, making it one of the first European vehicles to offer such a feature. Just three years later, Volvo made history by becoming the first manufacturer to fit three-point seatbelts as standard. This design, created by engineer Nils Bohlin, combined a lap belt with a diagonal strap anchored at a low point beside the seat, establishing the template for the safety belts found in every modern vehicle.

Volvo’s commitment to saving lives was further demonstrated when it made the three-point belt patent available to all competitors free of charge. This altruistic move accelerated the widespread adoption of seatbelts globally and helped fast-track legislation making them a legal requirement, ultimately saving millions of lives. The engineering principles established 70 years ago continue to inform modern Volvos, with the new EX60’s multi-adaptive belt representing the latest evolution.

This advanced system leverages real-time data from interior and exterior sensors to tailor protection for each individual occupant. It considers factors like height, weight and seating position, adjusting its response based on the specific crash scenario. For instance, a larger occupant in a severe collision would receive a higher belt load to mitigate head injury risks, while a smaller person in a minor incident would experience a lower load to protect against rib fractures. Crucially, the system is designed to learn. Through over-the-air updates, the vehicle can continuously refine its understanding of occupant dynamics and crash responses, ensuring the technology improves throughout the car's life. This landmark achievement arrives as Volvo prepares to celebrate its centenary in 2027.

Nicole Melillo Shaw, Managing Director, Volvo Car UK, said, “Volvo has always been at the forefront of safety evolution and innovation, and we’re pleased that we can continue to make new developments on such vital features like the seatbelt. The latest multi-adaptive seatbelt in the new EX60 is a testament to our pioneering technology and approach to safety that is continued today.”

TKM And Maharashtra Government Forge Ahead With Major ITI Skilling Initiative

- By MT Bureau

- March 05, 2026

Toyota Kirloskar Motor (TKM) has taken a significant step in its ongoing collaboration with the Government of Maharashtra by completing the upgrade of the Government ITI Deogiri in Chhatrapati Sambhajinagar. This development is part of a broader Memorandum of Understanding aimed at enhancing the state’s network of Industrial Training Institutes. The company has already facilitated the modernisation of 16 ITIs across the Marathwada and Nagpur divisions. The core objective of this partnership is to uplift rural youth by providing them with advanced technical training, thereby preparing them to become skilled technicians ready to support India’s expanding industrial sector.

A structured three-pillar strategy has been established to drive this transformation. The first pillar concentrates on educator development through specialised training programmes and workshops, including sessions held at Toyota’s facility in Bidadi. The second involves equipping the institutes with modern tools and learning materials, such as fundamental skill training kits and visual aids, to create an industry-relevant learning environment. The third pillar is dedicated to instilling a strong work culture by integrating practices that promote discipline, safety and environmental awareness. This holistic approach aims to cultivate graduates who not only possess technical expertise but also demonstrate integrity and a sense of social responsibility.

The rollout is planned in three distinct phases. Following the completion of the first phase covering 17 ITIs in the Marathwada and Nagpur regions, the subsequent phases will extend the initiative to the Amravati and Nashik divisions and finally to the Mumbai and Pune divisions by 2030. With the upgrade of ITI Deogiri, the institution now serves as a blueprint for this scalable skilling framework. Starting this academic year, it will begin offering training in both manufacturing and service domains to align with current industry demands. This long-term project, which ultimately aims to uplift 45 ITIs across the state, reinforces the national Skill India Mission by leveraging global manufacturing insights to address local skill development needs.

Mangal Prabhat Lodha, Minister of Skill, Employment, Entrepreneurship & Innovation, Government of Maharashtra, said, “Our youth are the foundation of Maharashtra’s future, and by nurturing their skills and aspirations, we are building a self-reliant society. This collaboration with TKM reflects our commitment to providing young people with industry-relevant training that enhances their confidence, employability and contribution to nation-building. Such initiatives ensure that our students are ready for the future to drive the country's growth story."

Vikram Gulati, Executive Vice President – Corporate Affairs and Governance, Toyota Kirloskar Motor, said, “At Toyota Kirloskar Motor, we firmly believe that the youth in rural India deserve the same opportunities as those in urban centres. Our vision is to empower them with world‑class technical capabilities so they can excel in their careers and contribute meaningfully to the nation’s progress. Guided by our philosophy of ‘Grow India, Grow with India’ and our mission of ‘Producing Happiness for All’, this initiative underscores our commitment to strengthening skilling at the grassroots level. As India moves towards the vision of Viksit Bharat 2047, we are dedicated to enabling equitable access to industry‑relevant skills that uplift communities and build a more resilient future.”

India Auto Retail Clock Best-Ever February Sales In 2026

- By MT Bureau

- March 05, 2026

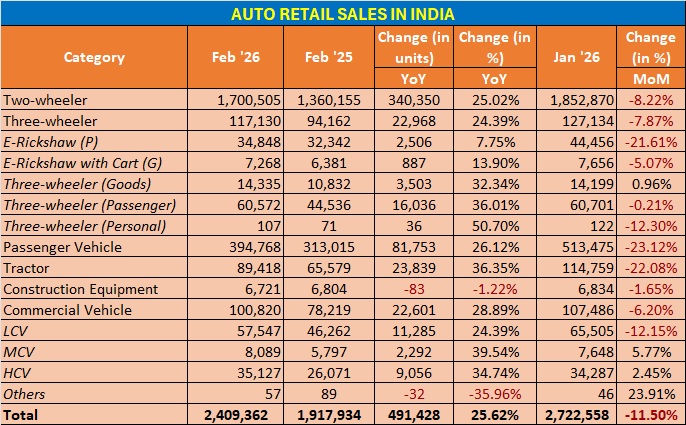

The Federation of Automobile Dealers Associations (FADA), the apex body representing automotive dealers in India, has reported a 25.62 percent YoY increase in retail sales for February 2026, reaching 2.40 million units, surpassing previous records for the month.

The growth followed the GST 2.0 announcement and was distributed across five of the six main vehicle categories. Tractors emerged as the fastest-growing segment with a 36.35 percent increase.

The two-wheeler segment clocked retail sales of 17,00,505 units, a 25.02 percent increase. This includes 28.96 percent growth in the urban markets and 22.16 percent in rural markets. Dealers cited improved rural liquidity from crop outcomes and tax revisions as drivers for demand.

The passenger vehicle segment grew by 26.12 percent to 3,94,768 units with rural demand surging 34.21 percent, outperforming the 21.12 percent growth in urban areas. This trend supported small car sales alongside utility vehicles. Inventory levels reduced to 27–29 days, moving closer to the FADA recommendation of 21 days.

The commercial vehicle segment saw registrations of 1,00,820 units, up 28.89 percent with the demand driven by infrastructure projects, e-commerce activity and freight availability.

Lastly, three-wheeler sales grew by 24.39 percent, while Construction Equipment (CE) was the only category to record a decline, falling 1.22 percent YoY.

C S Vigneshwar, President, FADA, said, “February 2026 has turned out to be a landmark month for the Indian auto retail sector, further strengthening the positive momentum seen after the GST 2.0 announcement. Despite being a shorter month, the industry delivered an exceptional performance with total vehicle retails touching 2.40 million units, marking a strong 25.62 percent YoY growth and surpassing the previous best Feb of 2024. The growth was broad-based across almost all segments. On a YoY basis, Two-Wheeler grew by 25.02 percent, Three-Wheelers by 24.39 percent, Passenger Vehicles by 26.12 percent and Commercial Vehicles by 28.89 percent, reflecting healthy demand across both personal mobility as well as economic activity-driven segments.”

“Encouragingly, PV inventory levels have further reduced by about five days and now stand at 27–29 days, which is an extremely healthy sign. We appreciate PV OEMs for moving inventory closer to FADA’s recommended 21-day level, reflecting improved supply discipline and stronger alignment between wholesale dispatches and retail demand,” he added.

Going forward, FADA maintains a positive dealer outlook, with 75.51 percent of respondents expecting further growth in March. Momentum is expected to be sustained by the financial year-end buying cycle and festivals including Navratri, Ramzan, Ugadi, Gudi Padwa and Eid.

Caterham Cars Welcomes Christian Gorton As Global Head Of Sales

- By MT Bureau

- March 04, 2026

Caterham Cars has announced the immediate appointment of Christian Gorton as its new Global Head of Sales. In this key strategic position, he will oversee the company’s international sales operations and spearhead expansion efforts in vital markets worldwide.

Bringing over two decades of experience in the automotive industry, Gorton joins from CA Auto Finance, where he most recently served as a Director. In that capacity, he was pivotal in accelerating business growth, devising client-focused solutions and cementing vital industry collaborations. His career also includes significant tenures with BMW and FCA Automotive Services.

Known for his proven ability to deliver strong commercial outcomes and cultivate robust dealer networks, his expertise is seen as a perfect match for Caterham’s ambitious growth strategy. Based at the company’s headquarters in Dartford, Kent, Gorton will lead the global sales force and report directly to Trevor Steel, the Senior Vice President of Operations and CFO.

Gorton said, “I’m incredibly excited to be joining Caterham Cars at such a defining moment for the brand. The Caterham Seven represents everything I love about cars – lightweight performance, pure connection and unforgettable experiences behind the wheel. Caterham’s commitment to delivering joy to its customers truly resonates with me, and I can’t wait to work with the team to build on its incredible heritage and create the next chapter of sales growth for the business.”

Comments (0)

ADD COMMENT