- Toyota Mobility Foundation

- TMF

- Arcadis

- CITYDATA

- VOGIC AI

- Prameya Consulting

- The Urbanizer

- Akshat Verma

- Pras Ganesh

- Avinash Dubedi

- Vikram Gulati

Five Finalists Selected for Toyota Mobility Challenge in Varanasi

- By MT Bureau

- August 08, 2025

The Toyota Mobility Foundation (TMF) has named five finalists for its USD 3 million Sustainable Cities Challenge. The challenge focuses on improving crowd management in the historic city of Varanasi, also known as Kashi.

The competition was developed in collaboration with the City of Varanasi, Challenge Works and the World Resources Institute. It aims to find solutions that will ease congestion and improve pedestrian flow in the city's narrow lanes, which see millions of visitors annually.

The five finalists were chosen from ten semi-finalists who had six months to develop their concepts. The selected teams will each receive USD 130,000 in funding to pilot their solutions in Varanasi.

The finalists are:

- Arcadis: Their solution, SANKALP, is an interconnected system of technologies designed for proactive crowd management. It uses real-time data, simulations and communications platforms to ensure people move safely.

- CITYDATA, Inc.: The company's CityFlow solution is a cloud-based platform that uses big data and AI to measure, analyse and manage crowds without needing new hardware.

- VOGIC AI: Behtar-Way is a community-based navigation platform that uses AI to guide people through alternative routes and provide real-time crowd intelligence to city officials.

- Prameya Consulting: Their Nayichaal solution is a 'phygital' AI ecosystem that combines a chatbot, a navigation app and digital signage to improve mobility and safety.

- The Urbanizer: Jan Jatra is a people-focused mobility solution that blends local knowledge with colour-coded wayfinding and digital signs to help with navigation.

Akshat Verma, Municipal Commissioner of Varanasi, stated, "These five outstanding finalists are not only developing solutions that enhance safety, accessibility and the lived experience for both residents and pilgrims, but also ensuring they safeguard the cultural and spiritual fabric of Kashi for future generations."

Pras Ganesh, Executive Program Director at the Toyota Mobility Foundation, added, "From a field of global innovators, these finalists stood out for their creative, practical and contextual approaches to one of the world’s most complex mobility environments."

Avinash Dubedi, Head of Sustainable Cities and Transport at WRII, noted, "Their solutions go beyond easing congestion, they reimagine how people of all ages and abilities—residents, pilgrims and those with special needs, can move through the city with dignity, safety and ease."

Kathy Nothstine, Director of Cities and Societies at Challenge Works, said, "The finalist teams reflect the best of collaborative, interdisciplinary innovation and their work will help transform how we think about movement, space and sacredness in dense urban areas."

Vikram Gulati, Country Head of Toyota Kirloskar Motor, commented, "Their innovations have the potential to transform historic cities and set new global standards in crowd management and urban mobility."

Motul Charts Future Of Mobility With Advanced Fluids At SIAT Expo 2026

- By MT Bureau

- January 31, 2026

Motul India presented a comprehensive vision for the future of automotive fluids at SIAT Expo 2026, centred on innovation, sustainability and supporting the industry’s technological transition. The company’s exhibition was built around the event’s core theme of pioneering safe and sustainable mobility, demonstrating a strategic commitment to evolving alongside new vehicle architectures.

A cornerstone of this vision is the development of fluids for new propulsion systems. A keynote address by Dr Julien Plet, Global Head of R&D, elaborated on the critical role of innovative fluids for next-generation mobility. The company showcased its E-Gen series, engineered for the thermal management of electric vehicle components like motors, batteries and power electronics, positioning it as a critical solution for evolving electrified mobility. Simultaneously, for alternative fuels, Motul presented specialised lubricant formulations for hydrogen internal combustion engines, reflecting early and active research into diverse energy sources. This dual focus underscores a readiness to support the industry’s broad technological transition.

Further solidifying its technical credibility, Motul emphasised its race-to-road development philosophy. The exhibit featured OEM-validated products, including a lubricant with formal Mercedes-Benz approval and another born from collaboration with Toyota Racing Development. These examples illustrate how the company leverages the extreme demands of motorsport as a dynamic proving ground for future commercial technologies, rather than for immediate market launch.

Integral to its presentation was a strong sustainability narrative, exemplified by the NGEN lubricant range. This product line utilises base oils derived from re-refined materials, embodying circular economy principles and a long-term commitment to reducing environmental impact through responsible resource use.

Ultimately, by participating in the expo, Motul India reinforced its role as an innovation-led partner to the automotive ecosystem. With a robust global research backbone and deep industry relationships, the company showcased its structured approach to developing high-performance, sustainable fluids tailored to meet the specific demands of the Indian market as it advances.

Dr Plet said, “Motul’s research and development teams across geographies continue to focus on advancing lubricant performance for existing powertrains while developing technologies aligned with future mobility needs and local market conditions.”

Nagendra Pai, CEO, Motul India & South Asia, said, ‘’SIAT Expo is a key platform for future mobility, and Motul is proud to showcase its global innovation strength in India. By combining advanced technologies with local adaptability, Motul is ready to lead solutions across electrification, sustainability and alternative fuels.”

India-EU Ink Historic Trade Deal To Reshape Global Automotive Landscape

- By Nilesh Wadhwa

- January 27, 2026

In a move that signals a seismic shift in global trade dynamics, the European Union and India today concluded negotiations for a historic and ‘commercially significant’ Free Trade Agreement (FTA). As the largest deal ever brokered by either side, the pact creates a massive free trade zone encompassing 2 billion people and the world's second and fourth largest economies.

While the agreement spans sectors from agriculture to pharmaceuticals, it is the automotive industry that stands as the centrepiece of this industrial realignment.

Cracking the 110% tariff wall

For decades, European automakers have struggled against India’s formidable trade barriers. Under the new agreement, these hurdles are set to crumble. India has committed to a radical reduction in car tariffs, which currently sit at a staggering 110 percent. According to the official release, these duties will be gradually slashed to as low as 10 percent.

Furthermore, the deal provides a massive boost to the automotive supply chain. Tariffs on car parts – a critical sector for European manufacturers – will be fully abolished within a 5-to-10-year window. This move is expected to integrate Indian and European manufacturing hubs more closely than ever before.

European Commission President Ursula von der Leyen hailed the deal as a milestone for rules-based cooperation. "The EU and India make history today. We have sent a signal to the world that rules-based cooperation still delivers great outcomes," she said.

With a population of 1.45 billion and a GDP of EUR 3.4 trillion, India is currently the world’s fastest-growing large economy. This FTA grants European carmakers and industrial firms a ‘privileged access’ that no other Indian trading partner currently enjoys.

Beyond the finished vehicles, the deal addresses the broader industrial ecosystem:

- Machinery & Chemicals: Tariffs of up to 44 percent on machinery and 22 percent on chemicals will be mostly eliminated.

- SME Support: Dedicated contact points will be established to help smaller European component manufacturers navigate the Indian market.

- Intellectual Property: The agreement guarantees high-level protection for designs and trade secrets, providing the legal certainty required for high-tech automotive transfers and R&D investment.

The deal is not merely about volume; it is about the future of mobility. A dedicated chapter on trade and sustainable development focuses on climate change and environmental protection.

To support India’s transition toward sustainable industrialisation – a move critical for the electric vehicle (EV) sector – the EU intends to provide EUR 500 million in support over the next two years. Additionally, a new EU-India platform for climate action cooperation is slated to launch in early 2026, likely serving as a catalyst for joint ventures in green hydrogen and battery technology.

The EU expects the deal to double its goods exports to India by 2032, saving European businesses approximately EUR 4 billion per year in duties.

The path to implementation now moves to the legal and political stage. The negotiated texts will undergo legal revision and translation before being presented to the European Council and the European Parliament for consent. On the Indian side, the agreement will move toward formal ratification.

After nearly two decades of stop-and-start negotiations – beginning in 2007 and relaunching in 2022 – the road is finally clear for a new era of Euro-Indian industrial synergy.

Birla Carbon To Display Carbon Nanotube Solutions At Nanotech 2026

- By MT Bureau

- January 24, 2026

Birla Carbon is set to showcase its innovative Nanocyl range of multi-walled carbon nanotube solutions at NanoTech 2026 in Tokyo, Japan, held from 28 to 30 January. The company’s presence at Booth 3W-A11 highlights a commitment to providing advanced materials that enhance performance and sustainability for industries including automotive, electronics, energy storage and transportation. Through the Nanocyl brand, a global leader in MWCNTs, Birla Carbon offers formulations that improve material efficiency, enable significant cost optimisation and support energy savings.

A key focus will be the NC7000 MWCNT, recognised for its high electrical conductivity, superior processability and strong mechanical property retention. Its UV resistance and exceptional cleanliness make it suitable for demanding industrial and advanced applications. Beyond the base material, Birla Carbon will showcase specialised engineered formulations that address specific industry challenges. These include thermoplastic concentrates for conductive polymers, elastomer masterbatches for durable static control and epoxy-based systems that improve conductivity with processing flexibility. The portfolio also features eco-friendly aqueous dispersions and specialised solvent dispersions tailored for energy storage applications, responding to the growing demand for sustainable and efficient conductive solutions.

This participation underscores Birla Carbon’s dedication to innovation-led growth and its commitment to developing advanced materials that meet evolving market demands. Visitors are invited to explore how these MWCNT technologies can enable new possibilities and support future growth in their own projects.

Laurent Kosbach, CEO, Nanocyl, said, “Nanotechnology is a powerful enabler of material innovation. Through the Nanocyl range of carbon nanotubes, we are advancing material properties such as electrostatic discharge (ESD), electrical conductivity, mechanical reinforcement and thermal dissipation across a wide range of materials. Nanotech 2026 provides an important platform to engage with global partners and demonstrate how our engineered formulations are already delivering value across demanding industries.”

- Amitabh Bachchan

- Alia Bhatt

- Vicky Kaushal

- Kay Kay Menon

- Shankar Mahadevan

- Swanand Kirkire

- Road Transport and Highways

- Nitin Gadkari

- Road Safety

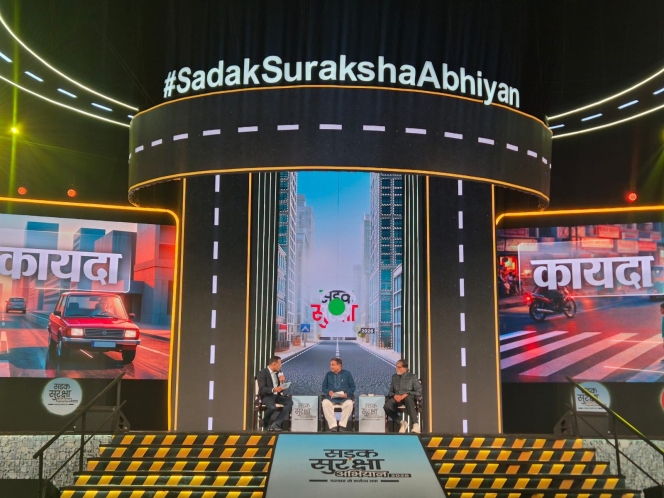

Road Transport Ministry Launches Sadak Suraksha Abhiyan 2026

- By MT Bureau

- January 23, 2026

Union Minister for Road Transport and Highways Nitin Gadkari has announced the return of the Sadak Suraksha Abhiyan (SSA) 2026. This campaign brings together figures from the film industry to address road safety through a public awareness initiative. The ministry will host a telethon on 25 January in Mumbai to mark the fourth year of the programme.

Notable participants joining the movement include Amitabh Bachchan, Alia Bhatt, Vicky Kaushal, Kay Kay Menon, Shankar Mahadevan and Swanand Kirkire. Data from the ministry shows that India recorded 487,707 road crashes in 2024, leading to 177,175 deaths. Figures indicate that adults between 18 and 45 years old represent over two-thirds of these fatalities.

The theme for SSA 2026 is 'Kartavya' (Duty), which frames road safety as a shared responsibility. The tagline for the initiative is ‘Parvaah Se, Kartavya Tak’. The 2026 edition operates on four pillars: Kartavya (Duty), Kayda (Discipline), Kavach (Shield) and Kranti (Change). These are intended to influence road user behaviour across the country.

Factors contributing to fatalities include overspeeding, rash driving, overtaking, jaywalking and the non-use of helmets and seatbelts. The campaign also highlights the failure to provide assistance during the golden hour. The initiative aims to use conversations and performances to encourage the public to follow road regulations.

The event is designed to move from awareness to action within the road ecosystem. The telethon will be broadcast on CNN-News18 on 25th January from 11:00 am onwards.

Comments (0)

ADD COMMENT