Witnessing manufacturing modernisation since Maruti Udyog began producing cars in collaboration with Suzuki of Japan at Gurgaon in 1984, the Indian auto industry landscape has drastically changed. Opening up to automation with the installation of some of the best robots available at Kuka, ABB and others, the auto industry has left no stone unturned. Such has been the fervor that Tal, a Tata Motors company, launched a robot called Brabo in 2018 to make manufacturing processes involving the application of sealants, picking and placing of parts, welding and vision inspection reliable and easy to perform. Made with an eye on manufacturing process the world over, the Brabo was tested in over 50 work streams and has so far found use in sectors like lighting, aerospace, software, electronics, plastics, education and logistics sectors apart from the auto industry. Coming from an auto maker that installed 300 Kuka robots to automate the assembly of Sumo and Safari at its Pune plant in 2009, the Brabo has seen many rounds of development and application-preparedness since its launch.

Smart manufacturing trend

Highlighting the smart manufacturing trend, the TAL Brabo robot with payloads of two and 10 kilos has also found favour with companies in Europe and other places. Highlighting the prowess of Artificial Intelligence (AI) and Internet of Things (IoT), the robot is an example of the fast-changing manufacturing canvas. Producing about 1,286 engines per day, the Igatpuri plant of Mahindra & Mahindra became India's first carbon-neutral manufacturing facility by adopting smart manufacturing practices under Industry 4.0 in 2019. It invested in energy efficient technologies among others. It invested in recycling of water and other waste. It invested in solar panels to power some of its processes in the plant. An industry source expressed that the rapidly changing business environment the world over is providing impetus to smart manufacturing. It is driving efficiency enhancements and collaborations, he added. Emphasising on efficiency enhancements and collaborative efforts as key smart manufacturing drivers, an industry expert stated that technologies like AI, Industrial Internet of Things (IIoT), automation, big data and 5G are the biggest triggers. They are touching every aspect of manufacturing, from sourcing of raw materials to final inspection, he quipped.

Industry 4.0

As companies like Lincode (it has collaborated with Switzerland-based Global Automotive Alliance), specialising in AI-powered visual inspection with multiple patent-pending defect detection capabilities, find more and more takers in India, the smart manufacturing shift is continuing to take place despite disruptions. It has, in fact, gained speed in India with the race to successfully accomplish BS VI transition in the last few years. A source in the auto industry mentioned that BS VI transition led to manufacturers upping their global ambitions. Vinay Raghunath, Partner and Leader, Automotive Sector, EY India, averred in a report that automotive shop floors are evolving and adopting digital technologies. This, he added, is happening amid challenges like slowdown in demand, non-availability of labour, concerns on health and safety management on the shop floor. Witnessing disruptions relating to ROI among other factors, as Raghunath has informed, the Indian auto industry has been an early adopter of digital manufacturing techniques.

Working to dial higher efficiency, expertise and superior productivity, the Indian auto industry has been overhauling existing assembly lines, erecting new ones and extensively re-evaluating its manufacturing processes and practices in view of smart manufacturing, especially from an automotive value chain point of view. Taking to Industry 4.0, it is leveraging AI and IoT-based manufacturing technologies to automate further – to engage in machine-to-machine communication (M2M) such that there is self-monitoring as well as self-diagnosing. Taking to Industry 4.0 to tackle unanticipated disruptions like the Covid-19 pandemic, which has put well-oiled supply chains and production lines to the test and made it painfully clear that they in their current form are not as agile or resilient as expected, the auto industry is shifting to smart manufacturing in a big way. It is exploring and experimenting; it is finding new ways. It is doing so as it absorbs a significant change in technologies and products like electrification and EVs.

Operator 4.0 and hyper-intelligence

Investing heavily in data analytics infrastructure and capabilities, the auto industry is leveraging opportunities to digitally transform itself. It is defining the boundaries of physics for data-driven model. It is focusing on digital skills development. It is supporting the rise of Operator 4.0. Taking to collaborative robots that coexist with humans in a workplace, it is transforming its ways of manufacturing significantly. Drawing attention to the semi-conductor shortage and how the auto industry was affected despite using only 10 percent of the production, Vipin Sondhi, Managing Director, Ashok Leyland, explained that the rapidly changing consumer psyche is dictating a move to a completely different technological aspect. Emphasising on material technology, he said smart manufacturing is about digitising and achieving cost competitiveness. It was some two to three years ago that the Chennai-based CV maker began implementing smart manufacturing technologies to mitigate challenges. It took to modernising and digitising existing workplaces to address quality issues that are difficult for human beings to detect and acquire made-to-order or mass customisation capabilities. It took to equipping itself with an ability to expand and contract in tandem with the market conditions even as it took to modularisation of product lines.

Automating its cab panel pressing plant at Hosur in 2019, which increased the output by up to 66 percent, Ashok Leyland has been one of the many automotive OEMs globally that are investing in hyper-intelligent automation. A confluence of AI and Robotic Process Automation (RPA), hyper-intelligent automation is redefining not just Industry 4.0 but also Operator 4.0. It is facing challenges like the high initial acquisition cost in terms of tools, but that isn’t worrying players involved like Tata Consultancy Services, Wipro, Mitsubishi Electric Corporation, Catalytic Inc and Infosys Limited among others. Estimated to grow at a CAGR of 18.9 percent as manufacturers strive to reduce energy consumption, up quality and reliability, and control costs through predictability and data-driven unique insights, hyper-intelligent automation is turning out to be yet another finer aspect of smart manufacturing. It is proving to be a big enabler for automating repetitive tasks – to enhance efficiencies, to take to cloud computing to ensure significantly more flexibility and to achieve scalability and the ability to collaborate and reduce costs.

Increasing visibility, predictability and enhancing control on operations and inventory, hyper-intelligent automation is aiding effective decision-making. Supported by development of new technologies such as 5G, which according to a domain expert, promises the need for speed and flexibility along with the capability to eliminate network instability or downtime, hyper-intelligent automation is helping automotive suppliers like Rane Madras Limited to make efficiency, reliability and cost control gains. In 2018, the company adopted automated solutions of Mistubishi Electric Corporation for its new plant in Gujarat. It led to a significant decrease in energy consumption. Aiding smart manufacturing, technologies like hyper-intelligent automation and 5G are helping the auto industry to achieve resilience and immunity against future uncertainties. They are helping to integrate Information Technology (IT) systems used for data-centric computing with Operational Technology (OT) systems – for data readiness and cyber security, and for the development of digital talent. Technologies like hyper-intelligent automation and 5G are helping to develop cross-functional profiles like engineering-manufacturing, manufacturing-maintenance and safety-security.

Tackling disruptions and smart working environment

Looking at productivity gains, emerging competition and risk aversity in the globalised world as per the EY report, the auto industry is taking to smart manufacturing to achieve significant technology transformations like electromobility as well. Apart from the creation of a smart working environment, it is also looking at the use of new materials, new process guidelines and practices. With health also becoming a disruptive factor in recent times, the auto industry is looking at automation in processes like inbound logistics, production planning, sourcing, press shop, body shop, paint shop, quality control and outbound logistics through data visualisation. With sensors and analytics shaping up, the smart working environment in a factory is coming to include AI-based alerts and fully automated work floors. This is increasingly getting compounded by data collection, historical data and high-quality extensive data mining. Helping to guarantee ROI, smart manufacturing is helping to lower the ‘takt’ time. It is also ironically undermining the involvement of humans on the shop floor.

Reducing the cost of computation, storage and connectivity, smart manufacturing is coming of age with plummeting prices of sensors, 3D printers and robots. Empowering cloud-based manufacturing techniques and a gradual increase in the understanding of emerging technologies, smart manufacturing is providing an advantage in terms of the ability to respond to market changes quickly. Taking to develop a new light-duty truck platform with export ambitions and flexibility in terms of left-hand drive and right-hand drive orientation, VE Commercial Vehicles Ltd took to automating its welding line with robots at its Pithampur plant. It also took to robotising its windshield pasting station among others. Experiencing quality, consistency, efficiency and cost gains, the CV maker is also known to have reduced the takt time and energy consumption. As global ambitions and modularity strike in view of the ability to explore new export markets with a cost competitive BS VI product, the auto industry in India is using embedded sensors, RFID and GPS etc. for smart tracking. It is using smart manufacturing technologies to monitor parameters like temperature, pressure, vibration, machine rpm and flow rate.

Smart flexibility

As part of a shift to smart manufacturing, automakers and suppliers are resorting to flexible manufacturing and AR-based solutions to upskill. They are, in view of the technologies like connected vehicles and EVs, stressing on re-aligning their traditional manufacturing setups with that of the future. Emphasising on quality, resource optimisation, streamlining of business processes and adoption of new emerging technologies, they are closely evaluating the advantages of solutions like digital twins and rapid prototyping using additive manufacturing offer. With ROI on their mind, they are embracing smart manufacturing to move up the value chain.

Rolls-Royce Crafts Exclusive Artwork In Support Of Aldingbourne Trust

- By MT Bureau

- March 09, 2026

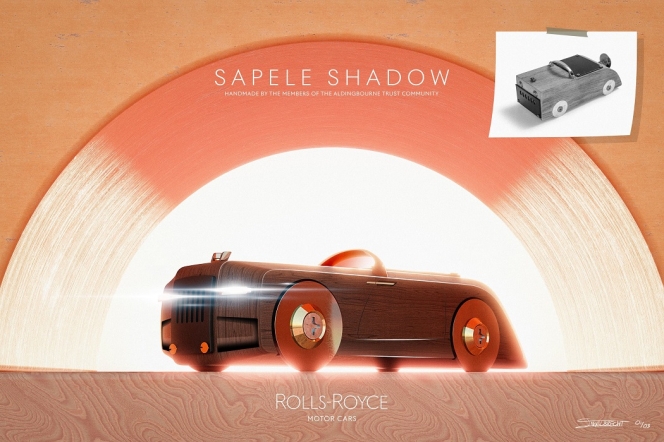

Rolls-Royce Motor Cars has marked the conclusion of its year-long partnership with Aldingbourne Trust by presenting the charity with a series of exclusive artworks. These pieces were created by the luxury marque’s in-house design team and inspired by a wooden model gifted to Rolls-Royce by the Trust late last year.

That model, named the ‘Sapele Shadow’ after the wood used in its construction, was made by the Wood@Aldingbourne team as a gesture of gratitude when Rolls-Royce delivered its final donation. Now displayed at the company’s Goodwood headquarters, the handcrafted vehicle prompted one of the marque’s designers to reinterpret it digitally using the same advanced rendering software applied for client commissions.

Only three framed prints of this original artwork have been produced, each signed and numbered by the designer. One is set to be displayed in the Aldingbourne Trust café, another has been presented to the Wood@Aldingbourne workshop and the third will be auctioned to support the charity during the Goodwood Members’ Meeting in April.

Wood@Aldingbourne is one of over a dozen social enterprises run by the Trust, which has supported more than 1,500 individuals with learning and physical disabilities since its founding in 1978. Operating as a self-funding environmental group, it collects and repurposes reclaimed wood from local sources, including the Rolls-Royce site. All materials are either transformed into handmade goods for sale or used to fuel the Trust’s biomass boiler.

The relationship between Rolls-Royce and Aldingbourne Trust extended beyond fundraising throughout 2024, with colleagues contributing both time and resources. This ongoing collaboration reflects the meaningful connections formed when employees engage with their chosen House Charity, often resulting in support that endures well beyond the official partnership.

Andrew Ball, Head of Corporate Relations, Rolls-Royce Motor Cars, said, “It was a privilege to work with Aldingbourne Trust as our House Charity in 2024. When we presented the final donation cheque, we received an unexpected gift – a model car made in Sapele wood by the Wood@Aldingbourne team. This delightful model inspired one of our designers to create a unique digital rendering, just as we would for a real client commission. We’re delighted that this artwork will be displayed in the Trust’s café and will also be offered as a significant prize in a fundraising auction. It’s a pleasure to extend our support for this wonderful organisation beyond 2024.”

Abigail Rowe of Aldingbourne Trust said, “We were so appreciative of the fundraising efforts by Rolls-Royce staff, and the tremendous awareness we were able to generate through being their House Charity. It’s wonderful that the relationship has continued through this collaboration, which meant so much to the client who created the original wooden model, and will help raise further money for us. We’d like to thank the whole Rolls-Royce team, and particularly the talented designer who created these images for us.”

Caterham And HWM Celebrate 1951 HWM-Alta Racer With Exclusive Seven HWM Edition

- By MT Bureau

- March 09, 2026

In a collaboration that fuses past and present motorsport excellence, Caterham and its Surrey-based retail partner HWM have unveiled the Seven HWM Edition. This limited-edition model pays tribute to the celebrated 1951 HWM-Alta Grand Prix car, a machine that helped define an era for British racing.

The Seven HWM Edition is limited to just 19 units for the UK market, each priced from GBP 57,990. Every example features a distinctive HWM Green exterior, a colour meticulously matched to the original 1951 racer. Design cues drawn directly from its predecessor include bespoke side panel louvres, a unique nosecone grille and suspension components finished in Retro Grey. Additional touches such as a custom HWM nosecone badge and a central chrome fuel filler cap reinforce the connection.

Inside, the hand-turned aluminium SuperSprint dashboard continues the tribute, equipped with classic SMITHS chrome instrumentation, a solid metal cut-off switch and a polished wood-rimmed Moto-Lita steering wheel. The cabin is completed with optional leather or composite seats bearing the HWM logo, while chrome accents on the gear knob and handbrake add refinement.

Mechanically, the car is rooted in the Seven 420, powered by a 210 bhp 2.0-litre Duratec engine. With a power-to-weight ratio of 375 bhp per tonne, it delivers exhilarating performance, accelerating from 0 to 60 mph in just 3.8 seconds. A numbered dashboard plaque, indicating its exclusivity, is fitted to each of the 19 cars.

HWM, originally established in 1938 as Hersham and Walton Motors, built its reputation as the first British team to claim a Grand Prix victory after the war. Yet it was the 1951 HWM-Alta that truly solidified its place in history, securing numerous international podium finishes with a roster of drivers that included the legendary Sir Stirling Moss. Now primarily a luxury sports car specialist, HWM became an official Caterham retailer for the South East in 2023, making this partnership a natural extension of its longstanding connection to performance engineering.

Trevor Steel, Senior Vice President of Operations & CFO, Caterham Cars, said, “It’s been a real privilege to work with HWM on this special limited edition. Drawing inspiration from the legendary HWM-Alta racer, this car pays tribute to Walton-on-Thames’ rich racing heritage while celebrating the lightweight, driver-focused ethos that defines what Caterham is today. Bringing together two iconically British brands with deep roots in motorsport made this project especially meaningful. It reflects a shared commitment to engineering purity, performance and craftsmanship – values that have shaped both our histories and continue to drive us forward. We’re proud to honour that with a car created for true enthusiasts.”

Guy Jenner, CEO, HWM, said, “We are immensely proud to celebrate HWM’s remarkable history as a works team and grand prix car constructor. This project has given us a unique opportunity to tell the story of how a small outfit from Walton-on-Thames took on the greatest teams in European grand prix racing during one of motor racing’s most inspiring eras. Our sincere thanks go to Caterham for being such an enthusiastic and committed partner. Each of the 19 hand-built cars showcases exquisite detailing, with an outstanding sense of quality and craftsmanship.”

Amazon Pay Expands Vehicle Insurance Portfolio Through New Partnerships

- By MT Bureau

- March 09, 2026

Amazon Pay has announced the expansion of its vehicle insurance sector, establishing partnerships with HDFC ERGO, ACKO and ICICI Lombard. The service provides insurance coverage for 280 million vehicle owners across India, including 250 million two-wheeler and 30 million car owners.

The platform allows users to purchase policies through the Amazon app. The system is designed to reduce common friction points by eliminating the requirement for physical inspections of two-wheelers and removing sales calls during the procurement process.

Policies are issued digitally and made available on the customer's orders page. The service includes access to cashless claims processing at a network of more than 9,000 garages nationwide. This network extends beyond metropolitan areas to include Tier 2 and Tier 3 cities such as Coimbatore, Gwalior and Jhansi.

Amazon Pay insurance offers 100 percent digital onboarding/issuance with minimal documentation. Payments via Amazon Pay with associated cashback options and ability to compare premiums from multiple insurers. Amazon Prime users also get specific discounts by insurers.

The expansion aims to address insurance penetration in India, where data indicates that 70 percent of registered two-wheelers remain uninsured. By partnering with established insurers, Amazon Pay intends to provide a financial safety net for road users in regions where access to such services has previously been limited.

Vikas Bansal, CEO, Amazon Pay India, said, “Amazon Pay strives to innovate for every Indian, simplifying lives and fulfilling aspirations by solving for their payment and financial needs. Our latest expansion of the vehicle insurance portfolio is a direct reflection of that commitment. With more than 70 percent of India's registered two-wheelers uninsured, we are focused on driving deeper insurance penetration into tier 2 and tier 3 cities where access has been limited by partnering with India's most trusted insurers to bring a comprehensive cashless garage network, we are not just offering a service – we are providing a critical safety net for millions of road users and helping to build a more financially secure society.”

- Recreatives Industries

- MAX Amphibious Vehicles

- All-Terrain Vehicles

- TRL Outdoors

- Muddog Amphibious Vehicles

Recreatives Industries Partners With TRL Outdoors To Accelerate MAX Dealer Network Growth

- By MT Bureau

- March 08, 2026

Recreatives Industries, the company behind the iconic MAX 6x6 Amphibious All-Terrain Vehicles, has announced a new partnership aimed at broadening its market reach. The manufacturer has signed a national representation agreement with TRL Outdoors LLC, known for Muddog Amphibious Vehicles. This collaboration is designed to accelerate the growth of the MAX dealer network while reinforcing the brand's ongoing push into utility, industrial and commercial sectors.

As per the agreement, TRL Outdoors will represent the full range of MAX vehicles across the entire country. The move is intended to strengthen nationwide coverage and foster a more structured and sustainable expansion of the dealer base. The representatives bring significant industry experience to the table, having previously worked with manufacturers of high-end industrial amphibious vehicles, whose prices often started well above USD 100,000. This background positions them to effectively introduce the more cost-effective MAX platforms to a market accustomed to substantially higher-priced equipment.

The agreement includes a framework of quarterly performance goals focused on integrating new dealers, increasing market share and enhancing brand visibility. This structured approach is intended to ensure growth is both disciplined and sustainable. With the upcoming availability of models like the MAX 4 and Buffalo, the company is confident that TRL Outdoors will be instrumental in penetrating new sectors. The core strategy hinges on offering capable amphibious performance at a price point significantly lower than many established industrial alternatives. This partnership represents a key step in the company's broader plan to solidify its dealer network and secure long-term, measured growth.

Andrew Lapp, CEO, Recreatives Industries, said, “This agreement aligns with our strategy of expanding deliberately and building a high-quality dealer network. TRL Outdoors has firsthand experience selling premium amphibious vehicles into demanding commercial environments. Their understanding of dealer development, combined with MAX’s proven designs and compelling value proposition, positions us well as we expand into new regions and applications.”

Comments (0)

ADD COMMENT