- US President Donald Trump

- 2 April 2025

- American Industry

- broad new tariff policy

- duty

- imports

- India

- 26 percent

- ‘discounted' reciprocal tariffs

- China

- Countries

- auto industry

- ancillary

- ACMA

US President Donald Trump Announces Retaliatory Tariffs; Indian Government Carefully Examining The Implications

- By Bhushan Mhapralkar

- April 03, 2025

After terming India’s import duty barriers high for some time, US President Donald Trump has expressed that 2 April 2025 will be remembered as the day the American industry was reborn as his government announced a broad new tariff policy that imposes at least a 10 percent duty on nearly all imports from certain countries. In the case of India, the policy speaks of 26 percent ‘discounted' reciprocal tariffs. The tariff on China, on the other hand, is 34 percent.

Aimed at protecting American farmers and ranchers, according to Trump, the broad-based tariff policy is also being termed as ‘national emergency’ driven in view of the ongoing trade deficits, which hit a record USD 1.2 trillion in 2024.

The German auto industry has reacted to the US policy by stating that it 'will only create losers'. While the Asian stock markets have shrunk in response to the announcement, the Indian Ministry of Commerce is analysing the impact of the 26 percent ‘discounted’ tariff announcement.

Mentioning in its statement that it understands the intent of the US administration to boost domestic manufacturing and address trade imbalances, the Indian auto components apex body ACMA (Automotive Component Manufacturers Association of India) has said that autos and auto parts as well as steel and aluminium articles are already subject to Section 232 tariffs at 25 percent announced earlier by the US President’s order on 26 March 2025. A detailed list of auto components that will be subject to 25 percent import tariff is awaited, it mentioned.

Shraddha Suri Marwah, President, ACMA and CMD, Subros Ltd, averred, “ACMA remains hopeful that the ongoing bilateral negotiations between the Indian and U.S. governments will lead to a balanced resolution that benefits both economies. We believe that the strong trade relationship between India and the United States, especially in the auto components sector, will encourage continued dialogue to mitigate the impacts of these measures. ACMA is committed to engaging with all stakeholders to ensure the long-term interests of the Indian auto component industry.”

Saurabh Agarwal, Partner and Automotive Tax Leader, EY India, observed, "With US automotive tariffs rising, India's electric vehicle sector has a prime opportunity to capture a larger share of the US market, especially in the budget car segment.” He drew attention to the fact that China's 2023 auto and component exports to the US stood at US$17.99 billion whereas India's were only US$2.1 billion in 2024, highlighting the potential for growth. “To accelerate this, the government should enhance the PLI scheme by including more auto components, opening it to new players, and extending it by two years,” he added.

Mrunmayee Jogalekar, Auto and FMCG Research Analyst, Asit C Mehta Investment Interrmediates Ltd, expressed, “Certain sectors such as auto and auto ancillary, which are already subject to a separate 25 percent tariff announced in March are exempt to the levy of reciprocal tariffs. This means no additional tariffs will be imposed on this sector.”

Stating that other exempted segments include copper, pharmaceuticals, semiconductors, critical minerals and energy products, she informed,

“Since import duties apply to all trading partners, the extent of impact will vary across sectors and countries based on competitive advantages.” “For the Indian auto component industry, which derives around 30 percent of its revenue from exports, with 30 percent of that coming from the US, this could result in a potential hit on sales or profit margins,” she added.

In FY2024, ACMA reported that India exported USS$ 6.79 billion worth of auto components to the US. It imported only USS 1.4 billion, resulting in a substantial trade surplus in India's favour.

Against the backdrop of the broader tariff policy that speaks of a 26 percent duty of Indian exports to US, the discussion between Indian and the US regarding the bilateral trade agreement will assume importance as well as urgency. For US automotive companies to find their way to the Indian market despite their near cult status – the likes of Harley Davidson and Tesla – will only mean facing a competition that is stiffer than expected and a customer mindset that is far different from how it is in the US.

Srikumar Krishnamurthy, Senior Vice-President & Co-Group Head, Corporate Ratings, ICRA, said, "The US Government has imposed a 25 percent tariff on passenger vehicles (sedans, sport utility vehicles, crossover utility vehicles, minivans and cargo vans) and light trucks (collectively referred to as automobiles), which come into effect from 3 April 2025. As the PV exports from India to the USA represent less than 1 percent of the total PV exports, the tariff imposition of the tariff does not have any material impact on the Automotive OEMs. The scenario is however different for auto components. On 12 March 2025, a 25 percent tariff was imposed on all aluminium and steel components being imported into the US. Subsequent to this, on 26 March 2025, a 25 percent tariff was imposed on other key auto parts as well (including engines, transmissions, powertrain components and key electrical parts except those under USMCA), with processes to expand tariffs on additional parts, if necessary. The effective date is pending but is expected to be no later than 3 May 2025. Auto components have not featured in the latest set of additional tariff announcements that has been made on 2 April 2025. India’s auto components exports accounted for around 29 percent of industry revenues in FY2024. Of this, about 27 percent went to the US. While the situation is evolving, the recent tariff related development and the consequent inflationary pressures and slowdown in demand in the US could have a negative impact on revenue and earnings for component exporters (in the affected product categories) over the next few months. Nevertheless, with higher tariffs being levied on other competing nations, this could also create long-term opportunities for the exporters. Exporters dependent on the US are also trying to diversify their revenue base across other geographies (including Asia). Measures to improve value addition, diversification into non-auto segments and cost-optimisation strategies are also being worked upon to reduce the potential impact on margins.

Image for representative purpose only.

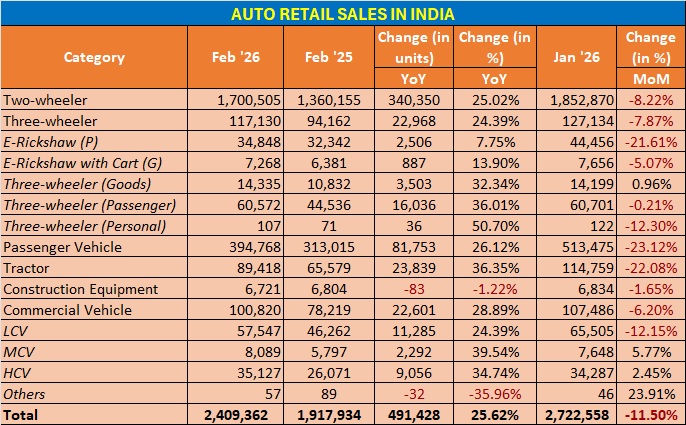

India Auto Retail Clock Best-Ever February Sales In 2026

- By MT Bureau

- March 05, 2026

The Federation of Automobile Dealers Associations (FADA), the apex body representing automotive dealers in India, has reported a 25.62 percent YoY increase in retail sales for February 2026, reaching 2.40 million units, surpassing previous records for the month.

The growth followed the GST 2.0 announcement and was distributed across five of the six main vehicle categories. Tractors emerged as the fastest-growing segment with a 36.35 percent increase.

The two-wheeler segment clocked retail sales of 17,00,505 units, a 25.02 percent increase. This includes 28.96 percent growth in the urban markets and 22.16 percent in rural markets. Dealers cited improved rural liquidity from crop outcomes and tax revisions as drivers for demand.

The passenger vehicle segment grew by 26.12 percent to 3,94,768 units with rural demand surging 34.21 percent, outperforming the 21.12 percent growth in urban areas. This trend supported small car sales alongside utility vehicles. Inventory levels reduced to 27–29 days, moving closer to the FADA recommendation of 21 days.

The commercial vehicle segment saw registrations of 1,00,820 units, up 28.89 percent with the demand driven by infrastructure projects, e-commerce activity and freight availability.

Lastly, three-wheeler sales grew by 24.39 percent, while Construction Equipment (CE) was the only category to record a decline, falling 1.22 percent YoY.

C S Vigneshwar, President, FADA, said, “February 2026 has turned out to be a landmark month for the Indian auto retail sector, further strengthening the positive momentum seen after the GST 2.0 announcement. Despite being a shorter month, the industry delivered an exceptional performance with total vehicle retails touching 2.40 million units, marking a strong 25.62 percent YoY growth and surpassing the previous best Feb of 2024. The growth was broad-based across almost all segments. On a YoY basis, Two-Wheeler grew by 25.02 percent, Three-Wheelers by 24.39 percent, Passenger Vehicles by 26.12 percent and Commercial Vehicles by 28.89 percent, reflecting healthy demand across both personal mobility as well as economic activity-driven segments.”

“Encouragingly, PV inventory levels have further reduced by about five days and now stand at 27–29 days, which is an extremely healthy sign. We appreciate PV OEMs for moving inventory closer to FADA’s recommended 21-day level, reflecting improved supply discipline and stronger alignment between wholesale dispatches and retail demand,” he added.

Going forward, FADA maintains a positive dealer outlook, with 75.51 percent of respondents expecting further growth in March. Momentum is expected to be sustained by the financial year-end buying cycle and festivals including Navratri, Ramzan, Ugadi, Gudi Padwa and Eid.

Caterham Cars Welcomes Christian Gorton As Global Head Of Sales

- By MT Bureau

- March 04, 2026

Caterham Cars has announced the immediate appointment of Christian Gorton as its new Global Head of Sales. In this key strategic position, he will oversee the company’s international sales operations and spearhead expansion efforts in vital markets worldwide.

Bringing over two decades of experience in the automotive industry, Gorton joins from CA Auto Finance, where he most recently served as a Director. In that capacity, he was pivotal in accelerating business growth, devising client-focused solutions and cementing vital industry collaborations. His career also includes significant tenures with BMW and FCA Automotive Services.

Known for his proven ability to deliver strong commercial outcomes and cultivate robust dealer networks, his expertise is seen as a perfect match for Caterham’s ambitious growth strategy. Based at the company’s headquarters in Dartford, Kent, Gorton will lead the global sales force and report directly to Trevor Steel, the Senior Vice President of Operations and CFO.

Gorton said, “I’m incredibly excited to be joining Caterham Cars at such a defining moment for the brand. The Caterham Seven represents everything I love about cars – lightweight performance, pure connection and unforgettable experiences behind the wheel. Caterham’s commitment to delivering joy to its customers truly resonates with me, and I can’t wait to work with the team to build on its incredible heritage and create the next chapter of sales growth for the business.”

Renault Group to Unveil futuREady Strategic Plan

- By MT Bureau

- March 04, 2026

Renault Group CEO François Provost and the management team will present a new strategic plan, ‘futuREady’, on 10 March 2026 at the Technocentre Renault in Guyancourt. The plan is designed to address changes in the automotive industry and establish a resilient business model.

The strategy focuses on transitioning the company from a ‘success story’ to a ‘success system’ through innovation and operational excellence. The Group intends to maintain a product offensive across its three brands to stimulate demand in Europe and high-growth international markets.

The futuREady plan emphasises the optimisation of management resources and the acceleration of production cycles. By anticipating market expectations and strengthening delivery efficiency, the Group aims to increase value and desirability across its portfolio.

Renault Group is preparing to open a new chapter in its history with futuREady, its strategic plan, designed to respond to the profound upheavals in the automotive industry and prepare the Group for a context that is more uncertain than ever. Building on its recent successes, the company will remain on the offensive with 'winning' products for each of its three brands, thus triggering a new dynamic in Europe and a targeted offensive in high-growth markets outside of Europe. futuREady is based on accelerating innovation throughout the company to anticipate market expectations. Being futuREady also means being at the top level on everything that can be controlled, by strengthening operational excellence: optimizing, accelerating and delivering efficiently to build a resilient model. The objective of the plan is clear: to move from a success story to a success system, designed to last.

Hindustan Zinc Attains 26.3% Women Workforce Representation

- By MT Bureau

- March 04, 2026

Hindustan Zinc (HZL) has recorded 26.3 percent women representation across its workforce, according to a company announcement. This figure marks the highest gender diversity level in India’s metals and mining sector.

The company employs over 745 women professionals, with 314 serving as engineers or in equivalent technical roles. Women at the company are currently involved in frontline operations, including underground mining, smelting, lead mine rescue and heavy machinery operation.

Hindustan Zinc has implemented Industry 4.0 practices, including robotics, automation and tele-remote underground operations, to standardise processes. These technologies have enabled the inclusion of women in night shifts and underground roles traditionally dominated by men.

Key workforce milestones and initiatives include:

- Frontline Roles: Women operate heavy machinery and manage night shifts in both mining and smelting units.

- Mine Rescue: The company has formed an all-women underground mine rescue team.

- Digital Infrastructure: Operations use drone-based surveillance and remote blasting systems to enhance safety.

- Workplace Policies: HZL offers a one-year childcare sabbatical, a spouse hiring policy, and work-from-home flexibility.

The company has launched a 25-day campaign titled “She Knows the Ground She Stands On” to encourage women to pursue careers in STEM and mining. As part of this initiative, 15 women from science institutions were invited to visit the company’s mining ecosystem to engage with operational teams and digital technologies.

Arun Misra, CEO, Hindustan Zinc, said, “Empowering women in mining is not merely a matter of equity, it is a strategic imperative for the future of the industry. At Hindustan Zinc, a culture has been cultivated where women lead from the front—whether operating underground mines, driving automation, or advancing sustainable metallurgy. ‘She Knows the Ground She Stands On’ reflects a commitment to challenging outdated norms and ensuring that every capable woman has the opportunity to grow and excel. As the company works toward achieving 30% diversity by 2030, the focus remains on building a workplace where inclusion fuels innovation and gender is never a barrier to excellence.”

The company aims to reach a 30 percent diversity target by 2030. The current campaign is scheduled to conclude on 8 March 2026

Comments (0)

ADD COMMENT