- Federation of Automobile Dealers Association

- FADA

- CS Vigneshwar

- auto retail sales

- electric vehicles

- trucks

- bus

- passenger vehicles

- SUV

Auto Retail Declines 12.4% In December 2024, Outlook For FY2025 & CY2025 Remains Optimistic

- By MT Bureau

- January 07, 2025

The automotive retail sales in India saw a decline of 12.49 per cent in December, with 17,56,419 units registered, compared to 20,07,042 units last year, according to data released by the Federation of Automobile Dealers Associations (FADA).

In terms of segment-wise performance, two-wheeler sales came at 11,97,742 units, down 17.6 percent YoY, three-wheeler at 93,892 units, down 4.5 percent YoY, passenger vehicle sales at 2,93,465 units, down 1.9 percent YoY and commercial vehicles at 72,028 units, down 5.2 percent YoY. In contrast, tractor sales were in the green at 99,292 units, up 25.7 percent YoY.

The decline in sales for petrol-powered two-wheelers were attributed to low cash flow, poor market sentiment, supply challenges for popular models and growing shift towards electric vehicles.

FADA President C S Vigneshwar stated that despite heightened discounts and limited financing options failed to offset demand. In the passenger vehicle space, dealers were looking to offload the high inventory buildup following the festive season and aggressive discounting to clear stocks. But poor market sentiment, limited new model launches and intense price competition had impacted the PV segment.

| Category | Dec '24 | Dec '23 | Change (in units) | Change (in %) | Nov '24 | Change (in %) |

| YoY | YoY | MoM | ||||

| Two-wheeler | 1,197,742 | 1,454,353 | -256,611 | -17.64% | 2,615,953 | -54.21% |

| Three-wheeler | 93,892 | 98,384 | -4,492 | -4.57% | 108,337 | -13.33% |

| E-Rickshaw (P) | 40,845 | 45,100 | -4,255 | -9.43% | 40,391 | 1.12% |

| E-Rickshaw with Cart (G) | 5,826 | 3,692 | 2,134 | 57.80% | 5,423 | 7.43% |

| Three-wheeler (Goods) | 9,122 | 9,546 | -424 | -4.44% | 10,940 | -16.62% |

| Three-wheeler (Passenger) | 38,031 | 39,962 | -1,931 | -4.83% | 51,466 | -26.10% |

| Three-wheeler (Personal) | 68 | 84 | -16 | -19.05% | 117 | -41.88% |

| Passenger Vehicle | 293,465 | 299,351 | -5,886 | -1.97% | 321,943 | -8.85% |

| Tractor | 99,292 | 78,944 | 20,348 | 25.78% | 80,519 | 23.31% |

| Commercial Vehicle | 72,028 | 76,010 | -36,216 | -47.65% | 81,967 | -51.45% |

| LCV | 39,794 | 42,814 | -38,152 | -89.11% | 47,530 | -90.19% |

| MCV | 4,662 | 4,987 | 17,794 | 356.81% | 5,473 | 316.24% |

| HCV | 22,781 | 23,904 | -19,113 | -79.96% | 24,441 | -80.40% |

| Others | 4,791 | 4,305 | 486 | 11.29% | 4,523 | 5.93% |

| Total | 1,756,419 | 2,007,042 | -250,623 | -12.49% | 3,208,719 | -45.26% |

For the commercial vehicle segment, the slowdown was attributed to low market sentiment, delayed government fund releases and slow financing approvals. Barring tippers, LCV degrowth and unseasonal rains further added to retail slowdown.

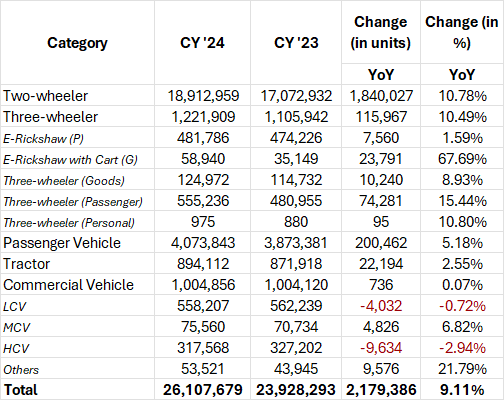

For CY2024, the auto retail sales grew 9.1 percent YoY at 2,61,07,679 units as against 2,39,28,293 units sold last year. This includes two-wheelers growing by 10.7 percent YoY, three-wheelers at 10.4 percent YoY, passenger vehicles at 5.1 percent, tractor at 2.5 percent and commercial vehicles reporting flat growth respectively.

“Despite multiple headwinds in CY24 – including heatwaves, elections at both central and state levels and uneven monsoons – the auto retail industry remained resilient, closing the year with a 9% YoY growth. Notably, three-wheeler, passenger vehicle and tractor segments touched new all-time highs and two-wheeler barely missed surpassing its CY18 peak. CV is also yet to reach its CY18 peak, a year which saw the introduction of axle load norms,” said Vigneshwar.

Outlook remains positive

The auto dealer body expects that the coming months will see stable growth two-wheeler, commercial vehicles and passenger vehicles to remain in the green.

The confidence stems on the back of improvement in rural liquidity, evolving government policies, new product launches, infrastructure investments, stable credit availability to support the growth.

FADA stated that it remains optimistic on market recovery, coupled with strategic OEM support and policy-level clarity, that will enable retail sales to end CY2025 on a robust note.

Zenvo Automotive Appoints Mark Harrison As Chief Commercial Officer

- By MT Bureau

- March 05, 2026

Zenvo Automotive, a manufacturer of limited-edition hypercars based in Præstø, Denmark, has appointed Mark Harrison as its new Chief Commercial Officer, bringing in a seasoned expert from the premium and performance car sector. His arrival marks a significant step in the company’s ambitious growth strategy as it prepares for the final development phase of its highly anticipated V12 Aurora hypercar. Harrison will oversee all commercial operations, including sales, marketing, public relations, global events and the expansion of the dealer network, working closely with the established leadership team comprising Chairman Jens Sverdrup, Chief Technical Officer Jon Gunner and Design Director Christian Brandt.

With three decades of industry experience, Harrison joins Zenvo from Praga Cars, having previously held influential management roles at McLaren Automotive and BMW Group, including its MINI division. His comprehensive understanding of the luxury automotive landscape is expected to be instrumental as the company moves towards the Aurora’s launch. Harrison’s appointment reinforces the management structure during this critical period, ensuring the commercial strategy aligns with the final engineering and design efforts to bring the new hypercar to market.

Jens Sverdrup, Chairman, Zenvo Automotive, said, “It is great to welcome Mark to the team, and to benefit from his experience and insight of the industry. We have known each other for many years, and our professional paths have crossed on several occasions, so I know first-hand what an impact he will be able to make. We are at an exciting part of the programme, and this appointment also highlights, once again, the talent that this project is attracting as we gear up for the launch of Aurora.”

Harrison said, “It’s really exciting to join Zenvo’s team and help bring to market a truly exceptional car in both its design and technical specification. I have admired the brand since the Aurora was announced and especially how the programme is pushing the boundaries in such a competitive sector. I have shared offices, showrooms, show stands and factories with great teams wherever I have worked, but this will be my first V12. I feel privileged to now have an opportunity to work together with this strong and passionate team helping bring this stunning car to market later this year.”

Renault Reveals The Name Of Its Upcoming Show-Car: Bridger Concept

- By MT Bureau

- March 04, 2026

Renault has unveiled the name of its latest show-car, the Bridger Concept, as part of its continued international expansion. This model serves as a precursor to a forthcoming production vehicle, specifically an urban SUV designed with new dimensions to accommodate the evolving needs of city-dwelling families.

The Bridger Concept stands out with its bold and robust design, featuring surprisingly compact proportions. Measuring under four metres in length, it maximises interior space, demonstrating that a smaller footprint does not necessitate a compromise on roominess. The name itself, derived from the English word ‘bridge’, was chosen for its connotations of strength, connection and linkage. This choice highlights the vehicle's assertive styling and reinforces the brand's commitment to fostering human connections within the cabin, a core aspect of its ‘voitures à vivre’ philosophy.

A comprehensive reveal of the Bridger Concept is scheduled for 10 March 2026. This unveiling will occur during the presentation of Renault Group's futuREady strategic plan, with the entire event being streamed live from the company's official events platform.

Explaining the thinking behind the name of the new show-car, Sylvia dos Santos, Head of Naming Strategy with Renault's Global Marketing Division, said, “With Renault Bridger, we are adding to our family of names based on English words. This one comes from the word 'bridge', with the letters 'ER' added for identification. The name Renault Bridger is part of the same approach as the name of Renault Duster. It’s a powerful, robust and versatile name, ideal to identify our new urban SUV show-car and open a new page in our international offensive!”

Axis Bank Becomes Preferred Financer For Tesla In India

- By MT Bureau

- March 04, 2026

Axis Bank has announced its appointment as a preferred financer for Tesla in India, which will see the company provide financing solutions for customers purchasing Tesla vehicles as part of a nationwide rollout.

The collaboration covers major metropolitan areas and emerging electric vehicle (EV) hubs. The initiative is designed to integrate with Tesla’s global ownership model by using digital onboarding to manage the purchase journey.

Axis Bank has developed specific auto-loan products for the premium EV segment. These offerings focus on repayment flexibility and digital processing speeds.

It includes loan tenure options extending up to 10 years. Customised structures designed to align with individual customer cash flows. A fully digital onboarding process intended to reduce sanction turnaround times. Coverage across all-India locations to support Tesla’s market entry.

Munish Sharda, Executive Director, Axis Bank, said, “As electric mobility gains momentum in India, Axis Bank is proud to collaborate with Tesla to help accelerate this transition. Through this collaboration, we are bringing together world-class electric vehicles with innovative, tailored financing solutions and seamless customer engagement. This makes it easier for customers to adopt sustainable mobility without compromising on convenience or flexibility. This initiative reflects our continued focus on responsible banking and future-ready solutions.”

Vietnamese Automaker Segments Portfolio Into Ultra-Luxury, Mass-Market And Commercial Lines

- By MT Bureau

- March 03, 2026

Vietnamese electric vehicle brand VinFast has announced the completion of its strategic restructuring into three automotive brand lines. The company officially unveiled two flagship models, the Lac Hong 800S and the Lac Hong 900S, to head its ultra-luxury marque.

The restructuring divides the portfolio into the Lac Hong ultra-luxury line, the VF passenger vehicle range and the Green commercial mobility brand. VinFast has maintained a leadership position in Vietnam for 16 consecutive months, delivering 175,099 vehicles in 2025.

The three brands target different market segments to support the company's next phase of development:

- Lac Hong: Comprises the 900 LX, 900S, and 800S models.

- VF: Includes a portfolio of passenger EVs from the VF 3 to the VF 9 and the VF MPV 7.

- Green: Developed for commercial mobility, featuring the Limo Green, Herio Green, Nerio Green and Minio Green models.

The new Lac Hong 800S and 900S models use design elements inspired by Vietnamese heritage, such as a grille with vertical slats and emblems evoking the Lac bird. Interior materials include Nappa leather, wood and gold-plated accents.

They are equipped with a tri-motor system with one front motor and two rear motors; a combined output of 460 kW and a fully active suspension system for ride comfort and stability.

On the inside, it gets executive seating and power-assisted doors. The 900S includes a privacy partition, a projection entertainment system and a workstation.

The Lac Hong 800S and 900S are scheduled for commercial launch in 2027.

At present, VinFast operates manufacturing facilities in Vietnam and India, with planned operations in the United States. The facility in Thoothukudi, Tamil Nadu, represents a USD 500 million investment and is designed to produce 150,000 vehicles annually.

Duong Thi Thu Trang, Deputy CEO of Global Automotives, VinFast, said, “Following a period of accelerated growth - achieving the No.1 position in Vietnam and establishing our presence in key regional markets - the completion of our three-brand structure lays the foundation for our next phase of development: structured, professional and breakthrough-driven. The Lac Hong 800S and 900S stand as further proof of VinFast’s technological mastery, product development capability and advanced manufacturing expertise. We believe products created by Vietnamese intellect, craftsmanship and resilience not only inspire national pride but also convey a powerful message about Vietnam’s cultural heritage and technological stature in this new era of global advancement.”

Comments (0)

ADD COMMENT