- Federation of Automobile Dealers Association

- FADA

- C S Vigneshwar

- Reserve Bank of India

- auto retails

- car sales

- two-wheeler sales

- commercial vehicle sales

- Diwali

Auto Retail For September Slips In The Red, FADA Pins Hope On Festivities To Boost Demand

- By MT Bureau

- October 07, 2024

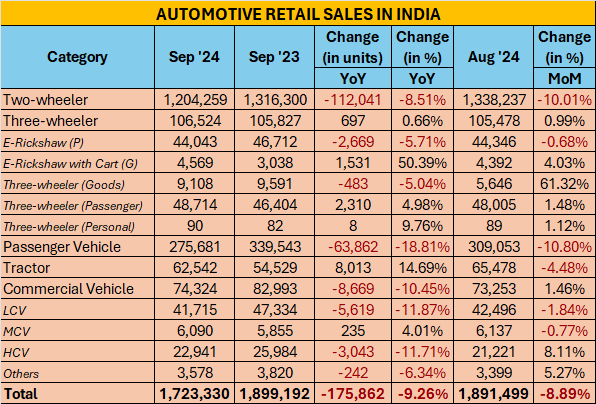

The automotive retail sales numbers for September 2024 show a decline in demand for two-wheelers, passenger vehicles and commercial vehicles. Barring three-wheelers with a flat growth and tractor segment with 14 percent growth, sales have declined both on a month-on-month basis as well as year-on-year basis.

The overall auto retails came at 17,23,330 units, which is a decline of 9.26 percent over last year. This includes 12,04,259 two-wheelers (-8.51% YoY); three-wheelers 1,06,524 units (0.66% YoY); 2,75,681 passenger vehicles (-18.81% YoY); 62,542 tractors (14.69% YoY) and 74,324 commercial vehicles (-10.45% YoY).

C S Vigneshwar, President, Federation of Automobile Dealers Association (FADA) said, “The 2024 southwest monsoon recorded 8 percent above-normal rainfall—the highest in four years—which has boosted Kharif sowing by 1.5 percent YoY. This increase in agricultural productivity has positively impacted rural demand and economic sentiment. Despite the onset of festivals such as Ganesh Chaturthi and Onam, Dealers have reported that the performance has been largely stagnant. This suggests that overall market sentiment during these festive periods has been underwhelming, with a trend leaning towards flat or negative growth. The Shraddh period further impacted sales negatively, leading to a YoY decline in retail sales across various categories.”

He further stated that while discounts and offers have been introduced across segments to stimulate demand, but they have “yet to translate into a significant improvement in sales.”

Vigneshwar said that the two-wheeler sales decline can be attributed to low consumer sentiment, poor inquiries, and reduced walk-ins. Seasonal factors like the Shraddh period, Pitrapaksha, and heavy rains further impacted demand, resulting in delayed purchases and a subdued market environment.

The three-wheeler sales showed marginal growth of 0.99 percent MoM and 0.66 percent YoY, driven by positive customer engagement and increasing demand for e-rickshaw options. However, overall demand remained subdued as many customers deferred purchases in anticipation of the upcoming festive season and heavy rains impacted walk-ins and sales activity.

The commercial vehicle segment reflected a mixed performance, while there was positive sentiment and marginal growth in regions supported by infrastructure projects, overall demand remained weak due to low government spending, extended monsoon delays and seasonal challenges. Despite some improvement in fleet purchases, the market conditions remain subdued.

The passenger vehicle segment has been a case of worry with an alarming trend of declining consumer demand and deteriorating market sentiment. Seasonal factors such as Shraddh and Pitrapaksha, coupled with heavy rainfall and a sluggish economy, have exacerbated the situation, leaving dealers with historically high inventory levels of 80-85 days—equivalent to 7.9 lakh vehicles worth INR 790 billion.

“Given the critical festive season around the corner, FADA urges OEMs to take immediate corrective measures to avoid a financial setback. FADA also calls on the Reserve Bank of India (RBI) to issue an advisory to banks, mandating stricter channel funding policies based only on Dealer consent and on actual collateral, to prevent dealers from facing additional financial pressure due to unsold stock. This is the final opportunity for PV OEMs to recalibrate and support market recovery before it's too late!”

Going forward, FADA’s near-term outlook for automobile retail is cautiously optimistic as both Navratri and Diwali fall in the same month, creating strong expectations for a surge in vehicle sales.

With healthy water levels in reservoirs and improved crop yields supporting rural demand, the festive season is expected to drive a substantial boost in two-wheeler, passenger vehicle, and tractor sales with new launches been planned for the month. However, the passenger vehicle segment faces a critical situation due to high inventory levels at dealerships.

Vigneshwar cautions that if sales do not pick up as expected in October, dealers could face significant financial pressure from unsold stock piling up in their warehouses.

While dealers and OEMs are betting on robust festive sales, especially in rural markets where positive cash flow and better agricultural conditions are expected to spur demand, the outcome remains uncertain.

He states that a successful October is essential to clear out excess inventory and set a positive growth trajectory for the remainder of FY2025. With rising inquiries and optimistic dealer sentiments, the outlook leans towards optimism, but high stakes and dependency on October’s performance warrant a cautious approach.

“If the anticipated sales do not materialise, it could shift the outlook to pessimistic, putting dealers as well as OEMs in a difficult position heading into the new year,” he concludes.

Hyundai Motor India Reports INR 123 Billion Profit In Q3 FY2026

- By MT Bureau

- February 02, 2026

Hyundai Motor India (HMIL) has released its unaudited financial results for Q3 FY2026 and nine months ending 31 December 2025.

The company reported a Profit After Tax (PAT) of INR 123.44 billion for Q3, representing a 6.3 percent increase YoY. Revenue for the quarter reached INR 1,797.35 billion, up 8 percent compared to the same period last year. EBITDA stood at INR 2,018.3 billion, a 7.6 percent rise, supported by festive demand and the implementation of GST 2.0.

The company stated that the domestic demand was supported by wholesale volumes increasing 5 percent QoQ. The Hyundai Creta recorded sales of over 200,000 units in the 2025 calendar year, while the new Venue model has received nearly 80,000 bookings to date.

Hyundai Motor India also entered the commercial mobility segment with the Prime HB and SD taxi models. Exports grew by 21 percent YoY in Q3 FY26, accounting for 25 percent of the total sales mix.

For the nine-month period, EBITDA reached INR 6,632.5 billion, a 3.3 percent increase. EBITDA margins expanded to 12.8 percent, up from 12.5 percent in the previous year, despite costs related to capacity stabilisation and commodity prices.

Tarun Garg, Managing Director & Chief Executive Officer, said, “The third quarter performance underscores our resilience and strong execution of 'Quality of Growth' strategy, marked by healthy growth in volumes, revenue and profitability. Notably on a year-to-date basis, EBITDA margins expanded to 12.8 percent as against 12.5 percent last year, supported by our efforts towards improving sales mix and prudent cost control measures. As we move ahead, the robust January’26 sales number gives us great momentum towards a healthy 2026.”

|

Particulars |

Q3 FY26 |

Q2 FY26 |

Q3 FY25 |

9M FY26 |

9M FY25 |

|

Revenue |

179,735 |

174,608 |

166,480 |

518,472 |

512,526 |

|

EBITDA |

20,183 |

24,289 |

18,755 |

66,325 |

64,211 |

|

EBITDA % |

11.2% |

13.9% |

11.3% |

12.8% |

12.5% |

|

PAT |

12,344 |

15,723 |

11,607 |

41,759 |

40,259 |

Jeep Reaffirms India Commitment With Strategic Plan Jeep 2.0

- By MT Bureau

- February 02, 2026

Stellantis-owned Jeep has announced its Strategic Plan Jeep 2.0, positioning India as a central hub for its operations in the Asia Pacific region. The plan focuses on localisation, manufacturing depth, and export expansion from the company's facility in Ranjangaon, Pune.

As part of the strategy, Jeep intends to increase localisation levels to 90 percent, up from the current 65–70 percent. This move is aimed at strengthening supply-chain resilience and cost competitiveness. The Ranjangaon plant, which has an annual capacity of 160,000 vehicles, currently exports the Compass, Meridian, and Commander to markets including Japan, Australia and New Zealand. Plans are underway to expand exports to Africa and North America.

The company plans to introduce a new vehicle lineup in India starting from 2027. In the interim, Jeep will maintain its current portfolio through refreshes and special editions. To support its customers, the brand has introduced the Confidence 7 programme, which includes a buyback scheme, pre-maintenance packages, and extended warranties.

At present, Jeep operates over 85 sales and service touchpoints across 70 cities in India. The automaker stated that in 2025, the Wrangler Willys 41 limited edition sold out within seven days. The company is also focusing on its owner community, which has reached 100,000 members, through experiential platforms and brand clubs.

Shailesh Hazela, CEO & Managing Director, Stellantis India, said, “Jeep’s 85-year legacy is built on authenticity and adventure. Strategic Plan Jeep 2.0 lays out how we will sharpen our product strategy and strengthen the customer experience year after year, driven by deeper localisation, global product alignment, expanding our vehicle offerings, and programs that deliver real value. We are equally focused on taking care of our existing customers, ensuring they receive the support, service and confidence they expect from Jeep. Success in India demands resilience and long-term commitment and we are investing with that clarity to ensure Jeep remains a brand of pride and desirability.”

Maruti Suzuki India Reports INR 37.94 Net Profit For Q3 FY2026

- By MT Bureau

- January 28, 2026

Maruti Suzuki India, the country’s largest passenger vehicle manufacturer, has reported its financial results for Q3 FY2026.

The company reported revenue of INR 475.344 billion, as against INR 368.02 billion last year, net profit came at INR 37.94 billion, as against INR 36.59 billion last year. It is to be noted that the net profit was impacted for Q3 FY2026 was impacted due to a one-time provision of INR 5,939 million relating to new Labour Codes.

During the period, the company achieved its highest quarterly domestic sales of 564,669 units, an increase of 97,676 units over the previous year. Total sales reached 667,769 units, which included 103,100 units in exports. This performance was supported by a recovery in the car market following GST reform, with the small car segment in the 18 percent GST bracket contributing significantly to the volume increase.

For the nine-month period from April to December 2025, the company recorded its highest sales volume, net sales and net profit. Total sales volume reached 1,746,504 units, with domestic sales at 1,435,945 units and exports at 310,559 units. Net sales for this period increased to INR 1,242 billion, while net profit grew to INR 1,085 billion.

Financial statements for the period have been restated following the amalgamation of Suzuki Motor Gujarat (SMG) with MSIL. This process took effect from 1 April 2025. The company continues to monitor market conditions as it manages its manufacturing and sales operations.

The recovery in the car market was led by the small car segment. Sales growth in this category accounted for 68,328 units of the total domestic increase. The company remains focused on domestic and export markets to maintain its sales volumes.

Volkswagen India Unveils Tayron R-Line, Plans 4 More Launches In 2026

- By MT Bureau

- January 28, 2026

Volkswagen Passenger Cars India has showcased the Tayron R-Line, marking the first of five product interventions scheduled for 2026.

The company plans to introduce updates or new models in every quarter to maintain market presence. These interventions will include SUV, Sedan and Hatchback body styles, with each model intended for different segments of the premium market.

For 2026, the company stated it has established objectives focused on products, customer engagement and experiences. The strategy involves using product actions to address various customer sets throughout the year. The brand aims to sustain interest through these quarterly releases across its vehicle portfolio.

The roadmap for the year is designed to cover multiple segments, ensuring a consistent rollout of updates. By addressing three body styles, the manufacturer intends to reach a broad audience within the premium category. The initiative forms part of a wider plan to enhance the ownership experience and interaction with the brand in India.

Nitin Kohli, Brand Director, Volkswagen Passenger Cars India, said, “Today, we are glad to showcase the Tayron R-Line for the first time in India. I am also delighted to announce that we have planned four more product interventions throughout the year. This year, every quarter will witness a new product intervention that will cater to a different premium customer set. Our objective is to continue building excitement for customers through smart product actions and introducing models that will continue to build aspirations.”

Comments (0)

ADD COMMENT