Produced at BMW Group Plant Chennai, the car is available in BS-VI diesel and petrol variants at all its dealerships across India.

Rudratej Singh, President and Chief Executive Officer, BMW Group India, said, “The BMW X1 has established and owned the dominant position in the premium compact sports activity vehicle (SAV) segment. This is also the trend worldwide - it reflects the global need the X1 serves. The X1 fits in perfectly with the attitude and lifestyle of modern ambitious future leaders who are redefining success - personally and professionally.”

The new vehicle adapts perfectly not only to a dynamic lifestyle but also to personal taste. It is available in three variants – the new SportX, xLine and M Sport. Each variant has distinguished exterior and interior design features that lend an individual personality to the car. SportX reflects the perfect combination of sporty and ‘X’ elements. xLine puts on a powerful character enhancing the car’s off-road looks. M Sport bestows a masculine character distinguishing itself as an elite sports model.

The new BMW X1 is available in 2 BS-VI petrol and 2 BS-VI diesel variants which are locally produced. The ex-showroom prices are: X1 sDrive20i SportX (petrol): INR 35,90,000; X1 sDrive20i xLine (petrol): INR 38,70,000; X1 sDrive20d xLine (diesel): INR 39,90,000; and X1 sDrive20d M Sport (diesel): INR 42,90,000.

The new X1 is truly an all-rounder. It is not just a vehicle offer but a comprehensive package that addresses every need from accessibility and cost of ownership perspective. A novel introduction in the segment is a 5 years / 60,000 km service and warranty package for the new vehicle. The comprehensive solution includes the protective cover of BMW Service Inclusive and BMW Repair Inclusive. Together, they take care of Condition Based Service (CBS), maintenance work and warranty, allowing customers to focus on the one thing that matters – sheer driving pleasure.

Design

Enhanced X-ness: Sharper design with a new larger kidney grille and LED lights, add greater road presence and premium appeal.

Impressive Interior: Generous space with panorama glass-roof now as standard, new 8.8 inch central display with touch screen functionality and wireless Apple CarPlay. All-new comfort suspension gives best-in-class dynamics and noticeably enhanced ride quality.

BMW Blue Performance: It is one of the cleanest diesel technologies in the world with 99 percent less particulate matter (PM) and 70 percent less nitrogen oxide emissions (NOx) than the defined BS-VI limits.

The car comes in 3 new exterior colours: Storm Bay, Misano Blue and Sunset Orange. The sharper design of the new vehicle strengthens its authentic and powerful SAV character. With commanding proportions, high seating position and good road visibility, it has greater road presence than ever before. The exterior embodies a muscular and dominant character with precisely drawn lines and strikingly contoured surfaces. The front has an imposing appearance with larger BMW grille and air intakes as well as striking new LED headlights with LED fog lamps. The athletic side view is complemented by a dynamic wedge shape formed by the roofline, eye-catching character lines and window surfaces that taper towards the rear. The rear design underscores the car’s width and sporty stance with wrap-around LED rear lights, inlays in body colour and bigger twin exhaust tailpipes.

The new vehicle has generous proportions, comfort and a feeling of spaciousness on the inside, thanks to an intelligent vehicle structure and smartly conceived interior configuration. Thanks to unrivalled BMW TwinPower Turbo technology, the BS-VI petrol and diesel engines meld best-in-class power with improved efficiency and offer spontaneous responsiveness even at low engine speeds. (MT)

Cars24 Introduces Refreshed Brand Identity

- By MT Bureau

- February 09, 2026

Cars24 has unveiled a refreshed brand identity, moving from its original transactional focus towards a car ownership ecosystem.

Founded in 2015, the company originally utilised an all-caps logo – CARS24 – to establish a presence in a fragmented market. The updated identity shifts the name to sentence case, Cars24, which the company states reflects maturity and a focus on trust.

The core of the redesign features an open circular logo. According to the company, this form represents the continuity of car ownership, where vehicles change hands and user needs evolve. The open shape is intended to signal flexibility rather than closure.

The brand has also replaced its traditional blue with a brighter shade. This ‘younger blue’ is intended to make the brand appear more attentive and human as it scales its operations.

The identity update was the result of over 1,200 hours of design and iteration. The goal of the project was to create a look that remains relevant as the company expands its services beyond buying and selling into broader ownership systems.

Vikram Chopra, Founder & CEO, Cars24, said, “When we started, being loud helped. But as the company and the team grew up, the work started speaking for itself. This change is about reflecting who we are today, calmer, more human and focused on earning trust over time.”

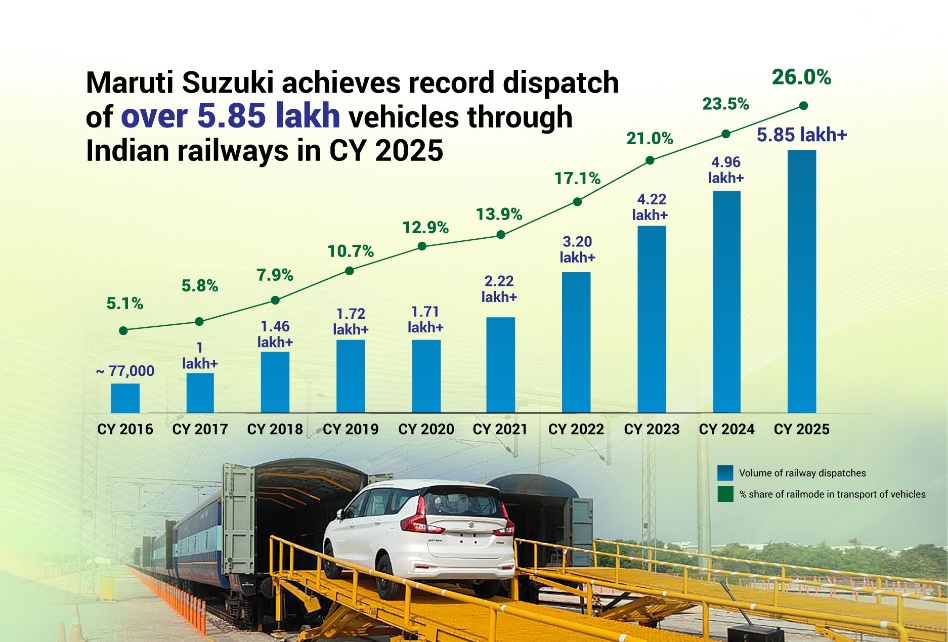

Maruti Suzuki India Increases Rail Dispatches To 585,000 Units, Up 18% In 2025

- By MT Bureau

- February 09, 2026

Maruti Suzuki India, the country’s largest passenger vehicle manufacturer, has reported the dispatch of over 585,000 vehicles using the railway network in CY2025, which marked an 18 percent growth compared to CY2024.

Over the last decade, the company's use of rail for outbound logistics has risen from 5.1 percent in 2016 to approximately 26 percent in 2025. The shift aims to reduce carbon emissions, oil imports and road congestion.

In 2025, Maruti Suzuki India inaugurated an in-plant railway siding at its Manesar facility. The company also became the first manufacturer to dispatch vehicles to the Kashmir valley using the railway bridge over the Chenab river.

Combined dispatches from in-plant sidings at Gujarat and Manesar accounted for 53 percent of the company's total rail volumes during the year. The manufacturer currently employs 45 flexi-deck rakes, with each train capable of transporting approximately 260 vehicles.

Combined dispatches from in-plant sidings at Gujarat and Manesar accounted for 53 percent of the company's total rail volumes during the year. The manufacturer currently employs 45 flexi-deck rakes, with each train capable of transporting approximately 260 vehicles.

The company was the first automaker to receive an Automobile-Freight-Train-Operator (AFTO) license in 2013. Since FY2014-15, it has transported more than 2.8 million vehicles to 600 cities using a hub-and-spoke model.

Hisashi Takeuchi, MD & CEO, Maruti Suzuki India, said, “The year 2025 marks our highest-ever rail dispatch, with over 585,000 units. During the year, we strengthened our green logistic efforts through two landmark events – the inauguration of India’s largest automobile in-plant railway siding at our Manesar facility and second was we dispatched vehicles by rail to Kashmir valley through the world's highest railway arch bridge over Chenab river, a first by any automobile manufacturer. Our mid-term goal is to increase rail-based vehicle dispatches to 35 percent by FY 2030-31, contributing to India’s net-zero ambition by 2070. Maruti Suzuki India has adopted a comprehensive ‘Circular Mobility’ approach to sustainability, aiming to reduce its carbon footprint across the entire vehicle lifecycle – from design and production to logistics and end-of-life vehicle (ELV) management.”

- Toyota Motor Corporation

- TMC

- Koji Sato

- Kenta Kon

- Japan Automobile Manufacturers Association

- JAMA

- Keidanren

- Japan Business Federation

Kenta Kon Appointed President & CEO Of Toyota Motor Corp, Koji Sato Transitioned As Vice-Chairman & CIO

- By MT Bureau

- February 09, 2026

Japanese automotive major Toyota Motor Corporation (TMC) has announced a restructuring of its executive leadership and Board of Directors. The changes to the executive structure will take effect on 1 April 2026, while board appointments remain subject to the 122nd Ordinary General Shareholders' Meeting.

Koji Sato, currently President and Member of the Board of Directors, will transition to Vice Chairman and the newly created role of Chief Industry Officer (CIO). Kenta Kon, currently Operating Officer, has been appointed as the incoming President and Chief Executive Officer.

Under this structure, Sato will oversee industry collaboration and external relations. Kon will lead internal management, focusing on company-wide reforms and value chain integration.

The board cited the need for decision-making in a changing environment as the primary driver for the move. Sato’s role as CIO reflects his responsibilities as Chairman of the Japan Automobile Manufacturers Association (JAMA) and Vice Chair of Keidanren (Japan Business Federation). These positions require him to lead policy proposals and industry-wide coordination to maintain international competitiveness.

The appointment of Kenta Kon as CEO follows his tenure as Chief Financial Officer, where he managed efforts to lower break-even volumes and improve the company's earnings structure. His experience at Woven by Toyota is expected to support the company’s transition into a mobility-focused organisation.

The board determined that Sato’s external commitments as a coordinator for the Japanese automotive industry required a structure that separates industry-level leadership from day-to-day corporate operations. The proposal for the new personnel structure was approved during a board meeting on 6 February.

The transition aims to improve Toyota’s earning power and strengthen partnerships within and beyond the automotive sector.

Force Motors Posts Best-Ever Third-Quarter Performance

- By MT Bureau

- February 06, 2026

Force Motors Limited reported its strongest third-quarter performance to date, with double-digit revenue growth and sharply higher profit margins for the three months ended December 31 2025, extending its record run in the 2025–26 financial year.

The Pune-based vehicle maker recorded standalone revenue of INR 21.55 billion in the quarter, up 13 percent year on year. Earnings before interest, tax, depreciation and amortisation rose 63 percent to INR 4.01 billion, while profit before tax, excluding exceptional items, increased 91 percent to INR 3.28 billion.

Including exceptional items, profit before tax rose to INR 5.39 billion, more than three times the level a year earlier, while profit after tax climbed 266 percent to INR 4.03 billion. The company reported no debt at the end of the quarter.

For the first nine months of the financial year, revenue rose 14 percent to INR 65.83 billion. EBITDA increased 43 percent to INR 11.45 billion, while profit before tax after exceptional items nearly doubled to INR 11.42 billion. Profit after tax for the period rose 153 percent to INR 9.38 billion.

Domestic volumes grew 25 percent during the nine-month period, supported by demand across the Urbania, Traveller, Gurkha (defence variants), Monobus and Trax platforms. Export volumes increased 30 per cent year on year, led by growth in light commercial vehicles, special vehicles and utility vehicles.

The Traveller platform-maintained segment leadership, with market share consistently above 70 percent, the company said.

Prasan Firodia, managing director of Force Motors Limited, said, “The performance in the third quarter reflects steady demand across our core product segments and improved operating leverage as volumes have scaled through the year. Growth has been broad-based, supported by continued traction in shared mobility, defence-related applications, and export markets.”

He added that demand visibility remained healthy in intra-city and inter-city passenger mobility, with institutional and fleet customers continuing to prioritise purpose-built platforms.

“Given the momentum we have gained and with Q4 underway, we are confident of closing the year on a strong note and delivering our best financial performance to date,” Firodia said.

Comments (0)

ADD COMMENT