Aluminium Can Play A Pivotal Role In The Changing Face Of The Automotive Sector

- By MT Bureau

- October 13, 2020

Currently, India’s foundry market for automotive components is small (only 10 percent of total foundry market — 10 million of cast iron + aluminium) in comparison to USA’s foundry market, which is at 14 million tonnes per annum, of which 3.3 million is aluminium (24 percent). With an increasing focus on higher performance with better safety and lower emission, this gap is going to shrink in the coming years, anticipates Ajay Kapur, CEO – Aluminium & Power Business, Vedanta Aluminium.

“There is immense scope for Indian aluminium producers to tap into the emerging market in the automotive sector,” said Kapur. Vedanta Aluminium was the first in India to supply PFA (primary foundry alloy) to the domestic auto sector. Before, the launch of PFA by the company, India’s entire PFA demand was being met through imports, even though the country has the world’s second-largest aluminium production capacity. Looking at the potential of the auto market and its import dependency, the company decided to tap into the opportunity and develop indigenous capabilities at its state-of-the-art facilities in Jharsuguda and BALCO to meet that demand. Currently, the company has a PFA casting capacity of 240KT spread across its plants in Odisha and Chhattisgarh.

“Primary aluminium producers develop PFAs which are customised to suit the exact needs of automakers in terms of performance, strength, durability, etc. Significant R&D and technical expertise go into developing PFAs, resulting in excellent metal quality and outstanding castability, which makes these alloys the preferred choice for the automotive industry,” explained Kapur. PFAs are ideal for aluminium alloy wheels, cylinder heads and brakes. The company also anticipates that with an increased focus on reduction of vehicle weight with higher safety performance, automotive parts critical to safety will be made from PFA instead of cast iron to offer higher strength and nearly double absorption of crash energy. “Besides, aluminium PFAs will always have the added advantage of cost-saving on fuel and maintenance,” added Kapur.

Vedanta Aluminium has started steadily supplying PFAs to OEMs and ancillaries in wheel manufacturing in India. “Our proactive move to expand business on this front helped us on-board some of the most reputed equipment manufacturers and auto ancillaries as our clients, and we have received a very positive response from them. Encouraged by that, we will soon look to expand our alloy portfolio for supporting manufacturing of cylinder heads, ABS brakes and certain key applications where traditional materials can easily get substituted with aluminium alloy. We are also exploring prospects of long-term investments by auto ancillaries near our aluminium smelters so that they may leverage cost savings in terms of freight, re-melting and electricity,” said Kapur.

The company, according to him, is well-positioned to cater to the current and emerging needs of the Indian auto sector, offering a broad range of products that find usage across the automotive value chain – from casting to extrusion. “When choosing suppliers for alloys, automotive players should look for companies having high-quality casting facilities, sophisticated R&D facilities and technological prowess for developing customised high-performance alloys for their specific needs, and finally, having robust after-sales technical support; USPs that have earned us the trust of our clients,” he added.

Aluminium is the second most used metal in the world after steel, today, and, according to Kapur, it has the potential to become the most important commercial metal in the future. “Most developed countries have already designated aluminium as a core industry. Aluminium holds strategic importance for the economy as the metal of choice for all kinds of transportation, power, aerospace, defence, building and construction needs. So, given the role it plays in supporting the core sectors meet the Government’s ‘Make in India’ initiative, we expect its application to only expand with time,” said Kapur.

The metal’s usage in the transportation sector has been rapidly increasing as it offers an environment-friendly and cost-effective way to increase performance, boost fuel economy and reduce emissions while maintaining or improving safety and durability. Aluminium is substantially lighter than its counterparts, offering a significant reduction in weight, which has a direct impact on fuel consumption and carbon emissions.

The metal also has a higher strength-to-weight ratio compared to traditional materials that enable it to absorb twice the crash energy of mild steel, ensuring that vehicular performance enhancements do not come at the cost of safety. “Further, nearly 90 percent of all the aluminium used in a vehicle is recycled at the end of its lifecycle. The energy required to recycle aluminium is only five percent of the energy required to produce the metal. With all these advantages, aluminium can play a pivotal role in the changing face of the automotive sector,” said Kapur.

Aluminium alloys are used by the Indian auto industry majorly as alloy wheels. Around 95 percent of two-wheelers include aluminium, averaging at 7kg per bike, taking total consumption of aluminium alloy in this segment to 115KTPA (kilo tons per annum). Whereas, only 20 percent of four-wheelers use aluminium, majorly in high-end models, which max out at 40kg per car. “The crux of the matter is, in India, we are yet to explore more applications of aluminium in the automotive industry akin to our global peers. For example, in developed countries, around 21 PFAs are used in the automotive segment to achieve light-weighting in the form of various auto parts and components. In India, we majorly use PFAs only for manufacturing alloy wheels and to some extent, for cylinder heads. So, there is immense potential for usage of aluminium in other auto parts like engine, suspension, front end carrier, instrument panel support, rear frame, chassis and many more,” said Kapur.

Shortly, the company expands its alloy portfolio for supporting manufacturing of cylinder heads, ABS brakes and certain other applications where currently steel or iron is being used but can be substituted by suitable aluminium alloys to provide additional benefits. As the market for aluminium alloys in automotive segment expands with inclusion of newer applications, Vedanta Aluminium will look for opportunities to leverage its technological expertise and R&D capabilities to develop products customised to the needs of the market. Vedanta Aluminium is also open to collaborating with the downstream industry, to unlock the entire potential of aluminium used in the auto sector and cater to the rapidly evolving aluminium requirements of the Indian automotive industry.

In the Indian automotive market, one of the biggest challenges faced today is the increasing imports of auto components from China and other countries. The size of the auto components imports was USD 17.6 billion in FY19. Asia, the largest source of imports for Indian auto-components, had a share of 61 percent followed by Europe at 29 percent; North America at eight percent; Latin America and Africa at one percent each in FY19. China, with 27 percent, enjoyed the status of the largest exporter in the Indian automotive market.

“The potential of the aluminium industry should be acknowledged and recognised as a core sector with a National Aluminium Policy that will encourage, protect and boost the domestic aluminium industry. The domestic capability needs to be harnessed for critical sectors of national importance like defence, aerospace, aviation, transportation, infrastructure, electrification, housing, etc. We must make the vision of ‘Make in India’ a ground reality in these sectors, leveraging the potential of the entire aluminium value chain, from mining to end usage. Besides enhancing domestic capacity and reducing import dependency and subsequently trade deficit, it will also generate huge employment opportunities in our country which has a deep talent pool that needs to be capitalised for the realisation of our vision of a USD5 trillion economy. We are on the right path, but there is still a long way to go,” said Kapur.

The global economy is swiftly moving towards a cleaner, greener and more sustainable lifestyle. For more than a decade now, concerns about fuel efficiency have encouraged OEMs to replace steel with aluminium in vehicle bodies, doors, trunks, hoods, bumpers, crash boxes, brakes and wheels. With the advent of electric vehicles (EV), OEMs worldwide are focusing on exploring and applying new uses of aluminium. The need for lightweight battery casings and heat exchangers in electric vehicles, combined with autonomous vehicles’ demands for high visibility and structural integrity, is expected to exponentially increase the use of aluminium in cars, trucks and buses from now on. “Using aluminium in EVs has several advantages, foremost amongst which is the distance travelled per charge. Lighter the vehicle, the longer its range. Coming to better battery life, thanks to the metal’s thermal and anticorrosion properties, aluminium is ideal for battery frames. Demand for aluminium will also rise on account of infrastructure for serving EVs since the metal is commonly used as a housing material for EVs charging stations as well. While India is waking up to this future of automobiles, partnerships between different automotive industry bodies/institutions and auto companies for sharing knowledge and expertise will help fast-track development of electric vehicles in the country,” said Kapur. MT

Maurice Meijer Appointed As TIP Group’s First Chief Digital and Information Officer

- By MT Bureau

- March 06, 2026

TIP Group has announced the appointment of Maurice Meijer to the newly established position of Chief Digital and Information Officer. This strategic role underscores the increasing significance of digital innovation, data management and technology in advancing the company’s long-term Strategy 2030 objectives. As TIP expands its footprint as a comprehensive transportation services provider across 17 European nations, the integration of digital solutions is viewed as essential to fostering operational efficiency, business growth and superior customer engagement.

In his capacity as CDIO, Meijer will lead the formulation and execution of the group’s digital and technological roadmap. His responsibilities encompass overseeing digital platforms, enhancing data analytics capabilities, managing IT infrastructure and strengthening cybersecurity protocols. The goal is to build resilient, scalable systems that align with TIP’s future ambitions.

Meijer joins with a robust background in board-level technology leadership. He previously served as Chief Technology and Information Officer at Nederlandse Loterij, where he spearheaded major digital transformations across various brands and platforms. Prior to that, he held key roles in digital strategy, product development and operations within both the technology sector and public institutions. Additionally, he is involved in supporting early-stage tech startups as an investor and founding partner.

His educational credentials include executive programmes at Nyenrode University and INSEAD, along with a degree in international business management. Meijer is recognised for blending strategic commercial insight with practical technological expertise.

Arjen Kraaij, President & CEO, TIP Group, said, “Digitalisation is central to TIP’s future success. With Maurice, we are bringing in a strong business and technology leader who will help us simplify complexity, strengthen our digital foundations and accelerate execution across the Group. His leadership will be instrumental as we translate our Strategy 2030 ambitions into practical, value-creating solutions for our customers and our teams.”

Meijer said, “I’m really looking forward to joining TIP at this important stage in its journey. With strong foundations, great people and clear ambitions under Strategy 2030, there’s a lot to build on. At the same time, we’re ready to take the next step by accelerating our shift towards more digital solutions. By embracing digital, data and AI in a focused and practical way, we’ll turn opportunities into solutions that truly improve the customer experience and make day-to-day work simpler, smarter and more effective for both our customers and our teams.”

Holyvolt Completes $73 Million Acquisition Of Wildcat Discovery Technologies

- By MT Bureau

- March 06, 2026

Swedish battery technology firm Holyvolt has finalised the acquisition of US-based materials specialist Wildcat Discovery Technologies in a deal valued at USD 73 million. The transaction consists of a combination of cash, equity and deferred milestone payments.

The merger integrates Wildcat’s High Throughput Platform (HTP) for material synthesis with Holyvolt’s water-based screen-printing production processes. The combined entity intends to operate as a technology development partner for the automotive, aerospace and energy storage sectors, offering licensing and pilot-scale production services.

Wildcat’s HTP system allows for the simultaneous screening of thousands of material combinations. This method is reported to be up to 10 times faster than standard research and development protocols, generating terabyte-scale datasets suitable for machine learning and AI applications.

Key capabilities of the integrated group include:

- Material Discovery: Use of combinatorial chemistry to identify optimal battery systems.

- Manufacturing Process: Holyvolt’s water-based processing serves as a replacement for conventional organic solvent-based slurries.

- Data-Driven Optimisation: Integration of structured datasets into AI models to accelerate development cycles.

- Sustainability: Focus on cobalt- and nickel-free materials to reduce capital requirements and supply chain dependencies.

The acquisition follows a EUR 20 million funding round for Holyvolt. The new group aims to address production costs and supply chain independence in Europe and North America by combining chemistry expertise with modular manufacturing technology.

Mathias Ingvarsson, Founder & CEO, Holyvolt, said, “The acquisition of Wildcat is a perfect complement to our intended strategy of developing new technologies for the battery industry. Holyvolt is focused on developing new processes to make batteries cleaner and more affordable, and Wildcat has been pursuing the same goals via materials development and better chemistry. Combined, we are building what we believe is the most compelling technology to deliver on these objectives.”

Mark Gresser, President and CEO, Wildcat Discovery Technologies, stated, “The Wildcat team is thrilled with this acquisition by Holyvolt. Mathias and team are very thoughtful with regard to their objectives in the battery industry, and recognise the value that Wildcat’s High Throughput Platform can deliver to our combined company and the industry at large. With Holyvolt’s vision and financial backing, Wildcat can finally unlock the true potential of high throughput combinatorial chemistry for battery materials.”

Prof. Peter Schultz, Founder, Wildcat Discovery Technologies, noted, “With Holyvolt, we can do for batteries what high throughput and AI have done for drug discovery.”

BYD Unveils Second-Generation Blade Battery With Flash Charging Tech

- By MT Bureau

- March 06, 2026

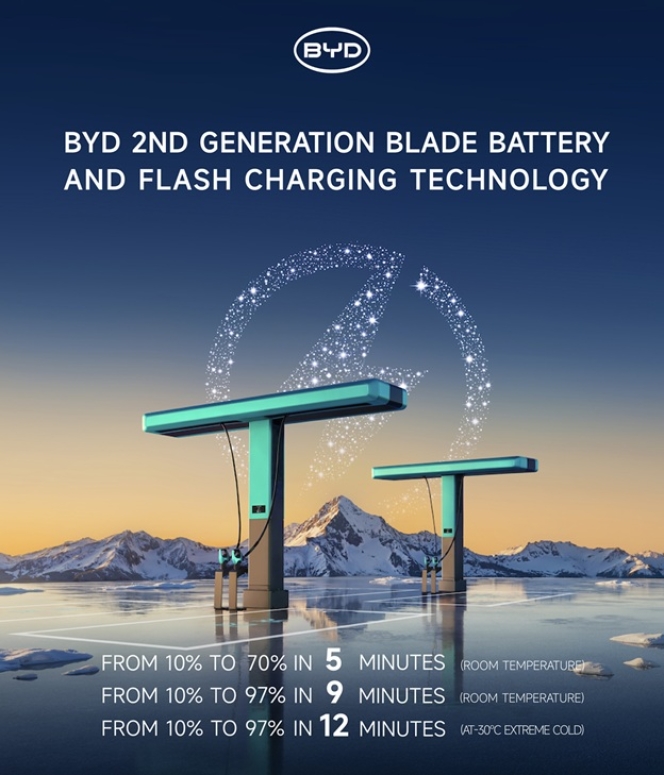

Chinese automotive major BYD has revealed its second-generation Blade Battery alongside FLASH Charging technology, aimed at improving charging speeds and battery performance in low temperatures.

The system achieves a claimed charge from 10 percent to 70 percent state of charge (SOC) in five minutes, and reaches 97 percent in nine minutes. In temperatures of -30deg C, the charging time from 20 percent to 97 perrcent increases by three minutes compared to performance at room temperature.

The second-generation Blade Battery increases energy density by 5 percent over the previous version. To manage thermal loads during rapid charging, BYD integrated a ‘Lithium-Ion High-Speed Channel’ and a thermal management system.

Key technical specifications include:

- Range: The Denza Z9GT, equipped with this battery, achieves a range of 1,036 km.

- Thermal Management: Full-spectrum systems to regulate heat dissipation.

- Safety Standards: The battery has passed national safety tests regarding puncture and thermal runaway.

- Infrastructure: A world-leading single-connector output of 1500 kW.

BYD plans to build 20,000 FLASH Charging Stations in China by end-2026, with a global rollout scheduled to follow. These stations will feature a pulley-based charger design to improve user ergonomics and keep cables off the ground.

To manage the high-power requirements of 1500 kW charging, the stations use energy storage systems to buffer the demand, reducing the load on the local power grid.

Horse Powertrain Debuts Groundbreaking ‘Amorphous Motor’ Technology

- By MT Bureau

- March 05, 2026

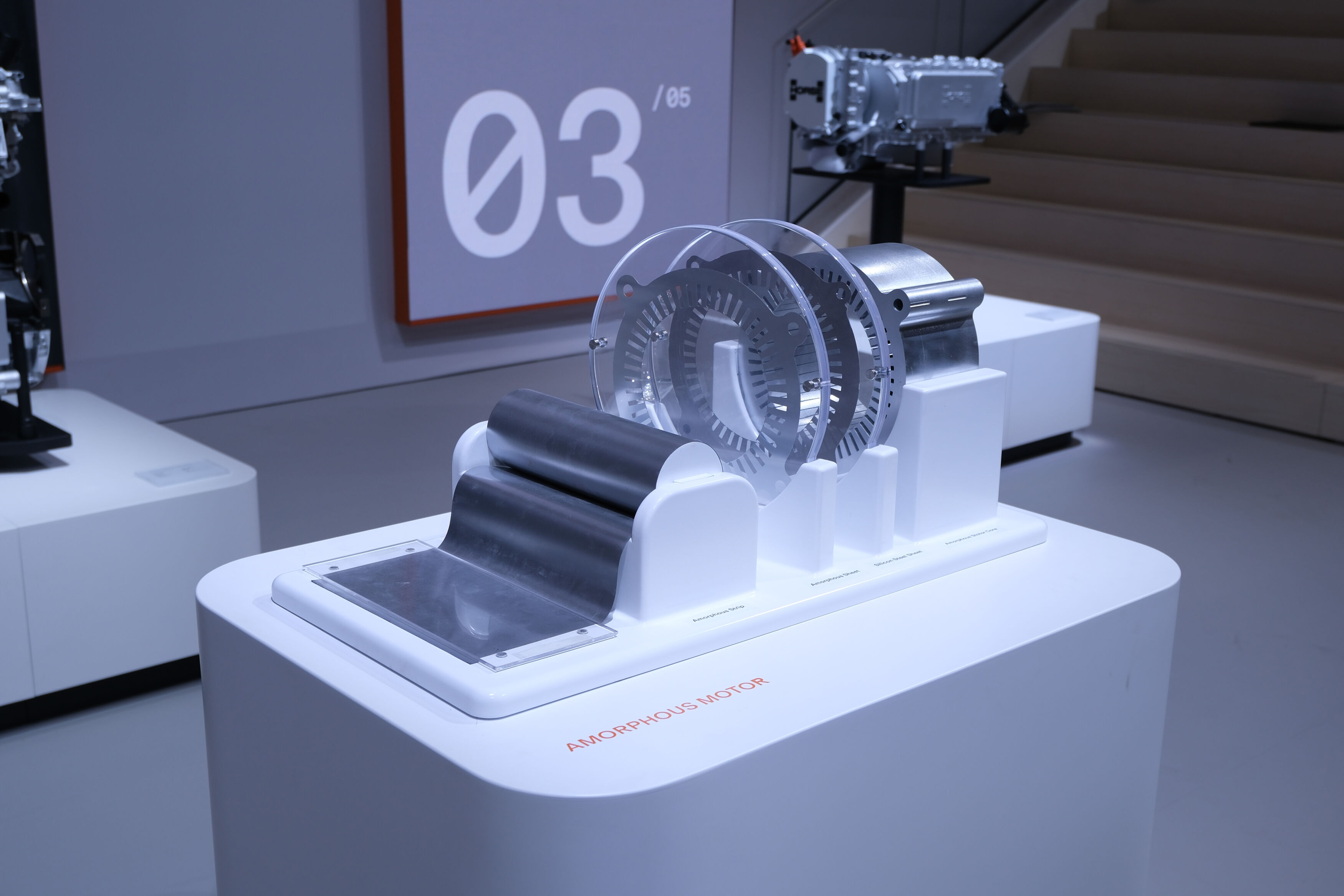

Horse Powertrain, a global leader in advanced and low-emission powertrain solutions, has unveiled its new Amorphous Motor technology, marking a significant step forward in hybrid transmission systems. The innovation was introduced to the public for the first time at the IAA Summit 2025.

Central to the motor’s design is the use of amorphous steel, a material known for its exceptional strength, durability and magnetic properties. This material allows the company to significantly reduce the thickness of the steel laminations used in the motor’s stator. While traditional motors use steel sheets of a standard thickness, the layers in the Amorphous Motor are only 0.025 mm thick, roughly one-tenth of the conventional standard.

This ultra-thin construction, combined with the material’s high conductivity, leads to a 50 percent reduction in stator iron losses compared to similar designs. Consequently, the motor achieves a record-setting efficiency of 98.2 percent, all while delivering a maximum output of 140 kW and 360 Nm of torque.

The practical impact for hybrid vehicles is a one percent improvement in overall fuel and energy efficiency. This reduction in consumption supports automotive manufacturers in their efforts to develop a new wave of lower-emission models. This breakthrough is part of a broader strategy by Horse Powertrain to advance hybrid and combustion technologies through a technologically neutral approach to decarbonisation. The company’s global capabilities, which include 17 manufacturing sites, five research and development centres and a workforce of 19,000, continue to drive this series of high-efficiency innovations.

Ingo Scholten, Deputy Chief Technology Officer, Horse Powertrain, said, “This latest innovation demonstrates Horse Powertrain’s continued commitment to research and development, providing suppliers and OEMs with the tools to raise the bar on when it comes to fuel economy and emissions performance. The Amorphous Motor is an ideal tool to power a new generation of high-efficiency range extended EVs, hybrids and plug-in hybrids, ensuring these technologies continue to play a substantial role in automotive’s decarbonisation journey.”

Comments (0)

ADD COMMENT