- BASF

- ZF Group

- Mercedes-Benz

- Martin Scheuble

- Dr. Michael Lohrmann

- Jana Kragenbring-Noor

- Dr. Martin Jung

BASF To Showcase Polyamide Recycling From End-of-Life Vehicles At K 2025

- By MT Bureau

- October 06, 2025

BASF and its partners are set to present two technologies at K 2025 that allow for the recycling of polyamides from end-of-life vehicles. While metal recovery from decommissioned vehicles has been standard for decades, about 200 kilograms of plastic per vehicle are often incinerated. The new technologies aim to change this, especially with upcoming requirements from the End-of-Life Vehicle Regulation (ELVR). Pilot projects show how automotive waste can be used as material and returned to a closed cycle for the car industry.

BASF developed a chemical recycling process that recycles used and contaminated plastic parts – including used oil pans from ZF Group vehicles. The core of the process is depolymerisation, where the long polyamide chains break down into their original monomers. The caprolactam monomer obtained from PA6 is then purified. This removes impurities that would have remained with mechanical recycling and potentially reduced the material's quality and safety.

The material is then repolymerised into high-quality polyamide, which is processed into a compound suitable for demanding car industry components, closing the automotive-to-automotive loop.

"What used to be considered non-recyclable is now the starting point for high-quality new products," said Martin Scheuble, Team Leader Circularity Engineering Plastics at BASF.

ZF Group processed the recycled material into a chassis component for Mercedes-Benz. Tests show that depolymerisation allows for polyamide compounds that can be used without compromising performance or other chemical and physical properties.

"This project highlights the potential of recycled plastic - even for technically demanding applications - and underlines ZF's innovative strength in establishing sustainable material cycles," said Dr. Michael Lohrmann, Director Materials Technology at ZF.

Solvent-based recycling of shredder residue

A second pilot project focuses on recycling automotive shredder residue (ASR) – a mixture of materials left after the removal of mostly metals and glass. Close cooperation with a recycling company, using new sorting and processing technology, has allowed the polyamides to be extracted from this mixture in a largely pure form.

This polyamide fraction was the starting material for a solvent-based recycling process. In this process, the polymer chain is selectively dissolved with a solvent, purified and then reprocessed into PA6 compounds.

Poppelmann manufactured and tested a chain guide rail in series production at Mercedes-Benz using this technology.

"The project impressively demonstrates that solvent-based recycling is a practical alternative for plastics that are difficult to recycle mechanically. It makes an important contribution to the holistic circular economy - from the car back into the car," emphasised Steffen Meyer, Team Leader Production Technology at Poppelmann.

Life cycle analyses (LCA) confirm that both the solvent-based and depolymerisation technologies offer substantial CO2 emission savings compared to both conventional polyamide production and traditional plastic recycling methods like thermal recovery.

BASF offers a range of recycling solutions, stating that targets are achieved only if technologies are used in a complementary manner, depending on the type and availability of waste.

Jana Kragenbring-Noor, Head of Sustainability & Environmental Protection at Mercedes-Benz, explained, "Mercedes-Benz is committed to the use of secondary raw materials in its vehicles today and in the future as part of resource conservation and circularity. To continuously increase the availability of such sought-after secondary materials, the expansion of existing and new recycling technologies is essential."

"We are continuously improving the efficiency of physical methods such as mechanical and solvent-based recycling. In addition, we are convinced that complementary technologies such as chemical recycling, which includes depolymerization, pyrolysis and gasification, are necessary to further promote the circular economy and reduce the plastic waste that still ends up in landfills or is incinerated today, as well as the potential to obtain high-quality recycled plastics," explained, Dr. Martin Jung, President of BASF Performance Materials.

British Battery Tech Company EQONIC Group Strengthens Senior Leadership With New Appointments

- By MT Bureau

- February 12, 2026

EQONIC Group, a UK-based battery technology company, has announced two senior leadership appointments to support the commercialisation of its lithium-free, sodium-free and rare-earth-free battery technology.

John Saunders joins as Executive Director, bringing 30 years of experience in banking, regulation and law. He has held senior roles at Coutts, Barclays, UBS and Deutsche Bank. On the other hand, Angela Knight CBE joins as Non-Executive Director, having previously served as Chief Executive of the British Bankers' Association and Energy UK, with board experience at Taylor Wimpey and Arbuthnot Banking Group.

EQONIC is developing proprietary technology that eliminates the use of lithium, sodium, and rare-earth metals. The company claims that its technology achieves materials cost savings of approximately 70 percent compared to traditional lithium batteries.

The technology utilises abundant materials that are non-flammable, which reduces the risk of thermal runaway. This approach is intended to address supply chain vulnerabilities and ensure the batteries are fully recyclable.

The company plans to license its technology to Original Equipment Manufacturers (OEMs) to enable global deployment while reducing capital risk. EQONIC’s roadmap aims for its technology to surpass sodium battery performance by 2026 and reach Nickel Manganese Cobalt (NMC) levels by 2029.

Currently, EQONIC operates a commercial division serving D2B and B2B clients with lithium iron phosphate (LFP) energy storage systems. The company has secured a multi-million-pound pipeline across multiple sectors.

John Saunders, Executive Director, EQONIC Group, said, "EQONIC's breakthrough technology represents a genuine paradigm shift in the battery sector. The combination of cost reduction, enhanced safety, and sustainable materials addresses the fundamental barriers that have constrained the industry. I'm excited to bring my experience to support the company's growth trajectory as we move toward demonstrating market-ready products and securing strategic partnerships."

Angela Knight CBE, Non-Executive Director, EQONIC Group, said, "EQONIC exemplifies the kind of innovative British technology that can lead global markets. The company's approach - developing transformative technology first, then building robust commercial frameworks around it, is hugely compelling. Strong governance will be critical as EQONIC scales its business model and establishes partnerships with established OEM’s. I look forward to contributing to the board's strategic oversight during this pivotal phase."

Jas Kandola, Founder and CEO, EQONIC Group, stated, "John and Angela bring exactly the calibre of leadership we need at this critical juncture. John's regulatory expertise and commercial acumen will be invaluable as we navigate partnerships and licensing arrangements, while Angela's governance experience across complex, regulated industries will strengthen our board oversight. These appointments reflect our commitment to building a world-class organisation capable of delivering on the enormous potential of our technology."

Einride Appoints Former Nvidia Executive Gary Hicok To Board Of Directors

- By MT Bureau

- February 12, 2026

Einride AB, a technology company specialising in electric and autonomous freight, has appointed Gary Hicok to its Board of Directors. He joins the company following a 25-year career at Nvidia, where he held several leadership roles in autonomous technology and automotive hardware.

The appointment comes as Einride prepares for a public listing on the New York Stock Exchange through a business combination with Legato Merger Corp. III.

During his tenure at Nvidia, Hicok served as Senior Vice-President of the Mobile Business Unit and led Automotive Hardware and Systems. He oversaw the development of the Nvidia DRIVE platform and the Tegra processor, which are used in safety-critical automotive AI and in-vehicle computing.

His experience spans engineering and executive leadership within AI-driven markets and global organisations. At Einride, he will focus on scaling autonomous platforms and managing industry partnerships.

Einride operates in seven countries with more than 25 enterprise customers. The company reports approximately USD 65 million in expected annual recurring revenue (ARR) from signed contracts, with a potential long-term ARR exceeding USD 800 million through joint business plans.

The company has secured regulatory permits for autonomous vehicle operations in the United States and Europe. Its platform uses proprietary AI technology to manage electric and autonomous fleets, targeting the global road freight market.

Gary Hicok said, “Einride is solving an industry-scale problem the right way. Its platform approach unlocks partnerships, accelerates innovation, and makes electrified and autonomous freight real. I’ve watched many smart companies struggle with doing everything in house. It doesn’t scale or leverage the expertise of the industry, whereas Einride’s approach does. I believe its approach is built to win.”

Robert Falck, Founder and Executive Chairman, Einride, said, “Gary brings deep, hands-on experience scaling autonomous technology through critical partnerships across the automotive and technological ecosystem. Working alongside the Einride team, his perspective on building and scaling safety-critical platforms with industry partners will strengthen our ability to deploy autonomy globally. We’re pleased to welcome him to the Board.”

Roozbeh Charli, Chief Executive, Einride, added, “Gary's expertise and experience in building high-performing teams tackling the most advanced technology development will be instrumental for us as we continue to scale and cement our leadership position within autonomous freight technology. I’m incredibly proud of what we’ve built so far, and I’m excited for what we’ll achieve together with Gary’s unique experience.”

BorgWarner Secures 800V Integrated Drive Module Award for European REEV

- By MT Bureau

- February 12, 2026

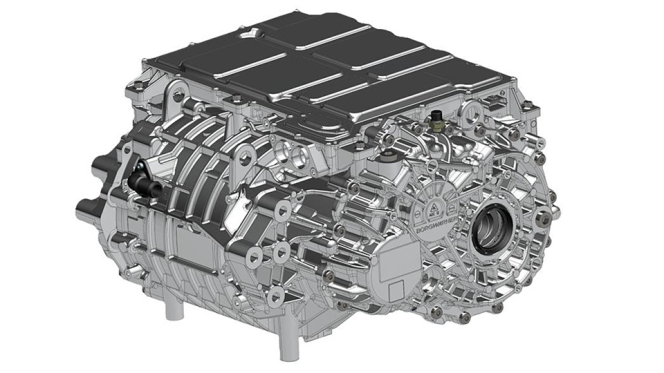

American powertrain major BorgWarner has been awarded a contract by a European original equipment manufacturer (OEM) to supply an 800V Integrated Drive Module (iDM). The system will support a Range Extended Electric Vehicle (REEV), with mass production scheduled to commence in 2029.

The iDM is a system incorporating a single-electric-machine design that provides both generator and drive functionality. The module operates alongside an inverter, two clutches and a dual-mass flywheel. It is paired with the customer's internal combustion engine.

The system includes energy-efficient generator functionality and an all-wheel-drive mode. By combining two REEV functions into one product, the module aims to optimise vehicle architecture.

The integrated inverter utilises Viper power switches and dual-side cooled power module technology. This platform is designed for high-performance electric drive applications to manage high-voltage and high-current requirements.

Dr. Stefan Demmerle, Vice-President, BorgWarner Inc. and President and General Manager, PowerDrive Systems, said, “Securing this program award underlines BorgWarner’s strength in electric drive technology and system integration. With the China team taking the lead and collaborating with a global team, we have created a highly integrated solution that balances performance, efficiency, and packaging. We are proud to support our customer with innovative technology for its next-generation range extended vehicles.”

BorgWarner maintains in-house capabilities across electric motors, drivelines, power electronics and software. The company intends to use its manufacturing footprint to support the development of the global energy vehicle market.

Aimtron Electronics Secures Initial European Order For Box-Build Solutions

- By MT Bureau

- February 11, 2026

Vadodara-based Electronics System Design and Manufacturing (ESDM) company Aimtron Electronics has secured its first order from a European Original Equipment Manufacturer (OEM). The contract, valued at approximately INR 38 million, involves providing box-build solutions for a client headquartered in Europe with manufacturing operations in Spain.

The order marks the company's entry into the European market, serving automotive and industrial sectors. Aimtron anticipates that revenues from this engagement could scale to four times the current size during the 2027 financial year.

The development follows the announcement of the India–Europe Free Trade Agreement (FTA), which aims to improve the competitiveness of Indian manufacturers. Aimtron intends to leverage its manufacturing operations in India and the United States to diversify supply chains for European customers.

This European foray follows the company’s recent acquisition of a US-based electronics system design and manufacturing (ESDM) firm to strengthen its engineering capabilities for global OEMs.

Sneh Shah, Whole-time Director, Aimtron Electronics, said, “Meeting European automotive requirements demands a high level of process discipline, quality governance, and execution consistency. Aimtron has invested steadily in building these capabilities across box-build, traceability, and program management. This engagement reflects that readiness and provides a clear pathway to scale programs across European end-markets.”

Comments (0)

ADD COMMENT