The Ministry of Environment, Forest and Climate Change (MoEFC), Government of India, has issued a notification on rules for battery waste management in view of the shift to electric vehicles. Anticipating a need to have an organised channel for the safe disposal and recycling of batteries, the rules, called the Battery Waste Management Rules, 2022, are applicable to the producer, dealer, consumer, entities involved in collection, segregation, transportation, refurbishment and recycling of waste batteries.

All types of batteries, regardless of their chemistry, shape, volume, weight, material composition and use are covered under the rules. The rules also have a provision for penal action in case of a violation and imposition of environmental compensation. The ministry has also set a minimum recovery percentage target for recovered materials out of dry weight batteries.

The recovered materials will be then used to produce new batteries. For FY2024-25, the recovery target is set at 70 percent whereas for FY2025-26, it is 80 percent. The target for FY2026-27 is 90 percent. Mentioning that the recovery target may be reviewed by the committee once every four years to revisit the minimum levels of recovered battery materials in light of technical and scientific progress and emerging new technologies in waste management, the notification is expected to contribute towards enhancing each and every EV’s cost to the environment in India. This is especially in connection with the fact that nearly 1.4 million EVs as of July 2022 are said to operate in India if the data shared by the ministry of road transport and highways is relied upon. More than half of this volume is claimed to consist of electric three-wheelers followed by two-wheelers and passenger cars.

The PLI scheme and other policy changes in terms of manufacture and sale of electric vehicles, it is clear that a strong battery ELV and disposal policy has to be in place. From the cost to the environment point of view, a policy extension in terms of the manufacture of such batteries locally down to the fuel cell level should also taking into view the ability of the battery to perform efficiently through out its lifecycle, thus staying alive for longer and when it does die, it should be recyclable to a great extent.

Dr Akshay Singhal, Founder and CEO of Log9 Materials, averred. “The newly introduced Battery Waste Management standards by the Government under the Extended Producer Responsibility (EPR) concept addresses two important concerns. An efficient and effective waste management of all Li-Ion batteries that are nearing the end of their useful life and are expected to end up in landfills in a few years, avoiding any residual pollution impact. Second is the emphasis on investing in and nurturing the recycling of such used batteries, reducing the reliance on fresh resource mining.”

Shubham Vishvakarma, CEO and Chief of Process Engineering of Metastable Materials, said, “The Battery Waste Management Rules announced by the Government of India is an excellent and much-needed step towards bringing to the fore innovations and myriad growth opportunities for the battery waste management and battery treatment space in our country, especially at a time when the ongoing EV boom in India is leading us to increasing concerns on e-waste.” “Under the new Rules notified, the Government has mandated a minimum percentage of recovery of various materials from end-of-life batteries, which is bound to enable the growth of novel business models such as urban mining in order to reduce India’s foreign dependency on procuring raw materials for EV batteries and other types of batteries,” he added.

Ashok Sudrik, Chief Scientist, Infinite Orbit Research and Development Pvt Ltd, commented, “The Battery Waste Management Rules, 2022, were much needed and we are happy that government has started taking cognizance of the hazardous waste being created and the recycling or waste collection. Other than waste management recycling rules, there is a need for manufacturers to incorporate extension of battery life technologies, keep the lithium content minimal and develop innovative cell chemistry. The life of a battery should be 4000 to 6000 cycles, which means a life spane of about 10 to 15 years. BaaS (Battery as a Service) concept with swappable batteries will be a big contributor to the ultimate goal of keeping cost to the environment low.”

In other parts of the world

In Canada, Li-Cycle will begin constructing a USD 175 million plant in Rochester, N.Y., for recycling of lithium-ion batteries. On the grounds of what used to be the Eastman Kodak complex, the plant will be the largest of its kind in North America with an eventual capacity of 25 metric kilotons of input material and a capability to recover 95 percent or more of cobalt, nickel, lithium and other valuable elements through zero-wastewater, zero-emissions process. Ajay Kochhar, Co-founder and CEO, Li-Cycle, said, “We'll be one of the largest domestic sources of nickel and lithium, as well as the only source of cobalt in the United States."

In May 2022, Hydrovolt, the largest battery recycling plant in Europe started operations in Fredrikstad, Norway. A joint venture between two Norwegian companies – Hydro and Northvolt, the plant has the capacity to process 12,000 tonnes of battery packs per year, enough for the entire end-of-life battery market in Norway currently. Claimed to have the capability to recover 95 percent of the materials used in an EV battery including plastics, copper, aluminum and ‘black mass’, a powder containing various elements inside lithium-ion batteries like nickel, manganese, cobalt and lithium.

Not just in Europe or US, the rise of Electric Vehicles (EVs) and associated battery gigafactories is pushing forward the creation of a battery recycling value chain. It is a matter of debate whether it got to be a close-loop or an open-loop design in terms of sourcing of batteries to recycle and to put the resulting material to good use so that the cost to the environment is kept minimal. As the demand for use of ‘green’ electricity source gathers pace the world over, on the other end of the spectrum, which involved the end-of-life vehicle for EVs, the demand for recycling in increasing partly due to regulations – the EU regulations have just intensified – and partly by a demand for re-use of materials due to geo-political reasons as well. A strong desire to localise supply chains and safeguard critical raw materials are also the driving factors.

- Radhakrishnan Kodakkal

- Daimler Truck Innovation Center India

- DTICI

- Raghavendra Vaidya

- Daimler Truck

- Whirlpool Corporation

- Thomas Ulm

Radhakrishnan Kodakkal Appointed MD & CEO Of Daimler Truck Innovation Center India

- By MT Bureau

- March 09, 2026

Bengaluru-based Daimler Truck Innovation Center India (DTICI) has appointed Radhakrishnan Kodakkal as its new Managing Director and Chief Executive Officer. He succeeds Raghavendra Vaidya, who has transitioned to the role of Global Chief Information Officer at Daimler Truck.

In his new position, Kodakkal will oversee the expansion of engineering and digital capabilities at the Bengaluru hub. His remit includes the acceleration of innovation in coordination with the global product engineering, technology and IT teams of Daimler Truck.

Kodakkal joins DTICI with 30 years of experience in technology, engineering, and research and development. He previously served as Global Head of Integrated Technology and Vice-President at Whirlpool Corporation, where he managed R&D operations and digital transformation strategies. His career has focused on the delivery of connected and intelligent technology solutions within multinational organisations.

DTICI serves as a strategic hub within the global Daimler Truck ecosystem, focusing on software, digital platforms and IT operations. The centre supports the parent company’s objectives in developing sustainable and connected transportation solutions.

Key focus areas for the new leadership include:

- Global Collaboration: Aligning Indian engineering output with international product cycles.

- Digital Platforms: Scaling software-defined vehicle technologies and IT infrastructure.

- Innovation Delivery: Transforming research into scalable automotive applications.

Thomas Ulm, Chairman, Daimler Truck Innovation Center India, said, “Radhakrishnan brings deep expertise in technology and engineering, complemented by strong global leadership experience and a proven ability to build and scale innovation. As DTICI continues to play a central role in Daimler Truck’s global engineering and IT network, we are confident that his leadership will further strengthen DTICI’s position as a trusted innovation and delivery hub across the global Daimler Truck ecosystem. I would like to express my sincere thanks to Raghavendra Vaidya for his outstanding leadership and strategic vision. Under his guidance, DTICI has grown into an integral part of Daimler Truck. We look forward to continuing our strong collaboration in his new role as CIO of Daimler Truck.”

Radhakrishnan Kodakkal, stated, “I am excited to step into this role and build on the strong foundation that has been established. The automotive industry is experiencing a period of significant transformation and there’s no better time to be part of it than now. DTICI has grown into a pivotal technology and innovation hub for Daimler Truck, driven by exceptional talent in India. I look forward to collaborating closely with colleagues across the globe to deliver solutions that are scalable, sustainable, and future-ready.”

Maurice Meijer Appointed As TIP Group’s First Chief Digital and Information Officer

- By MT Bureau

- March 06, 2026

TIP Group has announced the appointment of Maurice Meijer to the newly established position of Chief Digital and Information Officer. This strategic role underscores the increasing significance of digital innovation, data management and technology in advancing the company’s long-term Strategy 2030 objectives. As TIP expands its footprint as a comprehensive transportation services provider across 17 European nations, the integration of digital solutions is viewed as essential to fostering operational efficiency, business growth and superior customer engagement.

In his capacity as CDIO, Meijer will lead the formulation and execution of the group’s digital and technological roadmap. His responsibilities encompass overseeing digital platforms, enhancing data analytics capabilities, managing IT infrastructure and strengthening cybersecurity protocols. The goal is to build resilient, scalable systems that align with TIP’s future ambitions.

Meijer joins with a robust background in board-level technology leadership. He previously served as Chief Technology and Information Officer at Nederlandse Loterij, where he spearheaded major digital transformations across various brands and platforms. Prior to that, he held key roles in digital strategy, product development and operations within both the technology sector and public institutions. Additionally, he is involved in supporting early-stage tech startups as an investor and founding partner.

His educational credentials include executive programmes at Nyenrode University and INSEAD, along with a degree in international business management. Meijer is recognised for blending strategic commercial insight with practical technological expertise.

Arjen Kraaij, President & CEO, TIP Group, said, “Digitalisation is central to TIP’s future success. With Maurice, we are bringing in a strong business and technology leader who will help us simplify complexity, strengthen our digital foundations and accelerate execution across the Group. His leadership will be instrumental as we translate our Strategy 2030 ambitions into practical, value-creating solutions for our customers and our teams.”

Meijer said, “I’m really looking forward to joining TIP at this important stage in its journey. With strong foundations, great people and clear ambitions under Strategy 2030, there’s a lot to build on. At the same time, we’re ready to take the next step by accelerating our shift towards more digital solutions. By embracing digital, data and AI in a focused and practical way, we’ll turn opportunities into solutions that truly improve the customer experience and make day-to-day work simpler, smarter and more effective for both our customers and our teams.”

Holyvolt Completes $73 Million Acquisition Of Wildcat Discovery Technologies

- By MT Bureau

- March 06, 2026

Swedish battery technology firm Holyvolt has finalised the acquisition of US-based materials specialist Wildcat Discovery Technologies in a deal valued at USD 73 million. The transaction consists of a combination of cash, equity and deferred milestone payments.

The merger integrates Wildcat’s High Throughput Platform (HTP) for material synthesis with Holyvolt’s water-based screen-printing production processes. The combined entity intends to operate as a technology development partner for the automotive, aerospace and energy storage sectors, offering licensing and pilot-scale production services.

Wildcat’s HTP system allows for the simultaneous screening of thousands of material combinations. This method is reported to be up to 10 times faster than standard research and development protocols, generating terabyte-scale datasets suitable for machine learning and AI applications.

Key capabilities of the integrated group include:

- Material Discovery: Use of combinatorial chemistry to identify optimal battery systems.

- Manufacturing Process: Holyvolt’s water-based processing serves as a replacement for conventional organic solvent-based slurries.

- Data-Driven Optimisation: Integration of structured datasets into AI models to accelerate development cycles.

- Sustainability: Focus on cobalt- and nickel-free materials to reduce capital requirements and supply chain dependencies.

The acquisition follows a EUR 20 million funding round for Holyvolt. The new group aims to address production costs and supply chain independence in Europe and North America by combining chemistry expertise with modular manufacturing technology.

Mathias Ingvarsson, Founder & CEO, Holyvolt, said, “The acquisition of Wildcat is a perfect complement to our intended strategy of developing new technologies for the battery industry. Holyvolt is focused on developing new processes to make batteries cleaner and more affordable, and Wildcat has been pursuing the same goals via materials development and better chemistry. Combined, we are building what we believe is the most compelling technology to deliver on these objectives.”

Mark Gresser, President and CEO, Wildcat Discovery Technologies, stated, “The Wildcat team is thrilled with this acquisition by Holyvolt. Mathias and team are very thoughtful with regard to their objectives in the battery industry, and recognise the value that Wildcat’s High Throughput Platform can deliver to our combined company and the industry at large. With Holyvolt’s vision and financial backing, Wildcat can finally unlock the true potential of high throughput combinatorial chemistry for battery materials.”

Prof. Peter Schultz, Founder, Wildcat Discovery Technologies, noted, “With Holyvolt, we can do for batteries what high throughput and AI have done for drug discovery.”

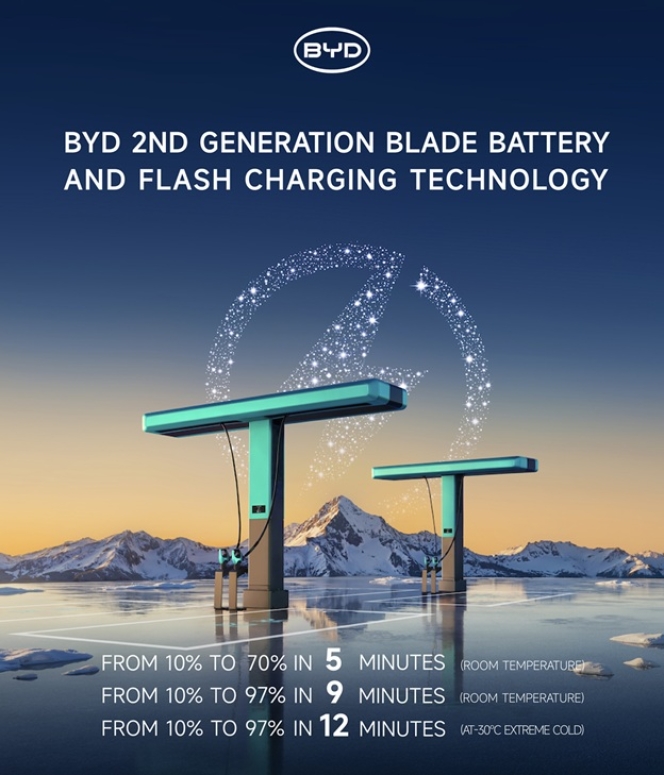

BYD Unveils Second-Generation Blade Battery With Flash Charging Tech

- By MT Bureau

- March 06, 2026

Chinese automotive major BYD has revealed its second-generation Blade Battery alongside FLASH Charging technology, aimed at improving charging speeds and battery performance in low temperatures.

The system achieves a claimed charge from 10 percent to 70 percent state of charge (SOC) in five minutes, and reaches 97 percent in nine minutes. In temperatures of -30deg C, the charging time from 20 percent to 97 perrcent increases by three minutes compared to performance at room temperature.

The second-generation Blade Battery increases energy density by 5 percent over the previous version. To manage thermal loads during rapid charging, BYD integrated a ‘Lithium-Ion High-Speed Channel’ and a thermal management system.

Key technical specifications include:

- Range: The Denza Z9GT, equipped with this battery, achieves a range of 1,036 km.

- Thermal Management: Full-spectrum systems to regulate heat dissipation.

- Safety Standards: The battery has passed national safety tests regarding puncture and thermal runaway.

- Infrastructure: A world-leading single-connector output of 1500 kW.

BYD plans to build 20,000 FLASH Charging Stations in China by end-2026, with a global rollout scheduled to follow. These stations will feature a pulley-based charger design to improve user ergonomics and keep cables off the ground.

To manage the high-power requirements of 1500 kW charging, the stations use energy storage systems to buffer the demand, reducing the load on the local power grid.

Comments (0)

ADD COMMENT