Robust, Smart Charging Network Needed To Boost EV Proliferation

- By 0

- April 05, 2020

.jpg)

Q: India is the first country outside of Europe where you are operating. Why this entry?

Jha: The Indian market is different from the Nordic and European markets, and it is the first country outside Europe, where Fortum entered the electric vehicle charging space in 2017. We have integrated a couple of Indian chargers into our system and this enables us to deploy ‘Made in India’ chargers to our network. This will give our customers the freedom to choose the chargers, their availability, price and other benefits.

Fortum established its first charging station in New Delhi in 2017. Its services in India include owning charging infrastructure, operating other’s charging infrastructure network using Fortum’s own cloud-based charging system and selling Fortum’s proven off-the-shelf cloud system to other operators to manage charging infrastructure in the B2B segment.

Q: How do you see and predict the EV market in India?

Jha: India will benefit from the global growth of EV technologies and can reach a maturity stage faster than in other countries. As Tesla did for the US market, start-ups in India are poised to promote the adoption of EVs. Free from any legacy baggage, they are able to offer pure electric vehicles as is evident on the road, particularly in the two and three-wheeler sector. Traditional OEMs also are trying to hold on to their market share. Hyundai has taken the lead by introducing Kona. The electric version of Maruti cars can be seen on the road though in test mode. More than ten models of electric vehicles are slated for launch in the next 12-18 months. Tata Motors has announced plans to introduce more models of the electric variant. Mahindra promises to launch KUV 100 and SUV 300 with the electric powertrain. With India poised to become the third-largest auto market in the world, none of the players would like to miss this great opportunity.

With more and more renewable energy being fed into the grid, the use of EVs will provide the flexible load to balance the system.

Q: What are the fundamental differences between India and Europe in terms of vehicle requirements and charging infrastructure?

Jha: India and Europe share a common requirement in the automobile space. India generally follows the European automotive emission norms as Euro 6. Europe started the EV journey with high voltage system cars like Nissan Leaf, which warrants a different set of chargers to offer good customer experience. Starting from 50kW DC chargers, Europe has moved to high power charging capacity of 350kW in DC mode which brings down the charging time to about 10 minutes for a 150-200km range. On the AC side in public charging, it has a network of 22kW chargers which offer semi-fast charging to most of the vehicles. The 3.3 kW AC chargers are generally deployed at home and parking places.

India, on the other hand, has a different vehicle composition. Most of its EVs are two and three-wheelers which have a different kind of charging need. They are currently dominated by lead-acid batteries. In the four-wheeler passenger car segment also, India started with a unique product. The available cars are on low voltage battery system, which requires a different set of chargers – 15/20 kW power in DC mode. They need longer charging time than their counterparts in Europe where a car with almost double the size of battery can get charged in nearly half the charging time than in India. Now, a few OEMs have started selling high voltage system cars which would require 50kW charging infrastructure.

Another significant difference between Europe and India is the need for public charging. Most of the European countries have single-family low-rise homes with garage whereas Indian cities like Delhi have mostly unorganised street parking. This fundamentally alters the need of charging infrastructure in India. While in Europe home charging would be dominating, India will need public charging as the dominant mode.

.jpg) Q: Charging infrastructure and time is probably the biggest hindrance in the adaptation of EVs in India? How do you find opportunities in this area?

Q: Charging infrastructure and time is probably the biggest hindrance in the adaptation of EVs in India? How do you find opportunities in this area?

Jha: Three major interdependent stakeholders influence the evolvement of EVs in any country. They are: automobile manufacturers, battery manufacturers, and charging infrastructure providers. Given the limited use of e-vehicles in India now, the infrastructure for the same is also at a very nascent stage. The lack of sufficient infrastructure could be the most common reason for the range concern that directly affects the consumer behaviour and potential of EV sales in India. However, from the operators’ point of view, it is difficult to invest in charging infrastructure without an existing demand for charging services.

India will need ubiquitous public charging networks. India needs millions of charging points once all cars sales happen on the electric platform. This offers huge opportunity for both the private and the public sectors. However, considering the space constraint and inadequate electricity infrastructure, setting up such a massive network of public charging will be a demanding task. Government support will be required in making locations available for this purpose if we have to roll out a good network of charging stations.

For EVs to be acceptable, consumers have to be assured of the availability of charging stations like fuel stations for ICE vehicles. A robust charging station network would give them confidence, and that would work as a pull effect on OEMs.

Q: India is a vast country. How are you going to identify and target the regions or pockets where EV adaptation will be faster?

Jha: As it happens with any new technological product, initially EV will be adopted by innovators or early adopters. We expect that these vehicles will be adopted mostly in cities with the highest per capita income. We operate now in five cities: Delhi-NCR, Mumbai, Bengaluru, Hyderabad and Ahmedabad. We have 66 DC public charging points. Since the launch of our DC fast-charging stations in Hyderabad, we have seen positive adoption of electric vehicles by customers. We have more than 900 registered users, and more than 1500 customers have downloaded our mobile app. These are smart chargers which are unmanned and give freedom to the consumer to charge their vehicles at the location of their choice, and at their convenience.

Q: Do you think public utility places would play a more prominent role in increasing the number of EV charging stations? Could you highlight Fortum India’s partnership with Indian Oil?

Jha: We provide our bit in creating reliable and smart charging infrastructure. Our first DC fast public charging station in Hyderabad came up at IOC COCO retail outlet at Begumpet. We are operating 16 charging points at eight retail outlets of IOC in Hyderabad. We demonstrated our capability of operating smart chargers by unveiling the charging of Mahindra e2oplus remotely from Hotel ITC Kakatiya, Hyderabad, using Fortum Charge & Drive Mobile App.

Q: How many EV charging stations has Fortum India set up so far, and what is the immediate target?

Jha: Fortum has made 66 DC Fast charging points operational in Delhi-NCR, Hyderabad, Mumbai, Bengaluru, and Ahmedabad. Fortum Charge & Drive also offers a cloud solution to EV charging service providers and infrastructure investors.

Recently, we have established India’s first public charging network of 50 kW DC chargers at dealership locations of MG Motors. Any car owner can access these stations if the car is compatible with CCS/CHAdeMO standards. We are continuously evaluating opportunities across the country.

Q: How do you see the role of the stakeholders such as charging station infrastructure manufacturers, energy companies and operators in the growth of EV adoption?

Jha: Each stakeholder has a role to play in EV adoption in India. It is important to note that it is the vehicle and its battery system which determines the charging infrastructure need, not otherwise. The charging standards or capacity of chargers or time of charging, and everything is dependent on the design of the battery and its management system adopted by the OEMs. Charging manufacturers and operators follow the demand. In charging ecosystem, manufacturer caters to the supply side by offering his product which can be put to use by charge point operators at strategic locations. Energy distribution companies also have a critical role to play. EV charging, particularly public charging in DC mode, requires high capacity which might need augmentation of electricity infrastructure. Energy to Charge Point Operators (CPOs) should be provided at a reasonable price so that end-consumers can charge their vehicles at affordable prices. Efforts of all these stakeholders have to get aligned.

Q: What have been the ground-level challenges for Fortum India?

Jha: Access to a suitable location and electricity supply is a major challenge. The number of EVs initially will be less, so also the business for the Charge Point Operators. It will be more challenging if CPOs have to pay rent for the space or bear any upfront cost on electricity infrastructure. So it is expected that these two parts would be taken care of by the government or partners to make EVs affordable for the customers.

Q: Being in the EV charging station space, what do you expect from the government?

Jha: For the manufacture of EVs and the growth of the industry, the government introduced the FAME scheme. It would also support the manufacturing of advanced batteries which will accelerate the adoption of EVs by bringing down the cost of the battery. Tax reduction is a significant boost for the consumer as it would push the EV price to inch towards ICE vehicle price.

Creating a robust and smart charging network should be the focus. Although through FAME-II the government has called for proposals on the setting up of 1000 electric vehicle charging stations in the country, this is not enough. Consumers would like to have charging points at their preferred locations, time, and price to avoid range anxiety. This requires a robust, ubiquitous, and friendly charging network of stations. As charging takes more time than gasoline refuelling, the consumer would like to find a charging station in an exciting place where he would feel happy to spend time while the vehicle gets charged.

We have to add lakhs of charging points year after year if in future all vehicles sold are electric. This would require access to space, which is scarce, particularly in urban areas. Augmented electricity infrastructure would be needed at the local network level even though at the national level this will not be significant. So if the government finds some ways to offer space and upgrades electricity connections on the plug-and-play mode to CPOs it will give a boost to the creation of charging infrastructure.

EV charging would be a different proposition. Unlike oil and CNG, this has interdependency of battery and electricity. Appropriate communication is needed between battery and charger, and charge and grid, to ensure safety and reliability to the vehicle and grid. This necessitates that charging infrastructure must be smart. This would also warrant a smart grid. What is needed is a greater and urgent push towards upgradation and strengthening of both electricity and charging infrastructure. (MT)

Multimatic Installs First VI-grade HyperDock System In North America

- By MT Bureau

- February 20, 2026

VI-grade has announced the installation of its HyperDock cockpit at Multimatic’s Vehicle Dynamics Centre in Novi, Michigan. This deployment marks the first instance of HyperDock technology in North America. The system upgrades an existing DiM250 driving simulator, installed in 2020, into a platform capable of simultaneous vehicle dynamics and NVH (Noise, Vibration, and Harshness) development.

The HyperDock consists of a carbon-fibre cockpit designed to increase stiffness and reduce inertia. By removing the traditional top disk in favour of a direct actuator interface and integrated vibro-acoustic feedback, the system allows engineers to assess ride, handling and acoustics within a single environment.

The upgrade introduces ‘full-spectrum’ simulation, which bridges the gap between high-frequency vibration testing and low-frequency motion cues.

- Construction: Lightweight carbon-fibre frame.

- Interface: Direct actuator connection to minimise signal delay and mechanical loss.

- Feedback: Integrated tactile and audio systems for vibro-acoustic realism.

- Application: Simultaneous tuning of vehicle handling and interior cabin noise.

Peter Gibbons, Technical Director – Vehicle Dynamics, Multimatic, said, “After evaluating the VI-grade HyperDock Full Spectrum Simulator cockpit at the SimCenter Udine over a year ago, Multimatic quickly realized that it would provide a significant step forward in the fidelity of all DiM applications, from road car ride tuning to race car limit handling. The overwhelmingly positive responses from Murray White, Technical Director of Vehicle Development at Multimatic, and Dirk Müller, professional race car driver, affirmed Multimatic’s decision to upgrade to HyperDock. The added immersion, superior tactile feedback, and audio advancements have moved the goalposts well beyond our expectations. Multimatic looks forward to continuing to leverage the impressive capabilities of HyperDock over the coming years.”

Alessio Lombardi, Global Sales Director – Simulation, VI-grade, added, “With the addition of HyperDock, Multimatic now benefits from full-spectrum simulation capability, expanding the scope of development activities that can be performed on an already well-established simulator platform. This installation represents an important milestone for VI-grade, as it brings HyperDock technology to North America for the first time.”

- ADAS 2026 Show

- Autonomous

- Driving

- Developments

- Magna

- Mobileye

- Renault

- Ampere

- Mobileye

- Tata Motors

- ARAI

- Aayera

- demo

- live

- conference

- inauguration

- automotive

ADAS 2026 Show Looks At Autonomous Driving Developments

- By Bhushan Mhapralkar

- February 20, 2026

Postponed from December 2025 to February 2026, the ADAS Show 2026 by Aayera was a combination of stalls where diverse players from the field of ADAS or autonomous driving highlighted their latest developments. There were live demo sessions that saw the use of passenger vehicles, trucks and dummies to highlight the technological prowess in the field.

Held at ARAI’s newest testing and certification facility for ADAS and other modern automotive technologies at Takwe (Pune), the show saw experts speak about the autonomous future in panel discussions, presentations etc. Live demos highlighted progress on the computing and vision front; on the software front, underlining certain zest.

In his inaugural address, Dr Reji Mathai, Director, ARAI, spoke about the motive behind setting up an ADAS testing facility at Takwe. Observing that tracks never give returns to draw attention to the decision of setting up an ADAS testing track at Takwe (the newest yet by ARAI), Dr Mathai informed that ARAI participates at the UN level in regulation forming.

Dr Mathai; Elie Luskin, Vice President – India and China, Mobil Eye, and Nina Roeck, Vice President – Software Engineering (Drive & Comfort), Ampere (Renault Group), were united in their expression about India’s unique traffic and driving conditions. The trio stressed on localisation of ADAS system parts such as sensors; on local engineering and development, and on local testing and validation.

“In India, the conditions are different and the effort therefore is to focus on perception, alerts and interventions that consider the local driving condition,” said Roeck.

Asserting that India’s expanding auto market has disproportionately low ADAS. Luskin explained, “ADAS would become mainstream as India’s GDP per capita grows.

Apurbo Kirty, Head – Electrical & Electronics, ERC, Tata Motors, focused on advanced driver assistance in CVs in his address. He referred to road challenges in India, road accident statistics and the challenges for ADAS implementation in terms of SAE autonomy levels, regulations like GSR 834 and how ADAS is a necessity rather than just a tech upgrade.

Touching on the complexity of landscape of Indian road conditions, Abijit Sengupta, Head of Business – SAE and India, HERE Technologies, spoke about vehicle safety trends such as connected vehicles, autonomous, shared services and electrification.

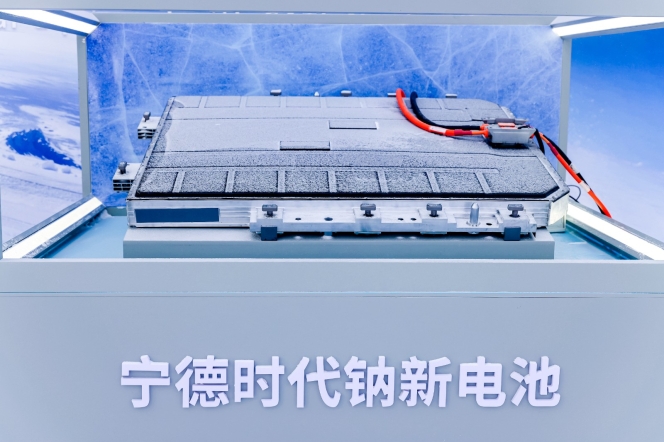

Changan And CATL Launch Mass-Production Sodium-Ion Battery Vehicle

- By MT Bureau

- February 19, 2026

Changan Automobile and CATL have unveiled the first mass-production passenger vehicle equipped with sodium-ion batteries. The vehicle, showcased at the 'Changan SDA Intelligence Milestone Release', is scheduled for market release by mid-2026. CATL, acting as the strategic partner for the project, will supply its Naxtra sodium-ion batteries across Changan’s brands, including Avatr, Deepal, Qiyuan and UNI. The partnership introduces a dual-chemistry approach to the market, utilising sodium-ion alongside lithium-ion technologies.

CATL's Naxtra battery reaches an energy density of 175 Wh/kg. Utilising a Cell-to-Pack system and a battery management system (BMS), the technology provides a range exceeding 400 km. Future iterations are projected to reach 500–600 km for battery electric vehicles (BEVs) and 300–400 km for hybrids.

The technology is designed for operation in cold climates. At –30deg Celsius, the battery delivers triple the discharge power of lithium iron phosphate (LFP) alternatives. It maintains 90 percent capacity retention at –40deg Celsius and continues to function at –50deg Celsius. Safety testing, including drilling and crushing, resulted in no smoke or fire.

The global sodium-ion battery market is forecast to grow from USD 1.39 billion in 2025 to USD 6.83 billion by 2034. To support adoption, CATL plans to establish over 3,000 Choco-Swap battery swap stations across 140 cities in China by the end of 2026, with a focus on northern regions.

The launch follows a decade of research. Since 2016, CATL has invested nearly 10 billion RMB (USD 1.45 billion) into sodium-ion technology, developing approximately 300,000 test cells. The project was supported by a dedicated team of 300 personnel to ensure scalability and performance.

Gao Huan, CTO of CATL's China E-car Business, said, "The arrival of sodium-ion technology marks the beginning of a dual-chemistry era. Changan's vision shows both its responsibility for energy security and its strategic foresight. Much as it embraced electric vehicles years ago, Changan is once again taking the lead with its sodium-ion roadmap. At CATL, we value the opportunity to work alongside such an industry leader and fully support its strategy, combining our expertise to bring safe, reliable and high-performance sodium-ion technology to market."

drivebuddyAI Demonstrates Scalable ADAS Platform At India’s First ADAS Test Track

- By MT Bureau

- February 18, 2026

Following its international unveiling at CES 2026, drivebuddyAI, a leading innovator in AI-powered Advanced Driver Assistance Systems (ADAS) and Driver Monitoring Systems (DMS), recently demonstrated its technology at the ARAI ADAS Test City. The company presented its range of vision-based Advanced Driver Assistance and Driver Monitoring Systems, focusing on their reliability in the varied and challenging conditions typical of Indian roads.

Live demonstrations were conducted using a heavy commercial vehicle to showcase the platform's versatility in meeting various compliance standards. A single, integrated hardware and software setup, utilising a fused network of cameras for 360-degree perception, executed multiple test scenarios simultaneously. These included a driver monitoring system that detects drowsiness, distraction and seatbelt usage in line with both Indian and European regulations. Further tests illustrated the vehicle's ability to warn of pedestrians moving into its path, identify potential collisions with cyclists in blind spots and issue forward collision warnings by combining radar and camera data.

Beyond merely fulfilling test requirements, the demonstrations highlighted practical applications that extend into everyday driving situations. This focus on real-world functionality is backed by extensive validation, with the company's systems having analysed nearly four billion kilometres of driving data. This has reportedly led to significant safety improvements, including a marked decrease in incidents caused by driver fatigue and a substantial reduction in overall fleet risks.

Currently validated for commercial vehicles against India's AIS-184 standard and Europe's stringent General Safety Regulation and Euro NCAP protocols for 2026, the technology is also adaptable for passenger cars. This scalability offers automotive manufacturers and their suppliers a pathway to not only meet but surpass upcoming global safety mandates. By refining its AI through extensive fleet operations over billions of kilometres before adapting it for original equipment manufacturer compliance, drivebuddyAI aims to deliver a mature, rigorously tested product that ensures an enhanced user experience.

Nisarg Pandya, CEO and Founder, drivebuddyAI, said, “ADAS Test City from ARAI is a great initiative, and we value participating in a format where we can showcase live demonstrations to a large audience together on the vehicle. This time, the turnout was significant and provided a strong opportunity to establish drivebuddyAI as one of the key players in the upcoming OEM compliance requirements. The engagement and response we received were phenomenal, reinforcing both the market need and the industry’s confidence in our solutions. The upcoming ADAS-compliant vehicles must have technology that works in Indian scenarios to achieve meaningful safety improvements and reduce fatalities.”

Comments (0)

ADD COMMENT