Stratasys Supports To Transform Indian Manufacturing: Rajiv Bajaj

- By 0

- February 04, 2020

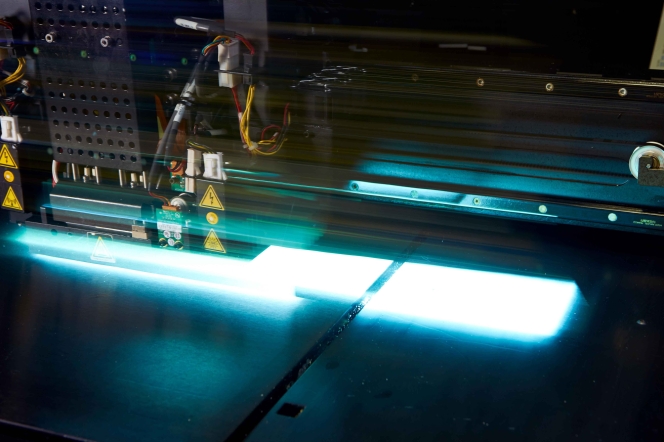

Stratasys, a global leader in additive manufacturing or 3D printing technology, helps Indian aerospace, automotive, healthcare and consumer products industries design and make prototypes, manufacturing tools, and production parts faster and cost effectively.

Several OEMs and Tier-1 companies in these industry segments are its customers who want high value products at very reasonable prices. In an interaction with T Murrali of this publication, Rajiv Bajaj, Managing Director, Stratasys India and South East Asia, said, “We are changing the game by giving industrial production-grade machines at affordable prices. We have a lot of takers for them across industries in the Tier-2& 3 cities also.” Edited excerpts:

Q: In India, is additive manufacturing still confined to R&D for making prototypes? What is the next step in the automotive sector?

Bajaj: The car companies we have in India are globally competitive, keeping pace with what is happening around the world. The differentiation we see as a technology provider is the level of technology adoption by the local OEMs. Similar-sized OEMs elsewhere in the world will have a series of our machines whereas in India they are just 1 or 2 each, most of them with the auto OEMs. It also has to do with the technology adoption rate and the trend of product development and differentiation which came in rather late.

Secondly, prototyping is a well documented area; people use it day in and day out. Companies like Honda, that do only manufacturing in India, are adopting it for their jigs and fixtures. The third stage we look at is personalisation where one can use the 3D printed part in a portion of the vehicle, which has been done with BMW MINI, and Daihatsu in Japan. We don’t have any use case in India as yet. We are looking at possibilities here.

Q: Are there some applications where it can be used?

Bajaj: Now we are talking about not just back-end or R&D use but actual customer experience. There we are giving tooled-up parts with multiple finishes. There are finite possibilities with the new numbers and quality of parts being manufactured. 3D is also used as a marketing tool. Typically, people look at it as a device to save money or time as this is a revenue generation tool.

Q: So even if you make 10,000 parts, each one can be customised?

Bajaj: Yes, absolutely; it’s mass customisation.

Q: Do you see opportunity globally and in India to replace traditional manufacturing by 3D, and to what extent?

Bajaj: There is no simple yes or no answer to this. It involves a deep understanding of how the two processes work. If volumes are a few thousands, yes; but if it is in lakhs, then maybe not. The most intelligent organisations would be the ones who would use a mix-and-match of this technology. Additive doesn’t mean it should remove subtractive. Intelligence lies in knowing when to use additive and where to leverage subtractive, and vice-versa. Combining these two will make for a very efficient organisation.

Q: Will this find a key role in low volume parts?

Bajaj: Yes, as well as complicated parts and in the aftermarket for different models. Even enthusiasts like Jay Leno will find a use for this. In fact Leno has bought a 3D printer from Stratasys to make parts for his collection of vintage cars. It’s a useful tool for motor enthusiasts to make parts that are not available in the market.

Q: Do you see additive manufacturing for lightweighting?

Bajaj: Parts consolidation is a very direct outcome of 3D printing because, for example, it can print a chain with interlock whereas in the traditional process each part would be a separate entity. In an aerospace part we consolidated some 100 plus parts into one unit. In automotive, now many areas for this are emerging for limited production; mass production would take some more time but it will come. When we talk of lightweighting, making prototypes earlier was quite difficult but today with this technology we can make very complex prototypes and validate the design. Once it is validated it can use any method: for low volume additive, for high volume something else. That’s the advantage. Also, in assembly, we can check minute gaps in the line very accurately. Changes in tooling can be done immediately instead of waiting for a long period as customisation has to be done in the shortest period possible.

Q: Would this help reduce the number of iterations?

Bajaj: Actually I can do more iteration by trying out newer ideas. This will help enhance the quality level at the design stage itself. We have to find a balance between the additive and the subtractive.

Q: Would the customer complaints reduce when you make a product faster?

Bajaj: Obviously, as I am designing quality into the process and product from day one; it helps me take informed decisions. Basically, what the customer wants is a good, tangible product.

Q: What is the response you get from customers who have not taken up this technology as yet?

Bajaj: In today’s scenario there would be very few customers in the automotive supply chain who have not experimented with 3D printing. If they are not using it directly they are getting services done outside. The expectations from customers is different; some want better quality, some want it faster, some cheaper and so on. Most of them are experimenting so that this should become a part of their process.

Q: Are there other concerns than cost?

Bajaj: In India, cost is a big concern; customers want high value at the most reasonable price; they are not looking just for low cost. So there is pressure; that’s why a lot of innovation helps. A company cannot just copy paste; it has to innovate. In 2015 our lowest cost of the printer in FDM series was around INR 60 lakh. Today, we have given the same technology on a different platform for INR 15 lakh. That’s how we are changing the game, giving the same class of industrial production grade machines at an affordable price. This has found a lot of takers for us in the Tier-2&3 cities, not just automotive but across industries.

Q: There might be apprehension among your potential customers that if they buy a machine from you they would have to be wedded forever to your company to get the material. Is that true or will they be free to choose their own material from the market for use?

Bajaj: For most of our technologies it is true but we are working on a new technology called SLA which is our only platform where the consumer can buy material elsewhere. The problems with 3D printing are many. Let us say if you make your material open and then the customer comes and says the parts are not printing correctly; then where do you fix the blame? That becomes a big problem. The reason why we keep it to us is not because we want to charge customers more, but because we want to give them 100 percent accurate results all the time. Predictability and repeatability are problems that 3D printers at entry level are facing every day. By controlling the oven temperature and the material properties we are able to achieve 100 percent accuracy. When companies like Maruti tell us there are some challenges, we work with them to sort it out.

It is like when the customer buys a car and goes to the spurious market to get parts. When the vehicle fails they come and complain to us. We check the car and tell them the company is not responsible for whatever parts the customer fits in. Even insurance companies do not entertain such claims. If you want consistent quality and most desirable product performance you will have to stick to some standards.

Q: Do you see Stratasys to become even a supplier to vehicle manufacturers or Tier-1s?

Bajaj: It is not done in India as yet but globally we do run Service Bureaus. The BMW MINI project is all done by our Bureaus.

Q: Is this like software as a service where they can use your facility?

Bajaj: Yes, they have to just give us the software data and we will be able to print it. But that is not the real intelligence of the service bureau. The services we provide are very high-end; redesigning the entire thing, adding more colour variants, giving a new look to the car. These are the kind of services we provide where 3D printing is a part of the process. We take into account all the special requirements the customer wants. We have done complex projects in India and our overseas offices as a service.

Q: Which are the markets that are very attractive, where you have more inroads as of now? Going forward, how will it be?

Bajaj: Automotive is our sweet spot, globally (around 25 percent) and in India (30 percent). I see it as a major place for expansion because compared to global standards the technology adoption with these companies is very low. I believe if they have to compete in testing times like this there is no other way than to come out with products faster and cheaper. Technologies like Stratasys 3D printing are tailor-made for this. Despite the slowdown we are very bullish about the automotive market because of the lack of penetration in it. It’s a technology life cycle, similar to the software industry where the cycle came from the US and went on to Europe and to Asia before coming to India.

Q: How do you compare with aviation as you are the only one certified by the aviation industry?

Bajaj: For aviation, we are limited to plastics at this point in time so the parts made by us are more suitable for the cabin interior. India is more about defence aviation where the aircraft interior is not that critical. While HAL, DRDL, etc are all using our technology, mass proliferation would occur when companies like Boeing and Airbus have their complete setup in India. We need civil aircraft to be manufactured in India to see that kind of growth; there are none at present.

Q: For automotive, what are the key drivers of growth globally and in India?

Bajaj: One is the quest for innovation through rapid prototyping. Two, the product development cycle time has reduced by 50 percent in the last four years. If a new platform time was 3 years earlier, today it is under 18 months. In the past two years, any automotive company that has not come up with newer models at a faster pace has not survived. To keep the momentum going in the market they have to come up with new products. If they have the right product at the right price in India their business will certainly grow. (MT)

BOX

User Forum

The 3rd edition of Stratasys India User Forum in Bengaluru recently had participation from over 620 industry leaders and end-users. Organised by Stratasys, a global leader in 3D printing and Additive Manufacturing (AM), the Forum was a platform for professionals to exchange views on the latest 3D printing trends, applications, and the best practices across key sectors in India.

Michael Agam, President, South Asia, Stratasys, said the User Forum brought together several leading brands such as Maruti Suzuki, Ashok Leyland and Honda Cars in the Indian ecosystem, that have used Stratasys’ products to innovate. This reiterates why India is a key market for the company.

Saurabh Singh, Head of Design Studio at Maruti Suzuki India Ltd, highlighted how the brand has been able to leverage 3D printing to provide high quality, ergonomically suited and distinctly personalized offerings, thereby enhancing the overall customer experience.

Sundaresan, Vice-President, Electric Vehicles and eMobility Solutions, Ashok Leyland, said that AM helped the company save about 14,138 days of hour-utilization and nearly INR 74 lakh in manufacturing costs. He said Ashok Leyland made clutch housing using AM to carry out fitment checks and it helped to contain the time to three days against close to 60 days in the conventional method. AM helped also to keep the time schedules for the development of blower cover and meet the CMVR regulations. The company made prototypes and parts for the initial production lot. The whole exercise was completed in a couple of days as compared to 90 days in the conventional method. Similarly, the three-axis intake pipe was made in a day as opposed to the usual three months. It also made a scaled concept of the seven-speed gearbox having geometric complexity. For electric vehicles the company made traction motor stator sector in AM, which helped in physically measuring the slot-fill, evaluate ease of winding and measure external portions of end-winding. “For smaller volumes also AM is economical. For advanced mobility it plays a key role in the combustion chamber”, Sundaresan added.

Bhushan Chandna, Manager, Business Excellence, Honda Cars, explained how the brand has spearheaded the use of additive manufacturing in the auto sector, especially with the use of 3D-printed jigs and fixtures. (MT)

Multimatic Installs First VI-grade HyperDock System In North America

- By MT Bureau

- February 20, 2026

VI-grade has announced the installation of its HyperDock cockpit at Multimatic’s Vehicle Dynamics Centre in Novi, Michigan. This deployment marks the first instance of HyperDock technology in North America. The system upgrades an existing DiM250 driving simulator, installed in 2020, into a platform capable of simultaneous vehicle dynamics and NVH (Noise, Vibration, and Harshness) development.

The HyperDock consists of a carbon-fibre cockpit designed to increase stiffness and reduce inertia. By removing the traditional top disk in favour of a direct actuator interface and integrated vibro-acoustic feedback, the system allows engineers to assess ride, handling and acoustics within a single environment.

The upgrade introduces ‘full-spectrum’ simulation, which bridges the gap between high-frequency vibration testing and low-frequency motion cues.

- Construction: Lightweight carbon-fibre frame.

- Interface: Direct actuator connection to minimise signal delay and mechanical loss.

- Feedback: Integrated tactile and audio systems for vibro-acoustic realism.

- Application: Simultaneous tuning of vehicle handling and interior cabin noise.

Peter Gibbons, Technical Director – Vehicle Dynamics, Multimatic, said, “After evaluating the VI-grade HyperDock Full Spectrum Simulator cockpit at the SimCenter Udine over a year ago, Multimatic quickly realized that it would provide a significant step forward in the fidelity of all DiM applications, from road car ride tuning to race car limit handling. The overwhelmingly positive responses from Murray White, Technical Director of Vehicle Development at Multimatic, and Dirk Müller, professional race car driver, affirmed Multimatic’s decision to upgrade to HyperDock. The added immersion, superior tactile feedback, and audio advancements have moved the goalposts well beyond our expectations. Multimatic looks forward to continuing to leverage the impressive capabilities of HyperDock over the coming years.”

Alessio Lombardi, Global Sales Director – Simulation, VI-grade, added, “With the addition of HyperDock, Multimatic now benefits from full-spectrum simulation capability, expanding the scope of development activities that can be performed on an already well-established simulator platform. This installation represents an important milestone for VI-grade, as it brings HyperDock technology to North America for the first time.”

- ADAS 2026 Show

- Autonomous

- Driving

- Developments

- Magna

- Mobileye

- Renault

- Ampere

- Mobileye

- Tata Motors

- ARAI

- Aayera

- demo

- live

- conference

- inauguration

- automotive

ADAS 2026 Show Looks At Autonomous Driving Developments

- By Bhushan Mhapralkar

- February 20, 2026

Postponed from December 2025 to February 2026, the ADAS Show 2026 by Aayera was a combination of stalls where diverse players from the field of ADAS or autonomous driving highlighted their latest developments. There were live demo sessions that saw the use of passenger vehicles, trucks and dummies to highlight the technological prowess in the field.

Held at ARAI’s newest testing and certification facility for ADAS and other modern automotive technologies at Takwe (Pune), the show saw experts speak about the autonomous future in panel discussions, presentations etc. Live demos highlighted progress on the computing and vision front; on the software front, underlining certain zest.

In his inaugural address, Dr Reji Mathai, Director, ARAI, spoke about the motive behind setting up an ADAS testing facility at Takwe. Observing that tracks never give returns to draw attention to the decision of setting up an ADAS testing track at Takwe (the newest yet by ARAI), Dr Mathai informed that ARAI participates at the UN level in regulation forming.

Dr Mathai; Elie Luskin, Vice President – India and China, Mobil Eye, and Nina Roeck, Vice President – Software Engineering (Drive & Comfort), Ampere (Renault Group), were united in their expression about India’s unique traffic and driving conditions. The trio stressed on localisation of ADAS system parts such as sensors; on local engineering and development, and on local testing and validation.

“In India, the conditions are different and the effort therefore is to focus on perception, alerts and interventions that consider the local driving condition,” said Roeck.

Asserting that India’s expanding auto market has disproportionately low ADAS. Luskin explained, “ADAS would become mainstream as India’s GDP per capita grows.

Apurbo Kirty, Head – Electrical & Electronics, ERC, Tata Motors, focused on advanced driver assistance in CVs in his address. He referred to road challenges in India, road accident statistics and the challenges for ADAS implementation in terms of SAE autonomy levels, regulations like GSR 834 and how ADAS is a necessity rather than just a tech upgrade.

Touching on the complexity of landscape of Indian road conditions, Abijit Sengupta, Head of Business – SAE and India, HERE Technologies, spoke about vehicle safety trends such as connected vehicles, autonomous, shared services and electrification.

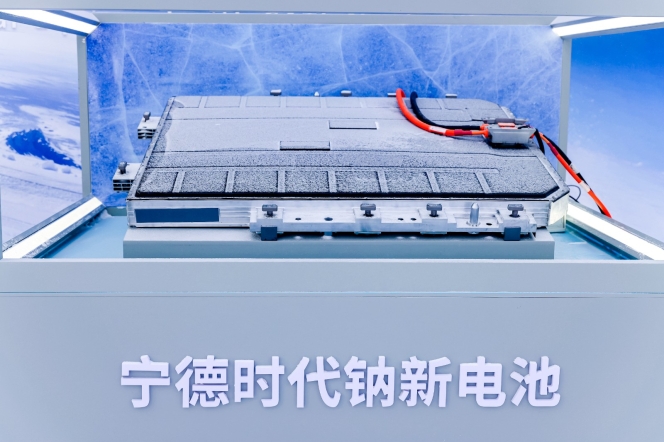

Changan And CATL Launch Mass-Production Sodium-Ion Battery Vehicle

- By MT Bureau

- February 19, 2026

Changan Automobile and CATL have unveiled the first mass-production passenger vehicle equipped with sodium-ion batteries. The vehicle, showcased at the 'Changan SDA Intelligence Milestone Release', is scheduled for market release by mid-2026. CATL, acting as the strategic partner for the project, will supply its Naxtra sodium-ion batteries across Changan’s brands, including Avatr, Deepal, Qiyuan and UNI. The partnership introduces a dual-chemistry approach to the market, utilising sodium-ion alongside lithium-ion technologies.

CATL's Naxtra battery reaches an energy density of 175 Wh/kg. Utilising a Cell-to-Pack system and a battery management system (BMS), the technology provides a range exceeding 400 km. Future iterations are projected to reach 500–600 km for battery electric vehicles (BEVs) and 300–400 km for hybrids.

The technology is designed for operation in cold climates. At –30deg Celsius, the battery delivers triple the discharge power of lithium iron phosphate (LFP) alternatives. It maintains 90 percent capacity retention at –40deg Celsius and continues to function at –50deg Celsius. Safety testing, including drilling and crushing, resulted in no smoke or fire.

The global sodium-ion battery market is forecast to grow from USD 1.39 billion in 2025 to USD 6.83 billion by 2034. To support adoption, CATL plans to establish over 3,000 Choco-Swap battery swap stations across 140 cities in China by the end of 2026, with a focus on northern regions.

The launch follows a decade of research. Since 2016, CATL has invested nearly 10 billion RMB (USD 1.45 billion) into sodium-ion technology, developing approximately 300,000 test cells. The project was supported by a dedicated team of 300 personnel to ensure scalability and performance.

Gao Huan, CTO of CATL's China E-car Business, said, "The arrival of sodium-ion technology marks the beginning of a dual-chemistry era. Changan's vision shows both its responsibility for energy security and its strategic foresight. Much as it embraced electric vehicles years ago, Changan is once again taking the lead with its sodium-ion roadmap. At CATL, we value the opportunity to work alongside such an industry leader and fully support its strategy, combining our expertise to bring safe, reliable and high-performance sodium-ion technology to market."

drivebuddyAI Demonstrates Scalable ADAS Platform At India’s First ADAS Test Track

- By MT Bureau

- February 18, 2026

Following its international unveiling at CES 2026, drivebuddyAI, a leading innovator in AI-powered Advanced Driver Assistance Systems (ADAS) and Driver Monitoring Systems (DMS), recently demonstrated its technology at the ARAI ADAS Test City. The company presented its range of vision-based Advanced Driver Assistance and Driver Monitoring Systems, focusing on their reliability in the varied and challenging conditions typical of Indian roads.

Live demonstrations were conducted using a heavy commercial vehicle to showcase the platform's versatility in meeting various compliance standards. A single, integrated hardware and software setup, utilising a fused network of cameras for 360-degree perception, executed multiple test scenarios simultaneously. These included a driver monitoring system that detects drowsiness, distraction and seatbelt usage in line with both Indian and European regulations. Further tests illustrated the vehicle's ability to warn of pedestrians moving into its path, identify potential collisions with cyclists in blind spots and issue forward collision warnings by combining radar and camera data.

Beyond merely fulfilling test requirements, the demonstrations highlighted practical applications that extend into everyday driving situations. This focus on real-world functionality is backed by extensive validation, with the company's systems having analysed nearly four billion kilometres of driving data. This has reportedly led to significant safety improvements, including a marked decrease in incidents caused by driver fatigue and a substantial reduction in overall fleet risks.

Currently validated for commercial vehicles against India's AIS-184 standard and Europe's stringent General Safety Regulation and Euro NCAP protocols for 2026, the technology is also adaptable for passenger cars. This scalability offers automotive manufacturers and their suppliers a pathway to not only meet but surpass upcoming global safety mandates. By refining its AI through extensive fleet operations over billions of kilometres before adapting it for original equipment manufacturer compliance, drivebuddyAI aims to deliver a mature, rigorously tested product that ensures an enhanced user experience.

Nisarg Pandya, CEO and Founder, drivebuddyAI, said, “ADAS Test City from ARAI is a great initiative, and we value participating in a format where we can showcase live demonstrations to a large audience together on the vehicle. This time, the turnout was significant and provided a strong opportunity to establish drivebuddyAI as one of the key players in the upcoming OEM compliance requirements. The engagement and response we received were phenomenal, reinforcing both the market need and the industry’s confidence in our solutions. The upcoming ADAS-compliant vehicles must have technology that works in Indian scenarios to achieve meaningful safety improvements and reduce fatalities.”

Comments (0)

ADD COMMENT