Gulf Oil Lubricants Records Highest-Ever Quarterly Performance, Plans INR 550 Million CAPEX

- By MT Bureau

- August 14, 2025

Gulf Oil Lubricants India Limited, a Hinduja Group company, has announced its unaudited financial results for the quarter ended 30 June 2025, reporting its highest-ever quarterly volume, revenue, and EBITDA. The company achieved double-digit volume growth, which was more than three times the industry growth rate. Consolidated quarterly revenue exceeded INR 10 billion for the first time.

On a standalone basis, the company's revenue from operations was INR 9.96 billion, a 12.57 percent increase YoY, with a Profit After Tax of INR 9.6 billion, up 9.81 percent YoY. Consolidated revenue reached INR 1.01 billion, an increase of 13.69 percent YoY and PAT grew by 12.90 percent to INR 951.7 billion, . The company's EV charger subsidiary, Tirex, also saw significant growth, with its revenue for the quarter increasing by over 163 percent.

Strategic Developments and Outlook

The Board of Directors has approved an INR 550 million capital expenditure (Capex) plan to increase manufacturing capacity by 70 percent, from 140 million litres to 240 million litres. This expansion will be spread over two years and is a key strategic initiative to support the company’s growth ambitions. The Silvassa plant's capacity will increase by 55 percent to 140 million litres, while the Chennai plant's capacity will double to 100 million litres.

Ravi Chawla, Managing Director and CEO, Gulf Oil, said, “The year began on a strong note, delivering yet another market leading performance achieving double-digit volume growth of 11% during the quarter, clearly over 3x the industry growth rate. This underscores the strength of our brand and continued trust of our consumers. Our EV charger subsidiary, Tirex, continued to perform well and closed the quarter with over 163 percent growth in topline catering to broader customer base."

Manish Gangwal, CFO, Gulf Oil, added, "We are quite excited to see our consolidated revenue crossing INR 10 billion as we concluded the quarter with highest-ever volume, revenue and EBITDA, driven by strong strategic execution resulting in profitable, volume-led growth.” He also noted that the company's operating profit for the quarter was Rs. 126.58 crores, a growth of 8.9% over the same period last year.

- Tata AutoComp Systems

- Artifex Interior Systems

- Artifex Systems Slovakia

- Jaguar Land Rover

- Volkswagen

- Audi

- Skoda

- Sweden Engineering Centre

- Arvind Goel

- Alan Fennelly

- Manoj Kolhatkar

Tata AutoComp Completes Acquisition Of IAC Slovakia, Renames It As Artifex Systems Slovakia

- By MT Bureau

- February 18, 2026

Tata AutoComp Systems, through its British subsidiary Artifex Interior Systems, has completed the acquisition of 100 percent of the share capital of IAC Group (Slovakia). The entity has been renamed Artifex Systems Slovakia s.r.o.

The acquisition establishes a presence for Tata AutoComp in the European Union, specifically as a supplier to Jaguar Land Rover, Volkswagen, Audi and Skoda. The move is part of a strategy to unify Artifex operations in the UK, Sweden and Slovakia under a single identity.

Coinciding with the acquisition, Artifex has opened the Sweden Engineering Centre in Gothenburg. The facility is intended to support innovation and collaboration with regional partners and customers.

Artifex now operates with an annual revenue of USD 1.3 billion and a workforce of 4,100 employees across Europe. Its portfolio includes instrument panels, consoles, door trims and headliners.

Arvind Goel, Vice-Chairman of Tata AutoComp Systems, said, "The integration of Artifex Systems Slovakia s.r.o (formerly IAC Slovakia) has been successfully completed, marking a significant step in building the Artifex brand and advancing our global growth strategy. With this integration, we are now better positioned to deliver long-term value, operational excellence, and world-class quality to global OEMs."

Manoj Kolhatkar, MD & CEO, Tata AutoComp Systems, added, “In the light of this development, I would like to inform you that our European businesses demonstrate strong operational and cultural alignment. This integration will enable quicker decision-making, improved execution, and enhanced value delivery for our OEM clients in the region.”

Alan Fennelly, CEO, Artifex Interior Systems, stated, "We are proud to formally welcome Artifex Systems Slovakia (formerly IAC Slovakia) into the Artifex and Tata AutoComp family. Their skilled workforce, strong customer focus combined with great technical expertise will be key in accelerating our growth as we support the next generation of vehicle platforms."

- BWI Group

- Dayton Engineering Laboratory Company

- Delco

- Beijing West Smart Mobility Zhangjiakou Automotive Electronics Co

- Zhang Jia Kou Financial Holding Group

- ZJKFH

- Semi-Active Roll Control

- SARC

- GWM Tank

- Bruno Perree

BWI Group Launches Automated Roll Control System For SUVs And EVs

- By MT Bureau

- February 18, 2026

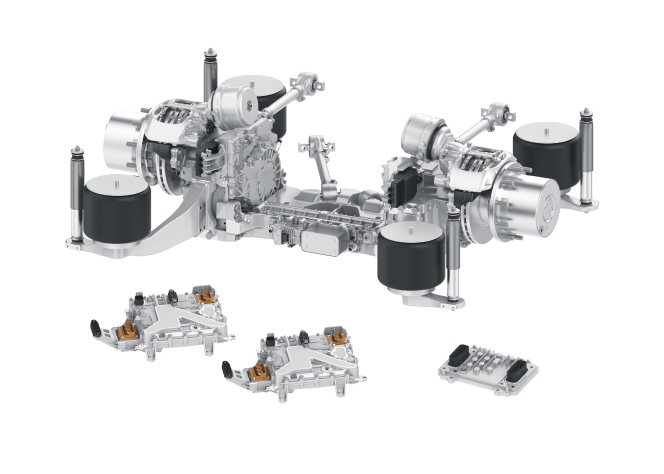

BWI Group has introduced an automated mode for its Semi-Active Roll Control (SARC) system, designed to address the weight challenges of modern SUVs and battery electric vehicles (BEVs). The update allows a vehicle's anti-roll bar to disconnect and reconnect on demand while driving.

For the unversed, BWI Group was incepted in 1909 as Dayton Engineering Laboratory Company (Delco). It is said to have created the first reliable electric self-starter for the global automotive market, and is now currently owned by China’s Beijing West Smart Mobility Zhangjiakou Automotive Electronics Co, led by Zhang Jia Kou Financial Holding Group (ZJKFH) and an assembled syndicate of key investors.

The SARC system aims to resolve the engineering conflict between ride comfort and handling. As SUVs now account for over half of European car registrations and BEVs weigh significantly more than internal combustion counterparts, chassis engineers have historically used stiff stabiliser bars that can compromise comfort.

Operational Data and Speed

The new mode uses vehicle data – including steering angle, speed, lateral acceleration, and yaw rate – to manage the anti-roll bar. During high-speed cornering, the system reconnects the bar in less than 200 milliseconds. When the bar is disconnected during normal driving, the vehicle maintains a more compliant ride.

At the centre of the technology is a rotary actuator and a self-contained hydraulic mechanism. Unlike mechanical alternatives, this hydraulic setup allows for connection and disconnection even when wheels are positioned at different heights. The system also features self-centring technology to ensure engagement across all suspension travel.

SARC is currently in production for several platforms, including the GWM Tank series. BWI Group expects the automated functionality to increase adoption in the SUV and BEV sectors, where managing vehicle mass is a priority for manufacturers.

Bruno Perree, Engineering Manager, BWI Group, said, “Chassis engineers are continually trying to improve road handling and comfort, but the two goals are often incompatible. The latest update to SARC removes that compromise, allowing engineers to optimise the roll bar purely for handling as it will be disconnected the majority of the time. This not only improves comfort but also adds significant off-road capability, which can be a key competitive differentiator in a crowded SUV market.”

ZF India Secures Contract To Supply Electric Low-Floor Axle For E-Buses

- By MT Bureau

- February 16, 2026

German automotive component supplier ZF India has secured a contract from an Indian original equipment manufacturer (OEM) to supply the AxTrax 2 LF electric portal axle. The technology will be utilised in 11-metre city buses and 18-metre articulated buses for domestic and export markets.

The nomination, confirmed in October 2025, involves a multi-year programme for several thousand units, with deliveries scheduled to begin in 2026.

The AxTrax 2 LF integrates propulsion, braking and suspension within a single unit. This architecture replaces the engine, transmission, and conventional axle, increasing space for passengers and batteries. The system uses the same mounting points as previous generations, allowing for backward compatibility.

The unit is built on a modular platform featuring:

- Dual PMS Motors: Two permanent magnet synchronous hairpin motors.

- Inverters: Two 800V Silicon Carbide (SiC) inverters.

- Power Output: Continuous power variants of 260 kW and 360 kW.

- Torque: Peak torque of 36,800 Nm.

An oil cooling system with an integrated e-pump manages temperature and lubrication to maintain performance. The system is compatible with battery-electric, hydrogen fuel cell and trolley bus configurations.

The axle includes software for torque vectoring, regenerative braking, hill hold, and axle condition monitoring. It is designed to meet ISO 26262 functional safety requirements and cybersecurity standards. The electronics are capable of receiving over-the-air (OTA) updates.

Akash Passey, President - ZF Region India, said, “AxTrax 2 LF enables OEMs to design buses that maximise passenger and battery space while delivering superior efficiency and reliability. Its compatibility with battery-electric; fuel cell and trolley bus platforms enable ZF to address the zero-emission mobility aspirations and reinforces the country’s emerging role in next-generation commercial vehicle technology.”

Paramjit Singh Chadha, Senior Vice-President - CVS, ZF Group (Region India), said, “By combining propulsion, braking, suspension, low noise, comfort, safety and intelligent electronics within a compact architecture, ZF helps OEMs simplify vehicle design and accelerate development timelines. Our focus remains on partnering with customers to enable reliable, efficient and future-ready solutions for zero-emission transportation in India.”

Juan Manuel Molla Appointed Managing Director Lighting At Forvia Hella

- By MT Bureau

- February 16, 2026

Tier 1 automotive supplier Forvia Hella has appointed Juan Manuel Molla as the new Managing Director Lighting and member of the Management Board, effective 1 March 2026.

He succeeds Bernard Schaferbarthold, who has held responsibility for the Business Group Lighting on an interim basis, and has stepped down from the Management Board on 15 February 2026.

Molla, joins the company with over three decades of experience in the automotive industry. He has held leadership roles at various manufacturers and suppliers, most recently serving as Chief Commercial Officer at Marelli.

In his new role at Forvia Hella, Molla will oversee the strategic development of the lighting business, focusing on market requirements and technological innovation.

Dr.-Ing. Wolfgang Ziebart, Chairman of the Shareholder Committee, said, “With Juan Manuel Molla, we are gaining a highly experienced leader who brings strategic foresight, many years of industry experience, and a deep understanding of the needs of our customers as well as of international markets to the company. We are therefore very pleased to welcome Juan Manuel Molla to Forvia Hella and are confident that he will successfully continue – and further accelerate – the strategic development of the Lighting business in a dynamic and challenging market environment.”

Juan Manuel Molla stated, “I am very grateful for the trust placed in me. The automotive industry is undergoing profound transformation – which will bring changes, but above all great opportunities for the future. Our goal is therefore to respond to new market requirements with agility and flexibility, to consistently strengthen our competitiveness, and to drive the development of lighting innovations that are technologically pioneering and yet affordable. The greatest asset of Forvia Hella’s Lighting business is the expertise of our colleagues worldwide. I look forward to working with them to tackle these tasks and to shape the future of the Business Group Lighting together.”

Comments (0)

ADD COMMENT